VA Case Study – Countertop Manufacturer and Installer

VA Tax Assessment Amount- $150,065.52

Reduction Amount – $145,661.56 – 97%

Interest Saved – $25,225.08

Virginia countertop manufacturer and installer was selected by the VA Department of Taxation for a Virginia sales and use tax audit. This was the first-time audit for this Taxpayer. Marsu was contacted by the owner of the business because the Taxpayer had just received workpapers stating that they owed $150,065.52 in sales and use taxes. Marsu immediately contacted the auditor and was able to start the review process in the field with the field auditor and supervisor which is a lot easier than having to request an informal hearing and having to explain everything all over again to a hearing officer. The auditor had reviewed a sample period for sales and expenses and projected the assessment over the audit period and reviewed all assets purchased during the audit period. Marsu did the following for each schedule in the audit:

- For sales tax collected, but not remitted, the auditor reviewed four sample months to confirm that sales tax collected was remitted. Taxpayer remitted taxes as they collected tax from customer instead of remitting taxes as billed (By law, taxes are supposed to be remitted as billed, not as collected). Auditor had problems reconciling the amount that was paid in the three of the four months selected and calculated a large deficiency. Marsu reexamined the three months and provided documentation that the Taxpayer had actually remitted all of the tax in two of the three months and had a small error in one month because of a change in bookkeepers. The tax assessed was reduced from $85,577.22 to $534.67, a savings of $85,042.45.

- In the sales sample of four months, the auditor listed four invoices where sales tax was not properly collected. Marsu reviewed these four invoices and obtained a resale certificate for one of the invoices. Luckily this one invoice was the largest invoice and consisted of 68% of the dollars listed in the schedule. The tax assessed was reduced from $28,493.20 to $1,709.58, a savings of $26,783.62.

- For expenses, Virginia was trying to assess the Taxpayer as a consuming contractor because the Commonwealth believed the Taxpayer did not meet the three prong test to be classified as a manufacturer/retailer because the Taxpayer did not have an inventory of products for sale, but purchased materials on a job cost basis. Marsu provided documentation that the Taxpayer actually did have inventory on hand and did not have to pay tax on the materials incorporated into the job where they had already collected sales tax from their customer.

- For expenses, the auditor reviewed three months and had listed 139 line items as taxable. This list included COGS, assets, shop supplies and administrative expenses. Since Marsu proved to the auditor that the Taxpayer had an inventory, all the COGS materials were deleted from the list. For the assets and shop materials, Marsu provided the auditor a description of exactly how the assets and shop supplies were used in the manufacturing process and these transactions were deleted from the list. For the administrative expenses, Marsu was able to obtain copies of these expenses to show the auditor that sales tax was billed and collected by the supplier. After all the deletions, only 17 line items remained. The taxed assessed was reduced from $35,995.10 to $2,159.71, a savings of $33,835.39.

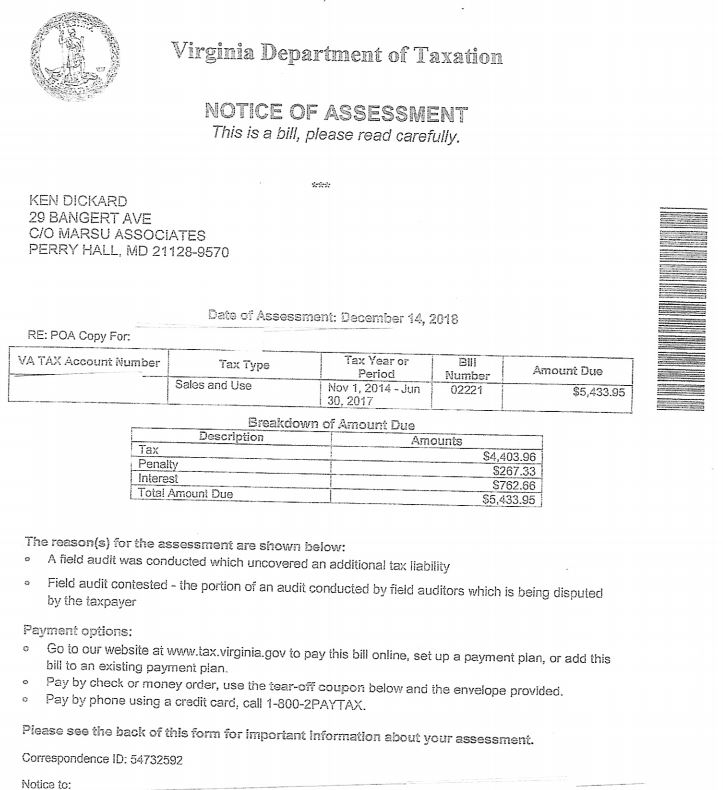

The original workpapers had the Taxpayer owing $150,065.52 in taxes and the final workpapers had the Taxpayer owing only $4,403.96 in tax, a savings of $145,661.56. With penalty and interest, the Taxpayer paid $5,433.95 to settle the assessment.

Main Audit Issues

In VA, the sales tax laws regarding manufacturers/contractors/retailers are different than in DC and MD and is discussed in detail in VA Administrative Code 10-210-410(G). In VA, a Taxpayer who is installing fences, venetian blinds, window shades, awnings, storm windows and doors, floor coverings, cabinets, kitchen equipment, window air conditioning units or other like or comparable items is considered a retailer and should collect tax on the sale if the Taxpayer meets the following three conditions:

- Maintains a wholesale or retail place of business

- Maintains an inventory of the aforementioned items and/or materials which enter into or become a component part of the aforementioned items

- Who performs installation as part of or incidental to the sale of the aforementioned items

In July 2010, VA changed their law regarding countertop manufacturers/installers. Prior to this, a countertop manufacturer/installer was a consuming contractor and paid tax on all materials incorporated into the job and collected no tax. The law change made a countertop manufacturer/installer a retailer and should collect tax on their sales. With this law change, this Taxpayer started to collect tax on their sales because they met the three above conditions.

I am not exactly sure what happened during the auditor’s original examination of the Taxpayer’s business in determining if the Taxpayer was a consuming contractor or a manufacturer/retailer. For whatever reason, VA believed that the Taxpayer did not carry an inventory of granite or marble slabs and therefore did not meet the three-part test of being a retailer and was deemed a consuming contractor. I am chalking this error up to a miscommunication between the Taxpayer and auditor. I am guessing that the auditor did not explain the three-part test to the Taxpayer, so the Taxpayer did not know the importance of their answers regarding this issue. Regardless of what happened, the key point here is that we were able to straighten it out and the Taxpayer’s assessment was corrected in this area. I thought it was sad though that the Commonwealth of Virginia was trying to get the tax from both ends of the transaction. First from paying the tax on the materials when purchased and then from collecting the sales tax from the customer. If the Commonwealth thought that the Taxpayer was a consuming contractor, then I would have thought the Commonwealth would have just been happy in getting the tax on sales price vs. the cost of the materials and not try to assess tax on the COGS when the Taxpayer had already collected the tax from their customers.

Second issue is that by law sales tax is to be remitted as billed and not as collected. I know this creates a cash flow issue, but that is the law.

Further Discussion

The key issue with dealing with any type of auditor is communication. Marsu believes in knowing the answer before the question is asked and if Marsu does not know the answer, then Marsu has the ability to say I am not sure, and I will get back to you with the answer. The problem here is that the Taxpayer should know everything about their business, but does the Taxpayer know how to properly answer the questions for sales tax purposes? Probably not. When the audit starts, the auditor will have some preconceived ideas of what the Taxpayer should be collecting tax on, if any, and what the Taxpayer should be paying sales and use tax on. These preconceived ideas will probably come from the auditor’s experience of auditing other like Taxpayers or viewing the Taxpayer’s website. In the first meeting with the auditor, the auditor will usually discuss the Taxpayer’s business to exactly find out what the business does. The auditor will be asking targeted questions that deals with collecting tax vs paying sales and use tax on materials purchased for the business. The auditor will be clinging to every word that the Taxpayer says, and their preconceived ideas can change with whatever you tell them. This includes miscommunication to when the auditor improperly interprets what was said or the lack of what was said. If Marsu is involved before the audit starts, then the information for sales and use tax purposes can be effectively communicated to the auditor and hopefully no improper interpretations will be made.

Additional Law Change

Effective July 1, 2017, VA reversed their 2010 law change regarding countertop manufacturers/installers and deemed them to be consuming contractors again. Therefore, these Taxpayers pay tax on their materials incorporated into the job and collect no tax when the job is installed.

If at times, the Taxpayer just manufacturers a countertop without installation or manufacturers a countertop with material provided by the customer, then the Taxpayer should collect tax on these transactions. To do this, the Taxpayer needs to have a VA sales tax license to collect tax.