Sales Tax Consultants

Serving Companies Doing Business

In MD, DC, VA & PA

- Sales and Use Tax Audit Experts

- Over 45 Years of Experience

- Previous Maryland Sales Tax Auditors

- Help Through Entire Audit Process

Sample Case Study

MD Case Study – Closed Assessment Appealed – Electrical Contractor

Total Original Assessment Amount – $11,835.94

Refund from Original Assessment $5,152.14 – 43%

Refund from Reverse Audit – $49,501.47

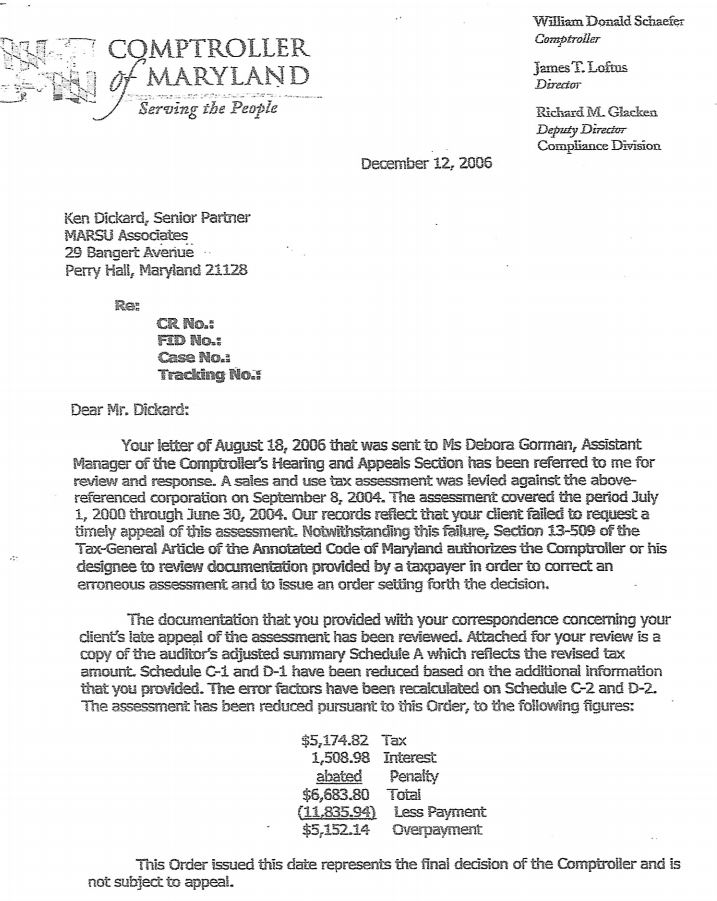

Unfortunately, I hate to admit it but, this is the only closed case that Marsu has ever been given the opportunity to appeal. I get it though. Most Taxpayers go from fire to fire in their business and once a fire is put out, the Taxpayer does not want to or have the time to revisit the fire. The Taxpayer believes they are paying their taxes properly. I mean, who overpays their taxes on purpose. The problem is that most Taxpayers are inadvertently overpaying their sales and use taxes. They just do not know it. This Taxpayer had been previously audited in 2004 and assessed and paid $11,835.94 for failure to pay use tax. The Comptroller classified the Taxpayer as a consuming contractor who performs real property work and was audited as such. In 2006, Marsu appealed the assessment under Section 13-509 of the Annotated Code of Maryland and was able to reduce the original assessment and get the Taxpayer a $5,152.14 refund check. This is a 43% reduction from the original assessment which includes penalty and interest.

After reviewing the old assessment, Marsu performed a reverse audit and was able to secure the Taxpayer a sales tax refund for $49,501.47. This refund averaged a savings of $12,375 a year, so since 2006 my electrical contractor friend has saved $173,250 in taxes that he would have been paying if he had not allowed Marsu to do their free review.

The Need for Getting Assistance for a Sales Tax Audit

You are my electrical contractor friend here. You are currently being audited by a State for sales and use tax compliance or have been audited by Maryland in the past four or five years. The audit letter comes in the mail or you get that phone call. The State sends a records request letter listing what records are needed to perform the audit. Asset, expense and sales records and invoices. Chart of accounts, general ledger info, banking information, sales and use tax returns with backup, profit and loss statements, depreciation schedules, income tax returns, withholding tax information and waiver forms.

It is a lot to take in and you think to yourself, “Oh I can handle this” or “I am collecting tax so I cannot really owe that much” or “let’s see what happens before I call someone”. You believe you are doing things correctly. The auditor does their review and really does not tell you much, asks a few questions here and there and maybe asks for some additional information. And boom it happens. The auditor issues workpapers for your review and with it comes a tax bill of $10,000 or $50,000 or even $150,000 like my friend from VA whose case is included in my Success Stories. What should I do?

There are a lot of things you should know about the audit process before it starts. What and how are they going to audit? What are they looking for and why? Do the sample periods and projection methodologies fairly represent the business? Should I ask for different sample periods or just more sample periods? What is a waiver form, and should I sign it? How much will interest and penalty be? How long does the audit process take? What are my rights? Remember, the auditor represents the State and is there to collect tax money. Sometimes the auditor will even have the nerve to tell you that. Usually if the Company is due a refund, the auditor will probably never see the refund because they do not audit the areas where no tax is due. And even if the auditor sees it or knows about something, they will probably not tell you. It is us against them.

And there is one especially important question that accountants and lawyers usually never ask – Is the Company due any sales and use tax refunds? (I tell my clients that your accountant is hired to prepare your tax returns and seldom knows a lot about sales taxes and the audit process and lawyers want to litigate and get paid by the hour regardless if they win or not). Since 1981, Marsu has been reviewing sales and use tax audits and determining if the company has inadvertently overpaid any of their sales and use taxes. Marsu has a two prong approach to a sales tax audit. First, reduce the amount due to the lowest amount possible and second, determine if the Company is due any refunds. In Maryland and sometimes in other states, the refunds are incorporated into the audit and that will reduce the interest and penalty owed. The interest and penalty rates in Maryland together are around 40%. That’s right, 40%. In DC, the penalty rate is 25% and I think that is a little outrageous. In VA, the penalty is 33% if your sales tax collection compliance rate is not above a certain percentage. In MD, sometimes after Marsu’s review the refunds are larger than the tax assessment, so the Company ends up owing no interest and penalty because the refund is incorporated into the audit workpapers and net tax due is zero and the refund balance over the tax due is received in a refund check. Just like my electrical contractor friend here would have had, if Marsu was called in to assist with the audit in 2004. Just check out some of the other “Success Stories” for Taxpayers who called Marsu.

Call Marsu

If you are currently being audited or about to be audited, then please give us a call. Marsu will sit down with you and answer all your questions about the audit and refund process. Initial conference is free of charge and all refunds are done on a contingent basis so if no refund is approved, then no fee is due. If a refund is approved, then Marsu only gets paid after the Taxpayer gets written notification that the refund is applied to the outstanding assessment or the refund check is received.

Call now for your Free Consultation to see what Marsu can do for you– 410-598-0955(cell).

Put MARSU Associates to work for you. Contact us for any Maryland sales / use tax questions that you may have. Business Being Audited? Owe Money? Late Filing? Penalties? Assessment Questions? Overpaying Sales Tax? Let us help. Call or email today for a FREE analysis with a tax consultant. Now also offering sales tax consulting assistance to clients in Washington DC, Virginia & Pennsylvania in addition to Maryland.