DC Case Study – MD HVAC Contractor Working in DC, MD and VA

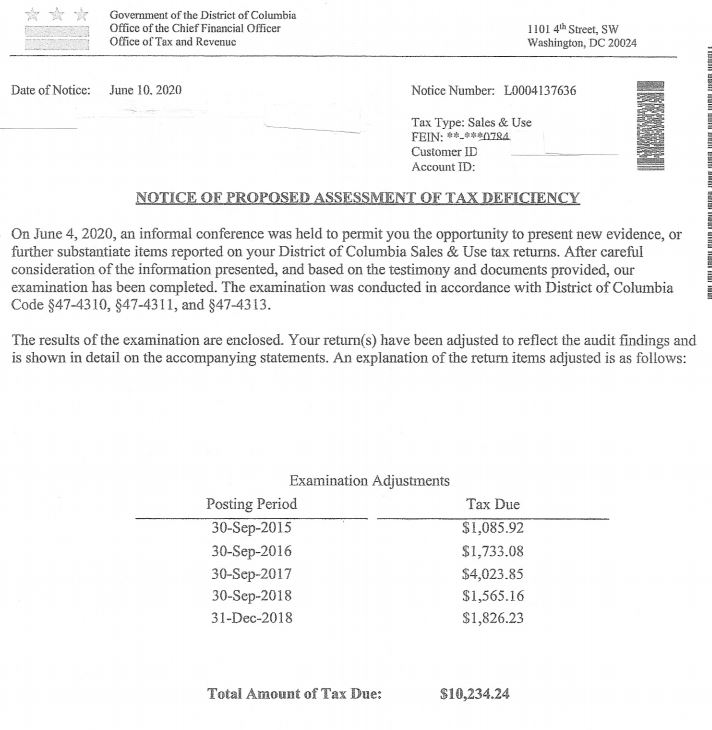

DC Tax Assessment Amount – $35,807.43

Reduction Amount – $25,573.19 – 71%

Interest Saved – $9,816.11

MD Refund Filed – $7,691.40

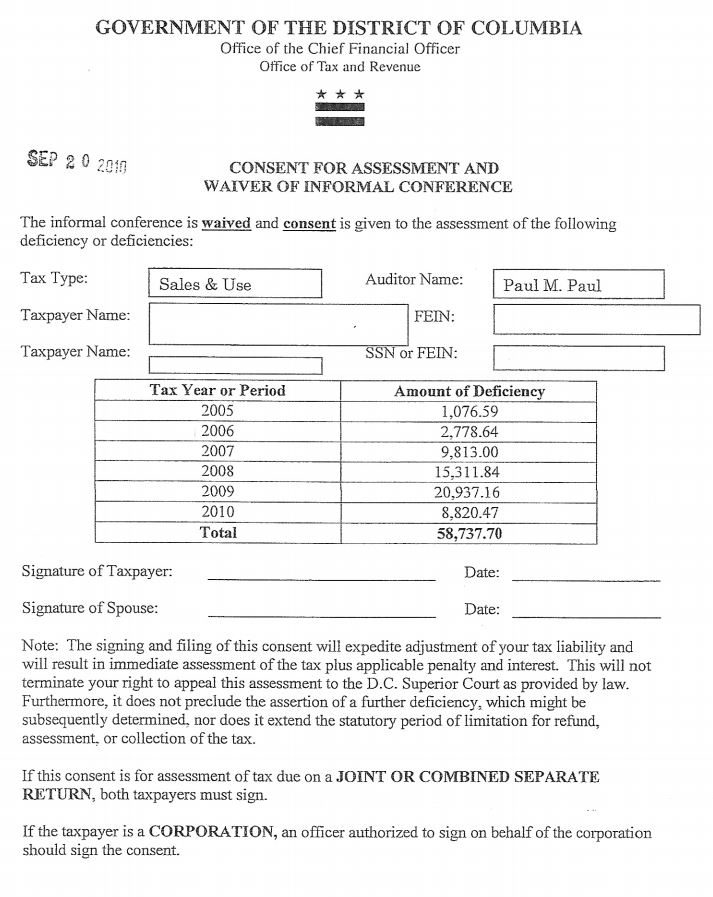

Maryland HVAC contractor working in DC, MD and VA was assessed by the DC Office of Tax and Revenue for failure to collect sales tax on taxable sales and services. After receiving the initial workpapers assessing the business $35,807.43 in taxes, the Taxpayer contacted Marsu to review the workpapers to determine if the assessment could be reduced. The taxpayer’s business is located in Maryland, but failed to properly register in DC for the collection of DC sales tax, so the statute of limitation for the audit was extended back beyond the normal three year audit period. Luckily the Taxpayer just started his business in 2015, so the starting period of the audit was 2015. Marsu assisted the Taxpayer with reviewing the sales schedule as follows:

- For sales, the auditor did an actual audit and reviewed all DC sales invoices for the audit period and listed 70 invoices as taxable. Marsu reviewed each invoice and proposal and documented that 19 invoices were not taxable and that 14 invoices were reduced. The tax assessed was reduced from $35,807.43 to $10,234.24, a savings of $25,573.19.

- For expenses, after Marsu provided documentation that some of the sales were actually for furnishing and installing equipment deemed real property after installation, the hearing officer requested that the Taxpayer prove that sales tax was properly paid on the materials incorporated into those jobs. Marsu provided the material invoices for each job to document that sales tax was properly paid on all materials to the suppliers and no further tax was due.

Upon getting the workpapers from the Taxpayer, Marsu contacted the auditor and supervisor to see if the workpapers could be reviewed in the field, but the supervisor stated that an informal conference would have to be requested. Marsu requested an informal conference and Marsu provided the above mentioned documentation and the total assessment, including penalty and interest, was reduced from the $56,042.04 to $16,721.14, a savings of $39,320.90. Marsu was also able to get the penalty cut in half by the supervisor and filed a Maryland sales tax refund in the amount of $7,691.40.

Main Audit Issue

In DC, there is a big difference is the sales tax laws regarding real property contractors who furnish and install, repair or alter equipment into real property in DC vs MD and VA. Certain services for HVAC contractors, like maintenance contracts and T&M billings for repair of real property are taxable services and tax should be collected from the customer. Effective July 1, 1989, DC amended their sales tax law to include the T&M billing as a taxable service where sales tax is to be collected on only the material portion of the bill. As mentioned above, the Taxpayer failed to register to collect DC sales tax and was held liable for the tax that the Taxpayer did not collect. Like many audits, this Taxpayer’s audit arose from the audit of one of his customers where the auditor saw that the Taxpayer was not collecting tax.

Please see section on website on DC Real Property Services that are taxable for other services that are taxable besides maintenance agreements and T&M billings.

Other DC Concerns

The normal statute of limitations for a DC sales tax audit is three years, but DC’s policy is that if the Taxpayer should have been licensed to collect tax, but does not get licensed, then DC is allowed to extend the audit back as far as it wants. As mentioned above, the Taxpayer had just started his business in 2015 so the audit period was for a five year period.