MD Case Study – Sales and Admission and Amusement Taxes – Caterer

MD Tax Assessment Amount – $65,265.81

Reduction Amount $18,977.58 – 29%

Refund from Reverse Audit – $14,595.52

Admissions & Amusement Tax Refund from Taxpayer- $10,638.56

Sales Tax Refund from Admission & Amusement Taxes from Taxpayer – $7,196.43

Interest Savings – $19,070.72

Maryland Taxpayer who has several catering locations throughout the Baltimore Metropolitan area was selected for another sales and use and admissions and amusement tax audit. This Taxpayer was last audited in 2004 and Marsu also assisted in that audit. Taxpayer is very well versed in the proper collection of sales taxes and in the payment of use and admission and amusement taxes. The Taxpayer just received the audit workpapers for the sales and use tax audit and there was no assessment for the admissions and amusement tax audit, but the Taxpayer discovered two refunds from the admissions and amusement tax audit that they were putting together to submit to the auditor so it could be incorporated into the audit. The Taxpayer contacted Marsu to review the sales tax audit to determine what, if any, adjustments could be presented to the auditor. Marsu did the following for the asset and expense schedules:

- For assets, the auditor reviewed all the asset purchases for all locations for the audit period and listed 42 invoices as taxable. Marsu reviewed each invoice and discovered that use tax had been paid on 7 of the invoices that the auditor missed in his review and 7 other invoices that were not taxable. The tax assessed was reduced from $6,945.08 to $4,069.38, a savings of $2,875.70.

- For expenses, the auditor only looked at a one-month sample for all locations and listed 65 invoices as taxable. Marsu reviewed each invoice and documented that 2 invoices were non-taxable and got 3 lines deleted and assessed on an actual basis for each supplier for the audit period. The tax was reduced from $58,320.73 to $42,218.85, a savings of $16,101.88.

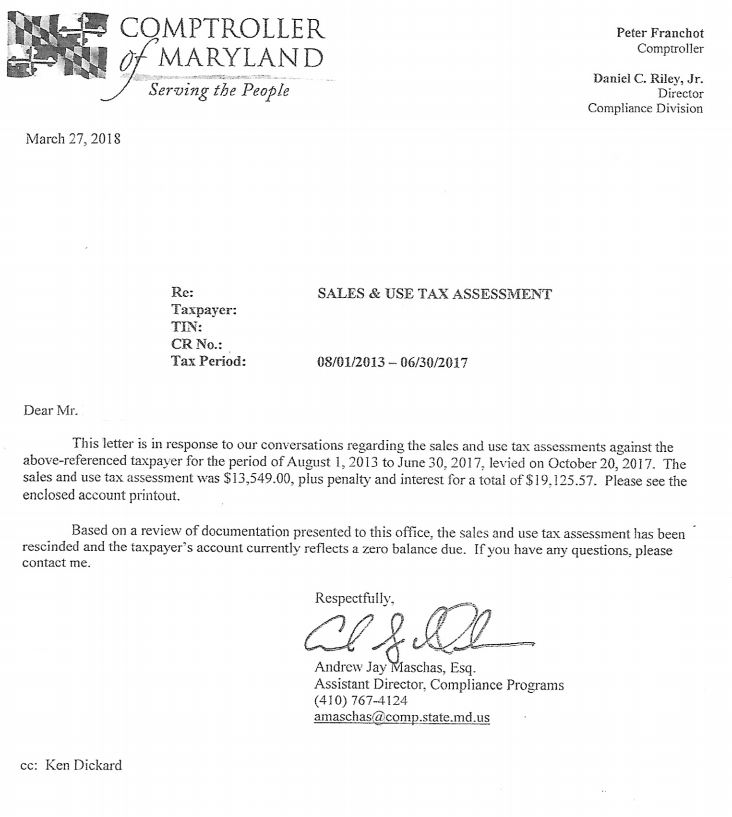

After the review of the workpapers, Marsu performed a reverse audit and documented sales and use tax paid in error and the Comptroller’s Office approved and included Marsu’s refund in the amount of $14,595.52 and the refunds filed by the Taxpayer in the workpapers as required by law. The original workpapers had the Taxpayer owing $65,265.81 in taxes and the final workpapers had the Taxpayer owing $0 in taxes, a savings of $65,265.81. Since the audit had a $0 amount of tax due, there was no interest and penalty due. From the original workpapers, the taxpayer saved $19,070.72 in interest because of the refunds approved from Marsu and the Taxpayer.

Collection of Tax by Caterers

This Taxpayer has been 100% compliant in the collection of sales taxes in the past two audits that Marsu has been involved in. That is a testimony to the great job that this Taxpayer is doing in this area. Caterers are to collect tax on almost every line item that is included in the bill. The main exception is the hall rental charge if separately stated. Usually most caterers do not have their computer system’s programed to collect tax on some labor or rental charges and then gets dinged for failure to collect sales tax when audited by the Comptroller’s Office.

Main Audit Issues

The only minor audit issue here is that the Taxpayer sometimes misses paying use tax on some of its assets and expense items. I mainly chalk this up to clerical errors because the Taxpayer does a decent job of paying use tax. One thing that Marsu recommends and this Taxpayer does is after an audit is to call up the MD suppliers who did not properly collect sales tax and inform them that they should be collecting tax. That way in the future the Taxpayer will be properly paying the tax to the supplier and does not have to worry about accruing use tax and possibly missing it again and it being included in the next audit. Because this Taxpayer knows they will be audited again.

The majority of the expense items included in this audit were items that were deleted in the 2004 audit because they were for resale and the Comptroller’s Hearings and Appeals section agreed. The auditor in the audit section was just following their guidelines which comes from a 2006 Maryland Tax Court Case that stated that similar items were taxable. Recently, the Comptroller’s Office has issued a Business Tax Tip that discusses the taxability of different expense items that a caterer uses to cater an event. This Tax Tip just confirmed the ruling that this Taxpayer received in their 2004 audit and has been following ever since.

Call Marsu

If you are a caterer and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.