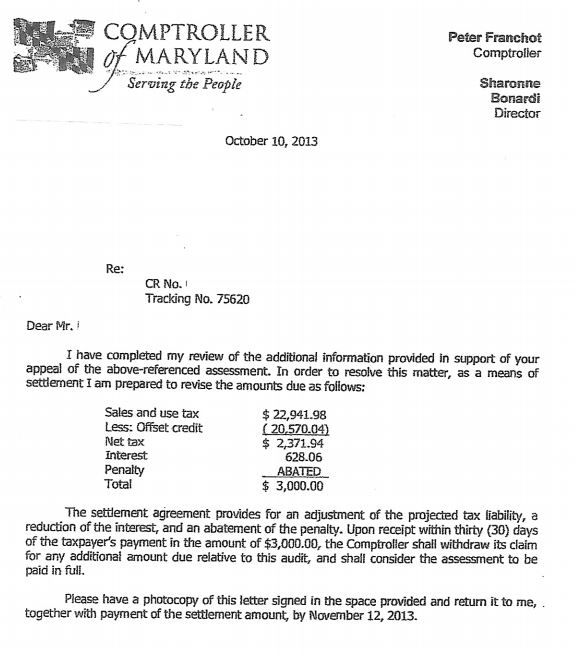

MD Tax Assessment Amount – $85,660.97

Reduction Amount – $62,718.99 – 73%

Offset Credit/Refund Approved – $20,570.04

Interest Saved – $22,053.89

Penalty – Waived at Settlement

Maryland manufacturer who sold products on a wholesale and retail basis was selected for a Maryland sales and use tax audit. Marsu was contacted by the company’s lawyer to assist in the review of the workpapers. The Taxpayer was assessed $85,660.97 for failure to collect sales tax on their sales and a small assessment for failure to accrue use tax on assets purchased when tax was not billed. Taxpayer was also issued a 60 day letter for their resale certificates which means that the Comptroller gave them 60 days from the date on the letter to obtain all properly documented Maryland resale certificates from their customers or the sales would be deemed to be taxable regardless if they were for resale or not. Marsu did the following for the capital and sales schedules in the audit:

- For the capital assets, the auditor reviewed every asset purchase in the audit period and listed every invoice that did not have sales tax billed and collected. The auditor listed 6 invoices on this schedule and Marsu was able to get three of those invoices deleted from the schedule for the manufacturer’s exemption. The tax assessed was reduced from $2,618.37 to $252.67, a savings of $2,365.70.

- For sales, the auditor reviewed a six-month sample period and listed just 19 lines, but the projection totaled $83,042.60 in tax liability. The majority of the assessment came from just two customers. One who did not have a resale certificate until after the 60-day grace period and the other went bankrupt and we could not get a resale certificate even if they had one. The Comptroller’s Office would not negotiate on the resale certificate customer because of the 60-day letter, but Marsu was able to get the bankrupt customer out of the projection and assess that customer on an actual basis over the audit period. Of the remaining lines listed, Marsu was able to get five (5) more lines out. The tax assessed was reduced from $83,042.60 to $22,689.31, a savings of $60,353.29.

Marsu also performed a reverse audit and documented sales taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $20,570.04 in the audit workpapers as required by law. The original workpapers had the Taxpayer owing $85,660.97 in taxes and the final workpapers had the Taxpayer owing $22,941.98 in taxes, a saving of $62,718.99.

Main Audit Issues

The Comptroller’s Office has the legal right to issue a taxpayer a sixty (60) day letter to have the Taxpayer obtain properly documented Maryland resale certificates for all customers that they do not collect tax from or The Comptroller will deem those sales as taxable and 6% tax will be due. See Title 11, Section 408 which allows the Comptroller to issue a Taxpayer a 60-day letter. The Taxpayer had a lot of customers that were for resale and the Taxpayer had actually done a great job in getting the majority of properly documented Maryland resale certificates for the auditor. The one thing the Taxpayer could have done a little different was to prioritize the resale certificates by dollar value in the audit so they would get the resale certificates for the customers that made up the largest portion of the $83,042.60 tax assessment. The one customer that they did not get a resale certificate in time for was worth $11,802.00 in tax.

The importance of getting properly documented resale certificates when the customer’s credit is approved or at the time of the first sale is also shown here by the fact that the Taxpayer got assessed for tax for a customer that went bankrupt. For whatever reason, the auditor had selected a sample sales period that was over two years old and that made it more difficult for the Taxpayer and Marsu in securing valid Maryland resale certificates and made it impossible for the customer that went bankrupt. Luckily Marsu was able to have the Comptroller assess the tax on the actual sales for the audit period instead of the projected tax assessment for this customer. The projected tax assessment was $34,397.00 and the actual amount due was only $3,790.49, a saving of $30,606.51.

The last important issue with the sales audit was that several of the lines included in the audit were sales where the customer picked up the product at the Taxpayer’s manufacturing plant in Maryland. Even though each customer could have had a resale certificate from their home state, DC, OH, PA, VA or WVA, pick-up sales are taxable unless the customer has a valid Maryland resale certificate.

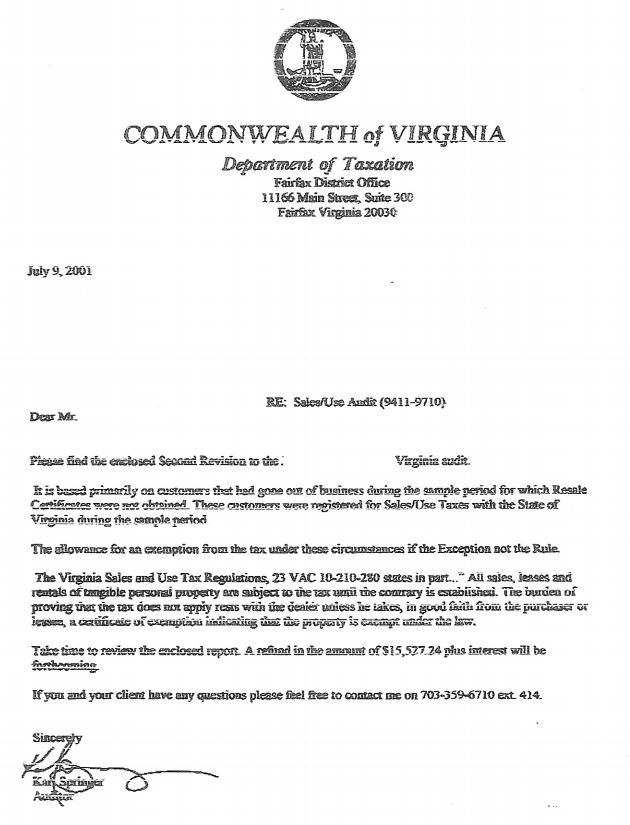

Click Here or Image Below for Full Letter

VA Total Assessment Amount – $600,191.46

Total Reduction Amount – $562,737.85 – 94%

Interest and Penalty Savings – $220,337.36

Large Maryland distributor of flooring materials to wholesalers and retailers in the MidAtlantic region was selected for a VA sales and use tax audit. Marsu had previously assisted this Taxpayer with a MD sales and use tax audit and the Taxpayer’s lawyer called Marsu for their assistance. Taxpayer was assessed $287,786.40 in tax for failure to collect sales tax and $82,224.67 in tax for failure to accrue use tax on purchases when sales tax was not billed. Marsu assisted the Taxpayer as follows with the sales and expense schedules:

- For sales, the auditor reviewed a two-month sample of sales and listed 132 invoices as taxable. Unlike MD, VA’s sample was a month in two separate years, whereas MD uses block sampling. Marsu reviewed each invoice and documented that 62 of the invoices were not taxable. The tax assessed was reduced from $287,786.40 to $24,536.02, a savings of $263,250.38.

- For expenses, the auditor reviewed the same two months as he did for sales and listed 29 invoices as taxable. Marsu reviewed each invoice and documented that 9 invoices were not taxable. These 9 invoices represented 82% of the sample dollars on the schedule. The tax assessed was reduced from $82,224.67 to $3,074.56, a savings of $79,150.11.

- For the sales projection methodology, Marsu determined that the numerator in the projection methodology did not properly include credit sales which makes the error factor higher, so the assessment was artificially inflated. The lawyer appealed the case to The Commonwealth of VA and The Commonwealth agreed, and the projection methodology was changed to include credit sales in the numerator as they were included in the denominator.

The original workpapers had the Taxpayer owing $370,011.07 in taxes and the corresponding Notice of Assessment also had the Taxpayer owing $119,177.07 in interest and $111,003.32 in penalty for a total amount due of $600,191.46. The final workpapers had the Taxpayer owing $27,610.58 in taxes, $922.38 in penalty and $8,920.65 in interest, for a total amount due of $37,453.61, a total savings of $562,737.85. VA’s penalty in their sales tax audits are based on their compliance level calculated in the workpapers. For this Taxpayer, the sales tax collection compliance level was only 78% in the original workpapers, so VA’s recommendation was to assess penalty at the rate of 30%. In the final workpapers, the sales tax collection compliance was 98%, so the penalty rate was reduced to 0%. So VA has a steep penalty for not collecting tax if that collection is not above a certain percentage of total sales.

Main Audit Issue

The worst nightmare for any Taxpayer that sells tangible personal property or provides taxable services is not to be properly collecting sales tax. This Taxpayer was initially assessed tax for failure to collect tax on sales that were for resale but had no resale certificate from the customer. Sales tax collection rule #1 is – If you have a taxable sale, then you collect tax unless you have a properly executed resale certificate in hand and here it is a properly executed VA resale certificate. Not a MD or any other state resale certificate. Also do not fall into the trap of the customer saying I have one and I will send it. If you do not have the properly executed resale certificate in hand, then tax should be collected and when the certificate is received, then credit the tax back.

Another problem arises when tax is not collected on sales that are supposedly for resale. These customers maybe just a customer for a short time, you never get the resale certificate or the customer goes bankrupt and then any of these three types of sales come up in the audit and you the Taxpayer are left holding the bag of liability. As I said above, collect the tax and then credit the tax back when the resale certificate is received.

Retention of Resale Certificates

The key here is whatever system you use to get and have copies of resale certificates on hand is fine with me if you can get that copy at a drop of a hat. I have clients who scan all their certificates and unfortunately, I am a little old school and recommend that you have a binder to put them in in alphabetical order. Also it would probably be good to have a copy in the customer file or with the initial credit report and account setup information.

I also recommend that with the initial setup of a new customer that in the application process, the Taxpayer ask for and receive any resale certificates that are proper for all states that the Taxpayer is legally obligated to collect tax in. The Taxpayer should also setup the new customer as a taxable or non-taxable customer depending on if a valid resale certificate is in hand.

VA Approach in a Sales Tax Collection Audit

VA’s approach in a sales tax audit is that the Commonwealth will usually sample three separate months in the three-year audit period and each sample month will come from a different year. The Commonwealth will also in the three-month sample pick a month that is high in collection of tax, average and low. In the Commonwealth’s mind, I believe they are honestly trying to select a total sample that represents the Taxpayer’s business.

I believe this is a good and honest approach and is probably better that MD’s approach where they will do a block sample of one or several months. The problems I see with VA’s approach is that we will be dealing with old records and possibly old accounting systems. If we are dealing with old accounting systems, then that can create problems with getting information. With old records, there is the question of getting copies of invoices and resale certificates and if the customer went bankrupt then we will not be able to get a resale certificate if the sale was for resale.

Call Marsu

If you are a retailer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.

Click Here or Image Below for Full Letter