MD Tax Assessment Amount – $598,110.61

Reduction Amount $531,320.75 – 89%

Refund from Reverse Audit – $17,085.98

Interest Savings – $189,486.77

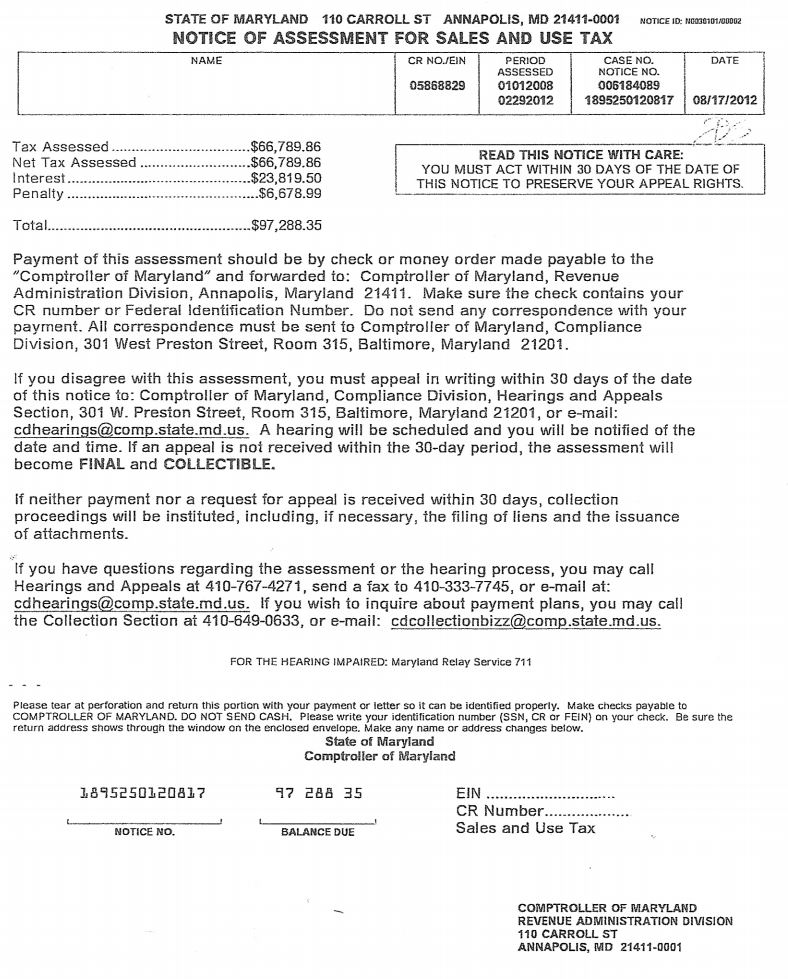

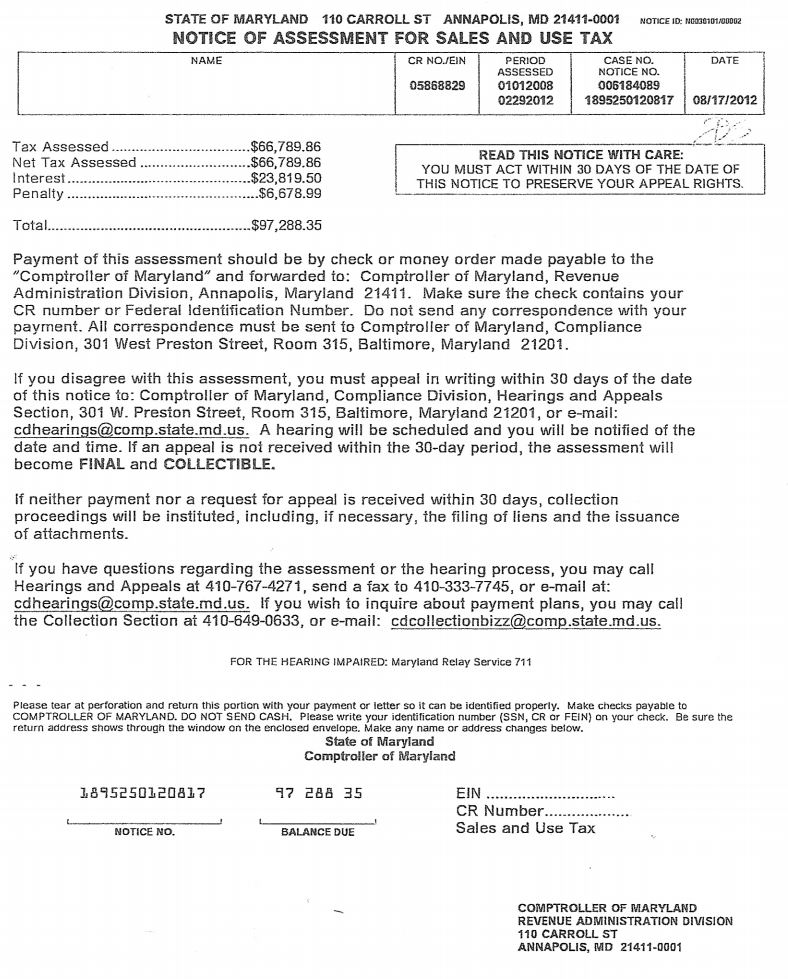

Large commercial and federal government contractor provides general contracting services in Maryland and Washington DC. This Taxpayer was selected by the Comptroller’s Office for a first-time MD sales and use tax audit. The Taxpayer undoubtedly got sticker shock when the auditor provided them the initial workpapers where they owed $598,110.61. Marsu was contacted by the Taxpayer’s lawyer and accountant to assist in the review of the workpapers. This Taxpayer was deemed a consuming contractor and the assessment was for the failure to pay use tax on their expenses and assets. Marsu assisted the accountant with the two schedules as follows:

- For capital assets, the auditor reviewed all Maryland assets and listed just 2 invoices as taxable. Marsu found no errors with this schedule.

- For expenses – Job Cost Materials, the auditor reviewed a three-month sample period and listed 45 invoices as taxable. Marsu pulled each job folder and reviewed each invoice and was able to get 26 invoices deleted from the schedule and had 2 invoices removed and put on a separate schedule and taxed individually. The tax assessed was reduced from $590,987.93 to $61,753.77, a savings of $529,234.16. Five of the remaining 19 invoices were credit card transactions and were not reviewed by this Taxpayer for use tax payments.

- For expenses – G & A Expenses, the auditor reviewed the same three-month sample and listed 9 invoices as taxable. Marsu reviewed each line and provided documentation to get 1 line deleted from the workpapers. The tax was reduced from $6,247.28 to $4,161.89, a savings of $2,085.29. Eight of the 9 invoices listed were credit card transactions which were not reviewed by this Taxpayer for use tax payments.

- For expense projection methodology – Job Cost Materials, Marsu documented and presented an alternative projection methodology that was approved by the Comptroller’s Office. This new methodology saved the Taxpayer $23,564.77 in taxes in the final workpapers.

With Marsu’s assistance, this Taxapayer was able to significantly reduce their tax assessment. The original workpapers had the Taxpayer owing $598,110.61 in taxes and the final workpapers had the Taxpayer owing just $66,789.86. Marsu performed a reverse audit and documented sales and use taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $17,085.98 in the audit workpapers as required by law.

Main Audit Issues

The Comptroller’s Office properly deemed this Taxpayer as a consuming contractor; therefore this Taxpayer is liable for sales and use taxes on all materials purchased directly by them and tangible personal property deemed tangible personal property after installation by a subcontractor into a job.

Unfortunately, this Taxpayer dealt with a lot of these gray area tax issues where there is not a lot of written information on, but the Comptroller’s Office loves to audit for and assesses many a business. This gray area deals with Regulation 19 and the State’s definition of tangible personal property. Pursuant to Regulation 19C, the Comptroller’s Office has written the following:

Reg. 19C(3) – “If the intention of the annexation is for a temporary purpose, that is, for the enjoyment or use of the material as a chattel or personalty, the material will be considered to retain its character a tangible personal property. Machinery used in a production activity retains its character as tangible personal property without regard to the method or permanency of its annexation to real property. Farm equipment, a foundation in support of machinery and equipment used in a production activity and any machinery, device, or equipment which is required for conformance with air or water pollution laws or regulations retain their character as tangible personal property”.

Reg. 19C(4) – “Factors to be considered in determining the intention of the party making the annexation are the:

- Nature of the article annexed;

- Mode of annexation;

- Purpose of which it was annexed; and

- Practicality and feasibility of removal of the annexed article”.

Reg 19C(5) – “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential or commercial spaces will be treated as realty”.

As you can see there is a lot of grey here and the only issue the Comptroller gives a little information about is on the furnishing and installation of countertops and cabinetry in commercial spaces which is automatically deemed tangible personal property with the exception of kitchen and bathroom areas.

I like to talk about this issue in another way to give a different perspective of what the Comptroller’s Office deems as tangible personal property and why. The question you must ask yourself is “whose purpose does the item or article serve, the tenant or the building?” If the item or article after installation was installed to serve some purpose for the tenant, then the Comptroller is going to say that it is tangible personal property and if the item or article serves the building, then the item or article is deemed realty. So if the item or article deals with the doors, windows, except blinds and drapes, walls, ceiling, floors, except carpet, roof, plumbing, heating, central air conditioning or domestic water systems of the building, then the item or article will most likely be deemed realty because they serve the building and not the tenant. In this case, the Comptroller even deemed that a sink that was installed in a work area of a doctor’s office was tangible personal property. The Comptroller deemed that it served the doctor’s office and not the building and entire amount of the contract to install was deemed taxable.

Below are some other examples of items that after installation, the Comptroller’s Office deems as tangible personal property and have taxed in audits that I have been involved in.

- Countertops and cabinetry installed in commercial spaces, regardless of how installed and not installed in kitchen or bathroom areas.

- Bars and food stations in bars and restaurants.

- Reception desks and bank teller stations.

- Lockers

- Blinds or drapes installed. Even motorized units that may hide in the ceiling.

- TV installation (fabrication labor), programming and cabling.

- Projection screens in conference rooms. Unit may hide in the ceiling.

- Specialized water systems that are outside the domestic water system that supplies water to the kitchen and bathroom areas.

- Backup generator systems for commercial customers.

- Canvas or vinyl awnings for commercial customers. Most residential awnings are considered tangible personal property.

- All types of signage. See Regulation 36.

- Fuel tanks, even those in the ground.

Another issue with this audit was credit card transactions. Even though this Taxpayer filed monthly use tax returns, the credit card bills were not reviewed for use tax due on purchases from out of state suppliers who did not collect MD sales tax. This is a favorite area for the MD auditor’s to review that usually leads to a lot of issues because more and more is being purchased via credit cards these days, there are missing invoices, and there is usually a fair amount of out of state purchases because a direct account is not setup with these suppliers to pay by the normal AP system.

Call Marsu

If you are a General or Subcontractor and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter

VA Tax Assessment Amount – $0.00

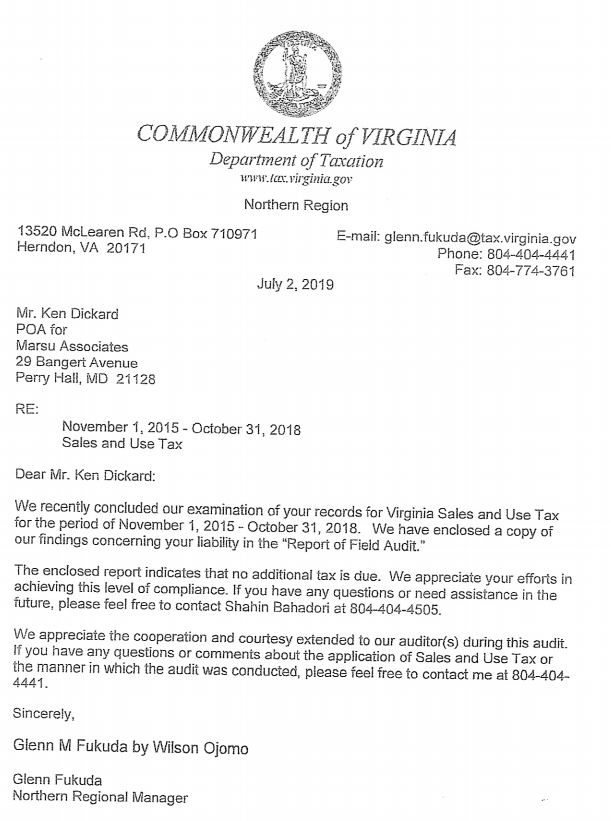

In March 2018, the Taxpayer was referred to Marsu by their accountant to address their methodology of paying use tax to Maryland and Virginia. Taxpayer manufactures countertops at their Maryland facility and installs countertops in Maryland and Virginia for residential customers only. Marsu determined that the “first use theory” applies and all sales and use tax on the materials incorporated into the countertops is due to Maryland because the materials are used in Maryland first thus titled passed in Maryland and Maryland is due the tax. So the Taxpayer closed their VA use tax account and in January 2019, the Commonwealth of Virginia selected the Taxpayer for a sales and use tax audit because the account was closed. At the initial meeting with the auditor, Marsu explained what had happened and why. The auditor agreed that this tax interpretation was correct. The auditor performed a cursory review and found no basis to assess the Taxpayer. Taxpayer was issued a zero assessment.

Main Tax Issue

States are always fighting over sales and use taxes due by contractors that have real property contracts in multiple states. This is especially true for companies that work in DC, MD, and VA. Marsu is always explaining the “first use theory” or that “title passes” in the Taxpayer’s home state to the auditors or hearing officers in the adjacent states to get invoices out of the audit workpapers. Just because the material is ultimately used in their state, the auditors and hearing officers think they are due the tax.

Click Here or Image Below for Full Letter

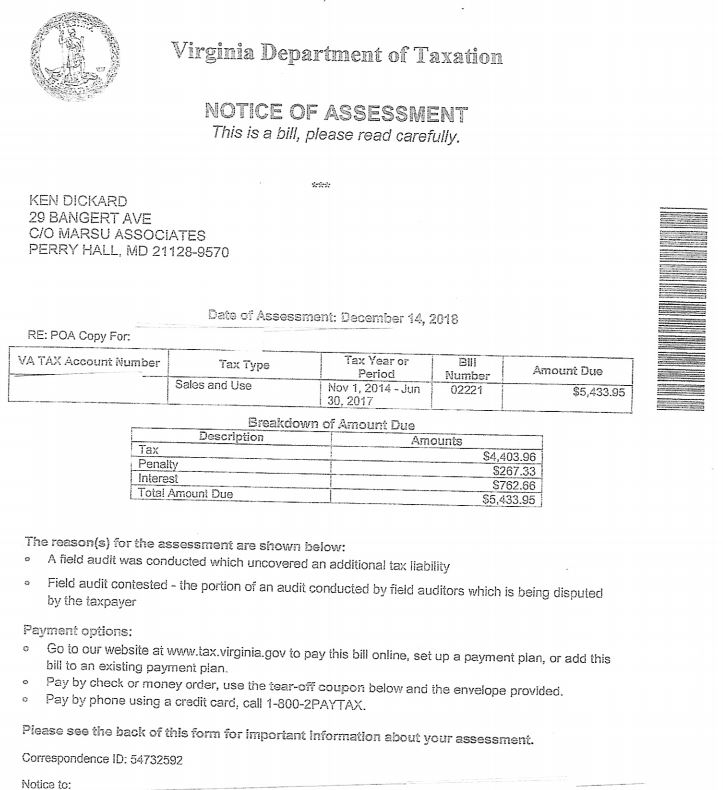

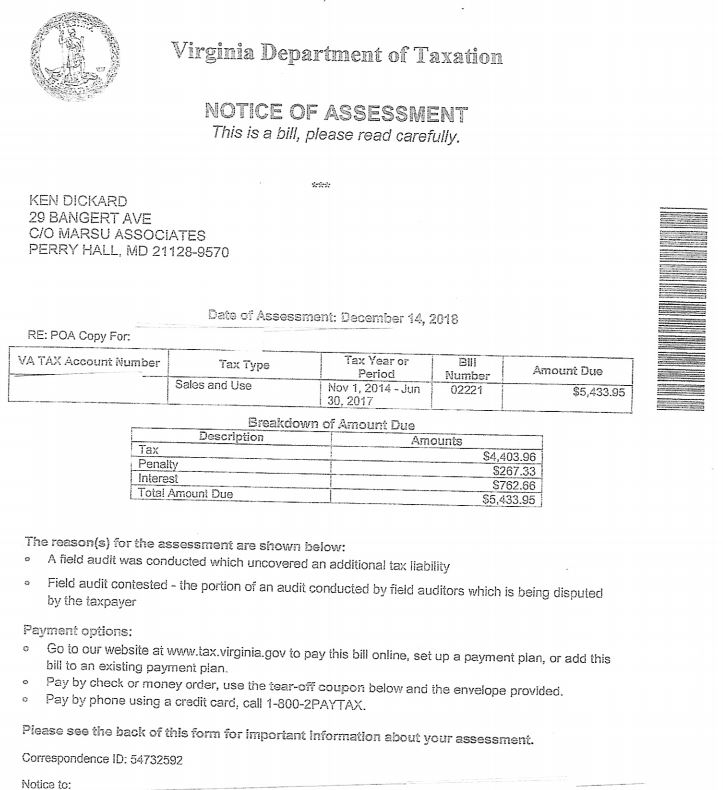

VA Tax Assessment Amount- $150,065.52

Reduction Amount – $145,661.56 – 97%

Interest Saved – $25,225.08

Virginia countertop manufacturer and installer was selected by the VA Department of Taxation for a Virginia sales and use tax audit. This was the first-time audit for this Taxpayer. Marsu was contacted by the owner of the business because the Taxpayer had just received workpapers stating that they owed $150,065.52 in sales and use taxes. Marsu immediately contacted the auditor and was able to start the review process in the field with the field auditor and supervisor which is a lot easier than having to request an informal hearing and having to explain everything all over again to a hearing officer. The auditor had reviewed a sample period for sales and expenses and projected the assessment over the audit period and reviewed all assets purchased during the audit period. Marsu did the following for each schedule in the audit:

- For sales tax collected, but not remitted, the auditor reviewed four sample months to confirm that sales tax collected was remitted. Taxpayer remitted taxes as they collected tax from customer instead of remitting taxes as billed (By law, taxes are supposed to be remitted as billed, not as collected). Auditor had problems reconciling the amount that was paid in the three of the four months selected and calculated a large deficiency. Marsu reexamined the three months and provided documentation that the Taxpayer had actually remitted all of the tax in two of the three months and had a small error in one month because of a change in bookkeepers. The tax assessed was reduced from $85,577.22 to $534.67, a savings of $85,042.45.

- In the sales sample of four months, the auditor listed four invoices where sales tax was not properly collected. Marsu reviewed these four invoices and obtained a resale certificate for one of the invoices. Luckily this one invoice was the largest invoice and consisted of 68% of the dollars listed in the schedule. The tax assessed was reduced from $28,493.20 to $1,709.58, a savings of $26,783.62.

- For expenses, Virginia was trying to assess the Taxpayer as a consuming contractor because the Commonwealth believed the Taxpayer did not meet the three prong test to be classified as a manufacturer/retailer because the Taxpayer did not have an inventory of products for sale, but purchased materials on a job cost basis. Marsu provided documentation that the Taxpayer actually did have inventory on hand and did not have to pay tax on the materials incorporated into the job where they had already collected sales tax from their customer.

- For expenses, the auditor reviewed three months and had listed 139 line items as taxable. This list included COGS, assets, shop supplies and administrative expenses. Since Marsu proved to the auditor that the Taxpayer had an inventory, all the COGS materials were deleted from the list. For the assets and shop materials, Marsu provided the auditor a description of exactly how the assets and shop supplies were used in the manufacturing process and these transactions were deleted from the list. For the administrative expenses, Marsu was able to obtain copies of these expenses to show the auditor that sales tax was billed and collected by the supplier. After all the deletions, only 17 line items remained. The taxed assessed was reduced from $35,995.10 to $2,159.71, a savings of $33,835.39.

The original workpapers had the Taxpayer owing $150,065.52 in taxes and the final workpapers had the Taxpayer owing only $4,403.96 in tax, a savings of $145,661.56. With penalty and interest, the Taxpayer paid $5,433.95 to settle the assessment.

Main Audit Issues

In VA, the sales tax laws regarding manufacturers/contractors/retailers are different than in DC and MD and is discussed in detail in VA Administrative Code 10-210-410(G). In VA, a Taxpayer who is installing fences, venetian blinds, window shades, awnings, storm windows and doors, floor coverings, cabinets, kitchen equipment, window air conditioning units or other like or comparable items is considered a retailer and should collect tax on the sale if the Taxpayer meets the following three conditions:

- Maintains a wholesale or retail place of business

- Maintains an inventory of the aforementioned items and/or materials which enter into or become a component part of the aforementioned items

- Who performs installation as part of or incidental to the sale of the aforementioned items

In July 2010, VA changed their law regarding countertop manufacturers/installers. Prior to this, a countertop manufacturer/installer was a consuming contractor and paid tax on all materials incorporated into the job and collected no tax. The law change made a countertop manufacturer/installer a retailer and should collect tax on their sales. With this law change, this Taxpayer started to collect tax on their sales because they met the three above conditions.

I am not exactly sure what happened during the auditor’s original examination of the Taxpayer’s business in determining if the Taxpayer was a consuming contractor or a manufacturer/retailer. For whatever reason, VA believed that the Taxpayer did not carry an inventory of granite or marble slabs and therefore did not meet the three-part test of being a retailer and was deemed a consuming contractor. I am chalking this error up to a miscommunication between the Taxpayer and auditor. I am guessing that the auditor did not explain the three-part test to the Taxpayer, so the Taxpayer did not know the importance of their answers regarding this issue. Regardless of what happened, the key point here is that we were able to straighten it out and the Taxpayer’s assessment was corrected in this area. I thought it was sad though that the Commonwealth of Virginia was trying to get the tax from both ends of the transaction. First from paying the tax on the materials when purchased and then from collecting the sales tax from the customer. If the Commonwealth thought that the Taxpayer was a consuming contractor, then I would have thought the Commonwealth would have just been happy in getting the tax on sales price vs. the cost of the materials and not try to assess tax on the COGS when the Taxpayer had already collected the tax from their customers.

Second issue is that by law sales tax is to be remitted as billed and not as collected. I know this creates a cash flow issue, but that is the law.

Further Discussion

The key issue with dealing with any type of auditor is communication. Marsu believes in knowing the answer before the question is asked and if Marsu does not know the answer, then Marsu has the ability to say I am not sure, and I will get back to you with the answer. The problem here is that the Taxpayer should know everything about their business, but does the Taxpayer know how to properly answer the questions for sales tax purposes? Probably not. When the audit starts, the auditor will have some preconceived ideas of what the Taxpayer should be collecting tax on, if any, and what the Taxpayer should be paying sales and use tax on. These preconceived ideas will probably come from the auditor’s experience of auditing other like Taxpayers or viewing the Taxpayer’s website. In the first meeting with the auditor, the auditor will usually discuss the Taxpayer’s business to exactly find out what the business does. The auditor will be asking targeted questions that deals with collecting tax vs paying sales and use tax on materials purchased for the business. The auditor will be clinging to every word that the Taxpayer says, and their preconceived ideas can change with whatever you tell them. This includes miscommunication to when the auditor improperly interprets what was said or the lack of what was said. If Marsu is involved before the audit starts, then the information for sales and use tax purposes can be effectively communicated to the auditor and hopefully no improper interpretations will be made.

Additional Law Change

Effective July 1, 2017, VA reversed their 2010 law change regarding countertop manufacturers/installers and deemed them to be consuming contractors again. Therefore, these Taxpayers pay tax on their materials incorporated into the job and collect no tax when the job is installed.

If at times, the Taxpayer just manufacturers a countertop without installation or manufacturers a countertop with material provided by the customer, then the Taxpayer should collect tax on these transactions. To do this, the Taxpayer needs to have a VA sales tax license to collect tax.

Click Here or Image Below for Full Letter

VA Total Assessment Amount – $37,293.07

Total Reduction Amount – $5,145.05 – 14%

VA Refund Approved – $15,287.22

DC Refunds Approved – $9,233.50

MD Refund Approved – $89,452.26

Exceptionally large Maryland mechanical contractor working in DC, MD and VA was selected by the Commonwealth of Virginia for a VA sales and use tax audit. This was the Taxpayer’s second VA audit in the past ten years. Marsu had assisted the Taxpayer in the previous audit and was called upon again to help. Because the Taxpayer was so large, Marsu recommended this time that the Taxpayer have VA perform a Stratified Statistical Sampling audit instead of the normal block sample audit because if a big or large error is in the block sample it distorts the projected liability. Stratified Statistical Sampling eliminates this problem. Once VA understood how big the Taxpayer was and the volume of records involved, VA agreed to the Stratified Statistical Sample audit. Marsu assisted the Taxpayer as follows with the Sample and resulting expense schedule:

- For the Stratified Statistical Sample, Marsu reviewed the expense accounts and job type selected by the auditor to be included in the audit, what information could be provided in the download given to the auditor, and what information would be provided for the invoices selected. After all the parameters were determined for the download, the Taxpayer had the program written to create the file of all the AP invoices and what data to be included for each invoice in the file. After the audit file was created for the three-year audit period and since the Taxpayer’s AP records were all scanned, the Taxpayer was able to print out all the selected AP invoices by supplier, in date order for the auditor’s review.

- For the selected expense invoices, the auditor reviewed 1,190 invoices and only listed 34 invoices where sales or use tax were not paid. This Taxpayer had a great accounting system for properly paying sales and use taxes and Marsu knew that from the last VA audit. Marsu reviewed the 34 lines and was able to reduce the taxable base by $9,981.14. This reduction resulted in the assessment being reduced from $37,293.07 to $31,147.41, a savings of $5,145.66. The savings included interest. Penalty was not assessed by VA, because of how compliant the Taxpayer was.

Main Audit Issue

With this Taxpayer, there is really no issue with the procedures in place to pay sales and use taxes on their real property construction jobs. The Stratified Statistical Sample file for the VA audit had over 25,471 lines in it with a dollar value of $39,343,230.43. The sample itself only had 1,190 invoices in it but represented 61.2% of the dollars. For the top two dollar value ranges in the sample, VA reviewed 100% of the invoices and if any of those invoices had been in the normal block sample audit with no tax being paid, the assessment would have been a lot higher than the Sample assessment of $31,147.41.

Reasons for Success

Unfortunately, states love to audit real property contractors. Real property contractors are considered consuming Taxpayers and owe tax on all the materials incorporated into their jobs and these Taxpayers have been audited so much it has become second nature for some of them to pay use tax on transactions where sales tax is not charged. This is the case with this Taxpayer. After a while, the Taxpayer needs to push back and that what happens when a Taxpayer hires Marsu to assist them with an audit. Not only will Marsu assist the Taxpayer in lowering the assessment to the lowest amount possible, Marsu will document all refunds that the Taxpayer has inadvertently overpaid. Plus I have seen it where Taxpayers who have been audited on a regular basis in the past have had that trend stop after Marsu has gotten involved with the audit to reduce the tax assessed and has filed an offsetting refund with the State Agency involved. In this case, the Taxpayer only owed a net of $15,860.19 after the refund and the auditor spent hundreds of hours doing the review with results that on an hourly basis were very below average. In some cases, the Taxpayer actually got a refund back from the State performing the audit. In this case, the State is really a loser.

For this audit, the Taxpayer actually made money. Marsu had DC, MD and VA refunds approved in the amount of $113,972.98 minus the VA audit of $31,147.41 for a profit of $82,825.57. Marsu did not have a lot of time invested in the VA audit review. Marsu mainly advised the Taxpayer on the Stratified Statistical Sample audit methodology and reviewed only 34 invoices. So for this three-year audit, the Taxpayer saved an average of $27,608 per year and if the Taxpayer instituted all changes, the Taxpayer has saved $220,864 over the past eight years.

Click Here or Image Below for Full Letter