MD Case Study – Security Guard and Private Investigative Services

MD Assessment Amount – $58,209.92

Reduction Amount – $36,250.95 – 62%

Interest Savings – $21,054.55

Penalty Savings – $5,820.99

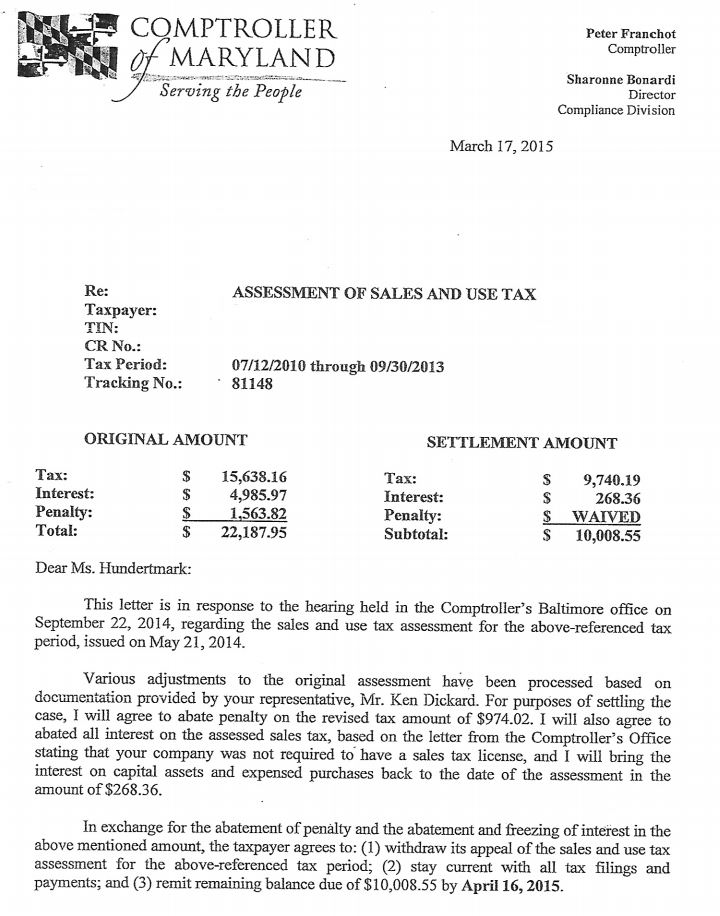

Maryland Taxpayer provides security guard and private investigative services to private, government and other clientele. Taxpayer was selected by the Comptroller’s Office for a Maryland sales and use tax audit. Taxpayer went through the audit process himself and went to an informal hearing without getting any relief from the $36,291.73 tax liability. Marsu was contacted by the Taxpayer’s lawyer to review the workpapers to determine if any adjustments could be requested. Taxpayer was being assessed for failure to collect sales tax on all line items on their invoices for security and private investigative services, failure to pay use tax and failure to remit all sales taxes collected. Since the Taxpayer had already had an informal hearing, the lawyer had to file an appeal to the Maryland Tax Court and then present our finding to the Maryland Attorney General’s Office for any reductions. Marsu did the following for each of the schedules:

- For taxes collected but not remitted, the auditor did an analysis comparing the MD sales tax collected, monthly sales tax liability report and the tax remitted to come up with the liability which was almost half the assessed tax amount for the whole audit. Marsu reviewed this schedule and found that the auditor had incorrectly recorded the tax collected amount for four of the months and tax liability became zero. The tax assessed was reduced from $15,915.00 to $0, a savings of $15,915.00.

- For sales, the auditor reviewed six months of invoices and listed 87 lines on the workpapers. Marsu reviewed the 87 lines and only found two adjustments. Marsu also reviewed the projection methodology and found that the total sales for the oldest year should have been for only 8 months and not for the entire year as the Comptroller had recorded. Marsu also found that the total sales for the sample period was higher than recorded. With these four minor adjustments, the liability for failure to collect sales tax was reduced from $17,378.10 to $13,492.88, a savings of $3,885.22. These four minor adjustments alone paid the bill for the lawyer and Marsu to do their review and present the case to the AG’s Office.

- For expenses, the auditor again reviewed six months of invoices and listed 38 lines on the workpapers. Marsu reviewed the 38 lines and found that all lines were correct. Marsu also reviewed the expenses projection methodology and again found that the expenses for the oldest year should have been for only 8 months and not for the entire year as the Comptroller had recorded. This minor adjustment reduced the expense tax assessment by $340.48.

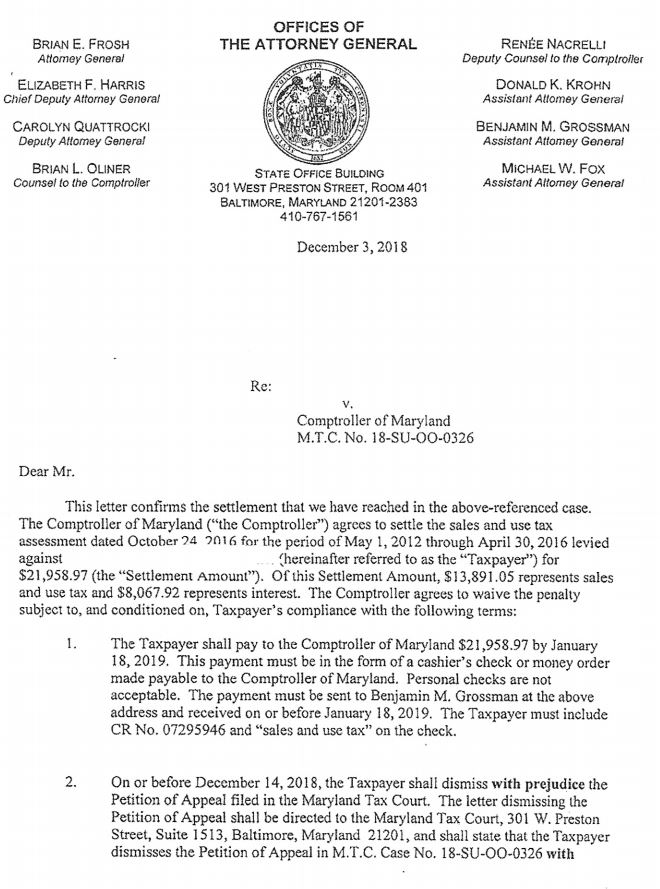

In the Settlement Agreement with the Attorney General’s office, the lawyer was also able to get the 10% penalty abated.

The total assessment due, including penalty and interest, in the Notice of Final Determination was $58,209.91. After our review, the Taxpayer paid, per the Attorney General’s Settlement Letter, $21,958.97, a savings of $36,259.04.

Main Audit Issue

Effective July 1, 1992, security and private investigative services in Maryland became a taxable service. Over the years, Marsu has represented several security firms and has seen plenty of firms listed in the Maryland Business Journal for liens being attached against the business for a sales tax audit. Usually these cases have assessments in the hundreds of thousands of dollars in just tax amount due. And the reason for all these tax assessments is the failure to properly collect tax on all items listed on an invoice for services provided. The Comptroller’s position is that all charges are part of the price of the services provided and taxable. So security firms should be collecting tax on all lines listed on their invoice.

Call Marsu

If you provide taxable services and want to confirm that sales tax is being properly collected, then please call Marsu to do a mock sales tax audit. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law.