MD Case Study – Office Workstation Installer

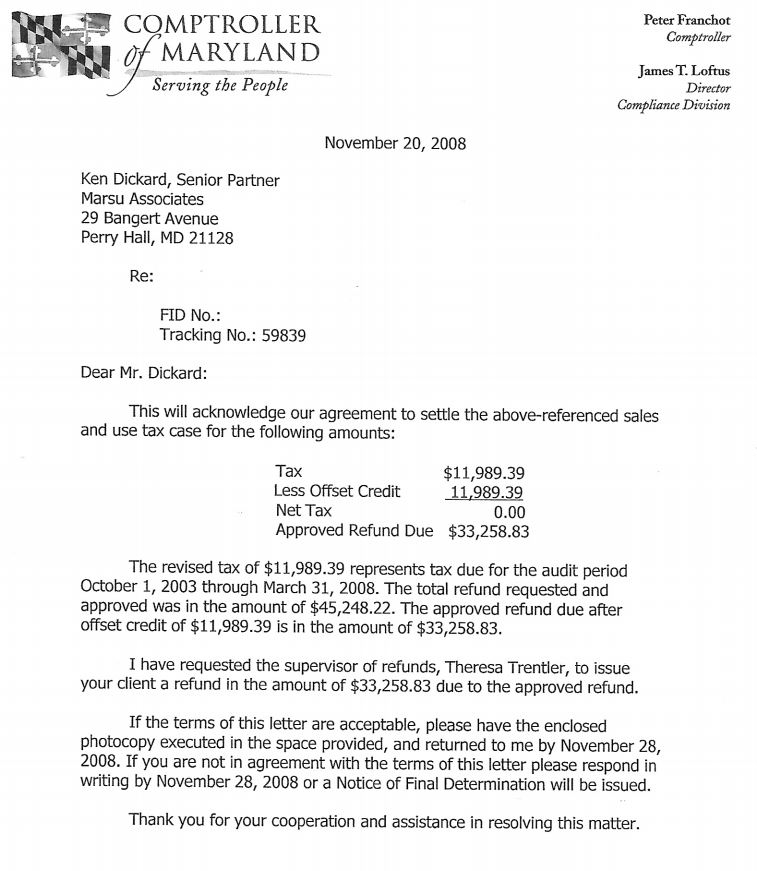

MD Tax Assessment Amount – $43,790.62

Reduction Amount – $29,862.58 – 68%

Interest Saved – $13,000.82

Penalty – Waived at Settlement

Maryland Taxpayer designs workplace environments, provides and installs office furniture, including workstations, in the Mid-Atlantic region. Taxpayer was selected for a first-time MD sales and use tax audit. Taxpayer contacted Marsu to assist in the review of the workpapers. The Taxpayer was assessed $43,790.62, $35,768.75 for failure to properly to collect sales tax and $8,021.87 for failure to pay use tax on assets and expenses where sales tax was not paid to the supplier. Marsu did the following for each schedule included in the audit:

- For sales, the auditor reviewed a block sample of two months and listed just 4 invoices as taxable to get the $35,768.75 tax assessment amount. Marsu convinced the hearing officer that the two month sample did not fairly represent the Taxpayer’s business and that the sample period should be expanded and a five month block sample was agreed upon. This five month sample included the original two months selected by the Comptroller’s Office. The auditor came back out to the Taxpayer’s office to review the additional three months and listed an additional 21 lines to the sales schedule as taxable sales. Marsu reviewed the job folder for each sales invoice and was able to document that 13 lines should be deleted from the schedule. The tax assessed was reduced from $35,768.75 to $6,957.40, a savings of $28,811.35.

- For sales projection methodology, the projection methodology did not fairly represent the Taxpayer’s business over the audit period and Marsu convinced the Controller’s Office to enlarge the sample period and to accept a different projection methodology that greatly reduced the sales tax collection liability.

- For expenses, the auditor reviewed the same two month block sample and listed 6 invoices as taxable. Marsu reviewed these 6 invoices and found no errors.

- For assets, the auditor reviewed all assets in the audit period and listed 31 invoices as taxable. Marsu reviewed these invoices and was able to document that 2 invoices were non-taxable. The tax assessed was reduced from $7,051.09 to $5,971.09, a savings of $1,080.00.

With Marsu’s assistance, this Taxpayer was able to significantly reduce their tax assessment by 63% and save $13,000.82 interest and to have the penalty abated at settlement. Marsu did perform a reverse audit, but this Taxpayer did not overpay on any sales or use taxes on their business purchases.

Main Audit Issues

When the Comptroller’s Office performs a sales and use tax audit, the procedure in how the sales and expense projections are calculated is always the same. The Comptroller takes certain information off the federal income tax returns and assesses the Taxpayer by multiplying the total expenses or sales for the audit period by the error factor calculated in the sample used and then multiplying the resulting taxable base by the 6% tax rate to finally calculate the amount of tax due. The problem with this methodology is that the sample does not always fairly represent the Taxpayer and his business over the four year audit period. Sometimes the sample is heavy in some type of taxable transaction or transactions that exaggerates the projection or sometimes the sample is light in non-taxable transactions that would also exaggerate the projection because they are not fairly represented.

This Taxpayer had a little bit of both problems in their sales projection. The sales sample selected by the state only had 4 sales invoices that were deemed taxable, but they were 4 large invoices which projected to a large assessment and the percentage of non-taxable transactions were not fairly represented in the original two-month sample. By expanding the sample size from two to five months, the average liability per month decreased so the total tax liability decreased and Marsu presented another projection methodology that pulled the non-taxable transactions out of the projection entirely.

A second issue that this Taxpayer had was that the Taxpayer was not collecting tax on all taxable separately stated lines items on their invoices. The Taxpayer was collecting tax on the furniture that was being sold but did not collect tax on the “fabrication labor” used at the jobsite to fully assemble the furniture or workstations. The Comptroller’s Office position is that all costs used to assemble a piece of property for the first time, on the jobsite or elsewhere, is taxable.

Call Marsu

If you are a retailer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.