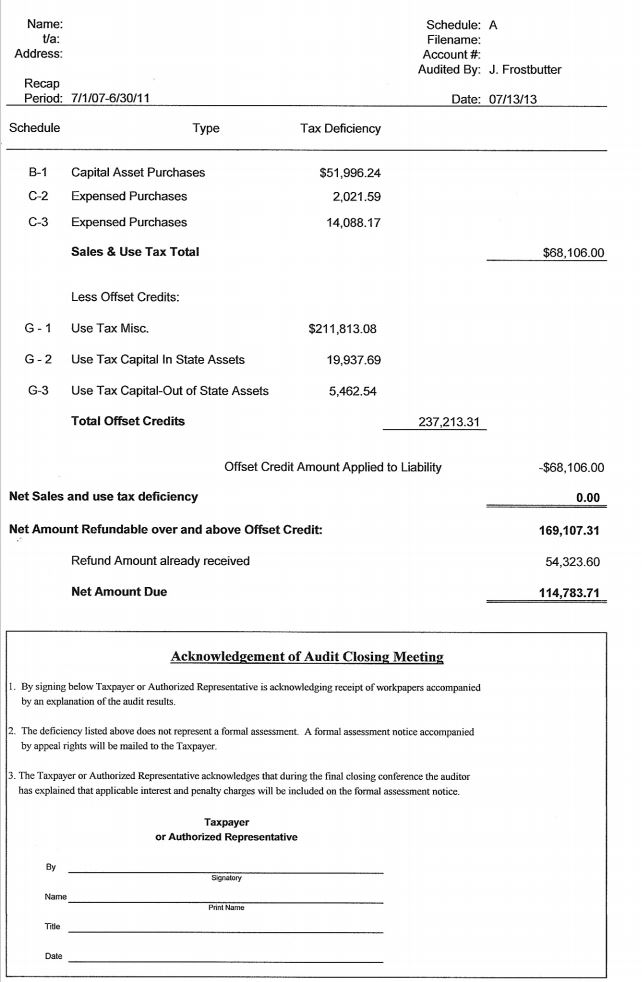

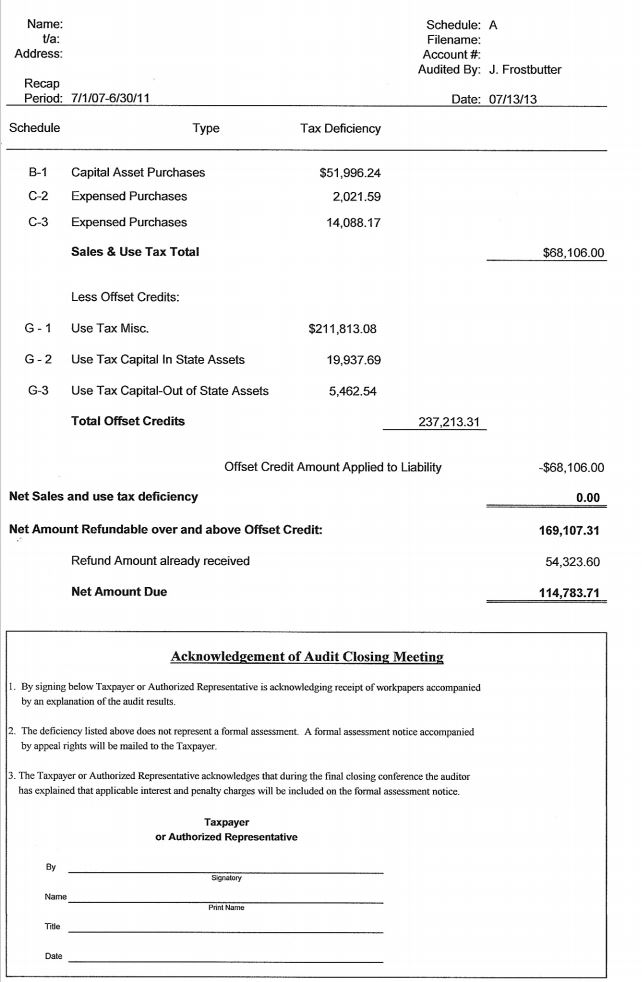

MD Tax Assessment Amount – $182,874.59

Reduction Amount $114,768.59 – 63%

Refund from Reverse Audit – $907,177.37

Refund from Taxpayer – $237,198.19

Interest & Penalty Savings – $73,149.84

Exceptionally large Maryland manufacturer and government contractor who manufacturers products and provides services to the federal government and has locations throughout the United States was selected for another sales and use tax audit. This Taxpayer was last audited in 2001 and Marsu assisted in that audit and had filed and gotten refunds approved by the Comptroller. Taxpayer had received their audit workpapers and was working on filing their own refunds but wanted assistance with reviewing the audit and in filing any additional refunds. Marsu assisted the Taxpayer as follows with the asset and expense schedules:

- For capital assets, the auditor reviewed all Maryland assets and listed 107 invoices as taxable. Marsu reviewed each invoice to determine where and how each asset was used to establish if an exemption was available or if sales or use tax was paid. Marsu was able to document 48 invoices were non-taxable. The tax assessed was reduced from $83,751.76 to $51,996.24, a savings of $31,755.52.

- For expenses, the auditor reviewed a one-month sample period and listed 38 invoices as taxable. Marsu reviewed each invoice and was able to get only 11 invoices deleted, but these 11 invoices represented 84% of the sample dollars. The tax assessed was reduced from $99,122.83 to $16,109.73, a savings of $83,012.60.

With Marsu’s assistance, this Taxapayer was able to significantly reduce their tax assessment and to recover all sales and use taxes paid in error. The original workpapers had the Taxpayer owing $182,874.59 in taxes and the final workpapers had the Taxpayer receiving refund checks in the total amount of $1,076,284.68, a savings of $1,259,159.27. Since the Taxpayer had filed their own refunds that exceeded the tax assessment amount, there was no interest and penalty assessed. This saved the Taxpayer approximately $73,149.84 in interest and penalty because the refunds were filed.

Main Audit Issues

The only minor audit issue here is that the Taxpayer sometimes misses paying use tax on some of its assets and expense items. Their percentage of error is exceedingly small. For assets, there were 6,041 assets and tax was not properly paid on 59 of them for an error rate of less than 1% – .0097665. I think that is a pretty great job. For expenses, the assessment ended up to total $16,109.76 which is a monthly average of $335.62 which is not terrible for the size of the company. A review of the final 27 invoices on the expense schedule shows that the assessment came from mainly office supplies and online purchases. One area that the States love to audit, and Taxpayers have difficulty with is credit card transactions. Usually the monthly credit card transactions are not reviewed by the Taxpayer to pay use tax and a lot of times these transactions come from out of state transactions where MD sales tax is not collected.

Audits of Exceptionally Large Businesses

Auditing exceptionally large businesses for sales and use taxes is very time-consuming job not only because of the sheer volume of records, but also because of the different exemptions or exclusions available for businesses that operate in and have contracts in multiple states. Just for the asset portion of this audit alone, this Taxpayer had to at least provide invoice copies of over 6,000 assets for the auditor to review to establish minimally that sales or use tax was paid so the asset would not be assessed. This does not even count the expense audit and heaven forbid if the Taxpayer had taxable sales and the auditor would have to review at least a one-month sample.

Time is one of the things that the States have as an advantage over the Taxpayer. The State’s auditor does not have a time limit or a job profit and loss statement to answer to. When the auditor does their audit, they will list everything possible on the workpapers and hope it sticks. If the Taxpayer does not invest the time by providing the requested information and then thoroughly reviewing the workpapers to provide additional information, then the Taxpayer will be over assessed. That is why is it is beneficial to bring in experts who for 40 years have been reviewing workpapers and dealing with auditors, supervisors, and hearing officers. Plus any refund that Marsu gets approved will offset any taxes due and decrease the interest and penalty due. After the audit is finalized, Marsu will review with the Taxapayer the refund that was approved so the Taxpayer can implement changes to their accounting system to take advantage of the annual tax savings.

Call Marsu

If you are a Government Contractor or a multi-state contractor and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter

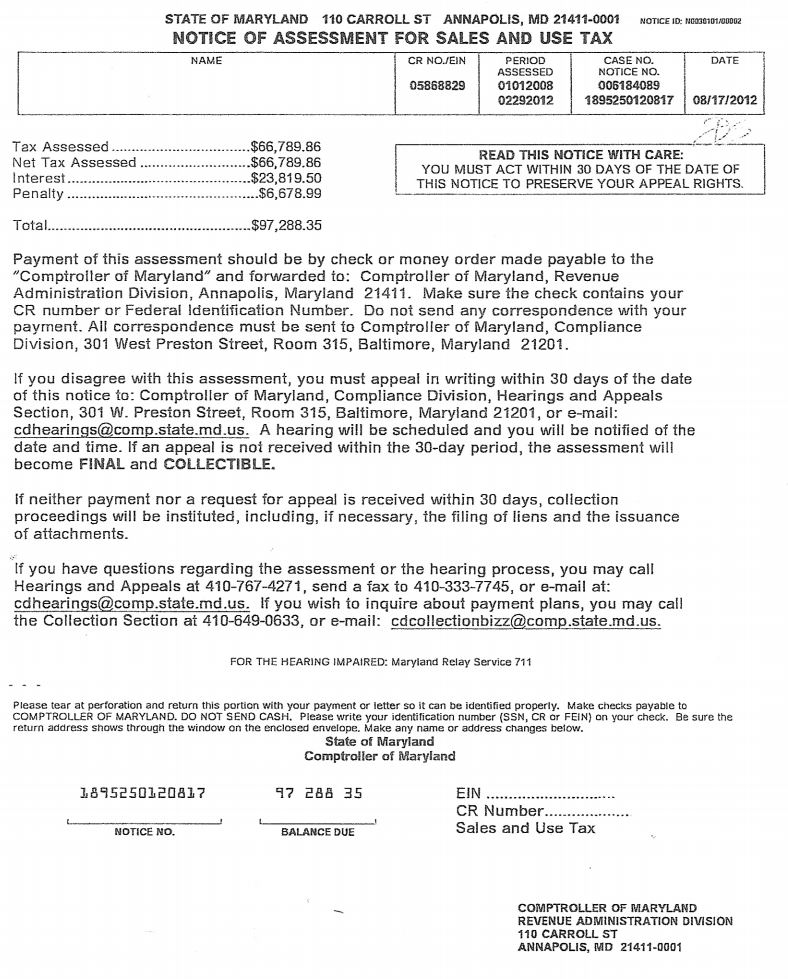

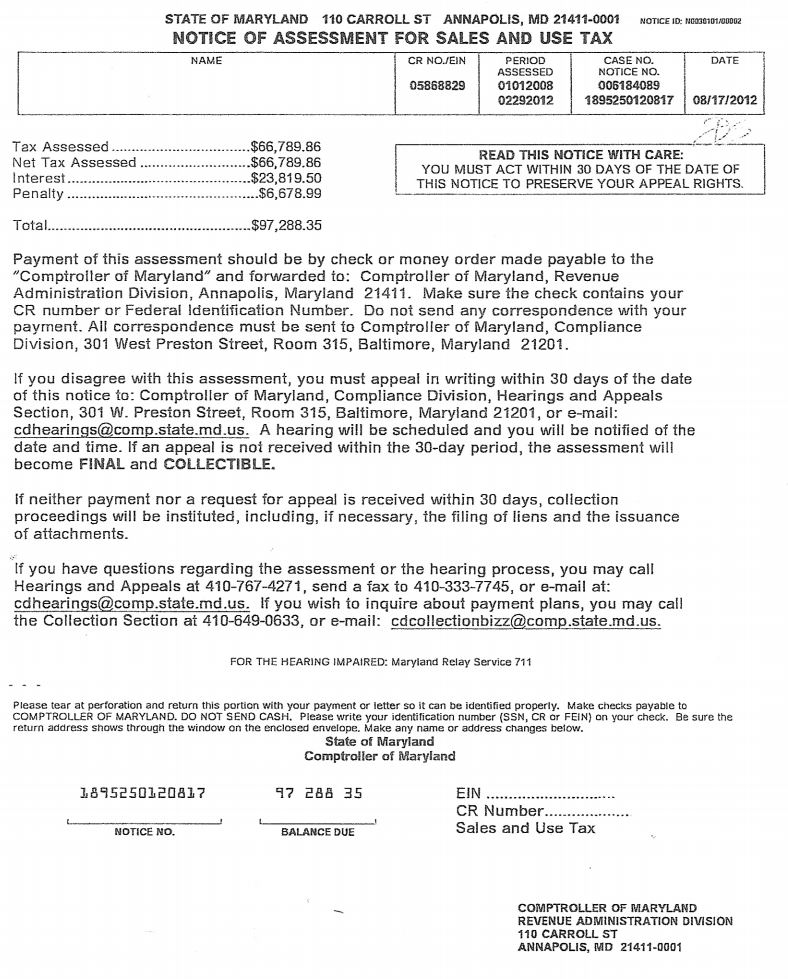

MD Tax Assessment Amount – $598,110.61

Reduction Amount $531,320.75 – 89%

Refund from Reverse Audit – $17,085.98

Interest Savings – $189,486.77

Large commercial and federal government contractor provides general contracting services in Maryland and Washington DC. This Taxpayer was selected by the Comptroller’s Office for a first-time MD sales and use tax audit. The Taxpayer undoubtedly got sticker shock when the auditor provided them the initial workpapers where they owed $598,110.61. Marsu was contacted by the Taxpayer’s lawyer and accountant to assist in the review of the workpapers. This Taxpayer was deemed a consuming contractor and the assessment was for the failure to pay use tax on their expenses and assets. Marsu assisted the accountant with the two schedules as follows:

- For capital assets, the auditor reviewed all Maryland assets and listed just 2 invoices as taxable. Marsu found no errors with this schedule.

- For expenses – Job Cost Materials, the auditor reviewed a three-month sample period and listed 45 invoices as taxable. Marsu pulled each job folder and reviewed each invoice and was able to get 26 invoices deleted from the schedule and had 2 invoices removed and put on a separate schedule and taxed individually. The tax assessed was reduced from $590,987.93 to $61,753.77, a savings of $529,234.16. Five of the remaining 19 invoices were credit card transactions and were not reviewed by this Taxpayer for use tax payments.

- For expenses – G & A Expenses, the auditor reviewed the same three-month sample and listed 9 invoices as taxable. Marsu reviewed each line and provided documentation to get 1 line deleted from the workpapers. The tax was reduced from $6,247.28 to $4,161.89, a savings of $2,085.29. Eight of the 9 invoices listed were credit card transactions which were not reviewed by this Taxpayer for use tax payments.

- For expense projection methodology – Job Cost Materials, Marsu documented and presented an alternative projection methodology that was approved by the Comptroller’s Office. This new methodology saved the Taxpayer $23,564.77 in taxes in the final workpapers.

With Marsu’s assistance, this Taxapayer was able to significantly reduce their tax assessment. The original workpapers had the Taxpayer owing $598,110.61 in taxes and the final workpapers had the Taxpayer owing just $66,789.86. Marsu performed a reverse audit and documented sales and use taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $17,085.98 in the audit workpapers as required by law.

Main Audit Issues

The Comptroller’s Office properly deemed this Taxpayer as a consuming contractor; therefore this Taxpayer is liable for sales and use taxes on all materials purchased directly by them and tangible personal property deemed tangible personal property after installation by a subcontractor into a job.

Unfortunately, this Taxpayer dealt with a lot of these gray area tax issues where there is not a lot of written information on, but the Comptroller’s Office loves to audit for and assesses many a business. This gray area deals with Regulation 19 and the State’s definition of tangible personal property. Pursuant to Regulation 19C, the Comptroller’s Office has written the following:

Reg. 19C(3) – “If the intention of the annexation is for a temporary purpose, that is, for the enjoyment or use of the material as a chattel or personalty, the material will be considered to retain its character a tangible personal property. Machinery used in a production activity retains its character as tangible personal property without regard to the method or permanency of its annexation to real property. Farm equipment, a foundation in support of machinery and equipment used in a production activity and any machinery, device, or equipment which is required for conformance with air or water pollution laws or regulations retain their character as tangible personal property”.

Reg. 19C(4) – “Factors to be considered in determining the intention of the party making the annexation are the:

- Nature of the article annexed;

- Mode of annexation;

- Purpose of which it was annexed; and

- Practicality and feasibility of removal of the annexed article”.

Reg 19C(5) – “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential or commercial spaces will be treated as realty”.

As you can see there is a lot of grey here and the only issue the Comptroller gives a little information about is on the furnishing and installation of countertops and cabinetry in commercial spaces which is automatically deemed tangible personal property with the exception of kitchen and bathroom areas.

I like to talk about this issue in another way to give a different perspective of what the Comptroller’s Office deems as tangible personal property and why. The question you must ask yourself is “whose purpose does the item or article serve, the tenant or the building?” If the item or article after installation was installed to serve some purpose for the tenant, then the Comptroller is going to say that it is tangible personal property and if the item or article serves the building, then the item or article is deemed realty. So if the item or article deals with the doors, windows, except blinds and drapes, walls, ceiling, floors, except carpet, roof, plumbing, heating, central air conditioning or domestic water systems of the building, then the item or article will most likely be deemed realty because they serve the building and not the tenant. In this case, the Comptroller even deemed that a sink that was installed in a work area of a doctor’s office was tangible personal property. The Comptroller deemed that it served the doctor’s office and not the building and entire amount of the contract to install was deemed taxable.

Below are some other examples of items that after installation, the Comptroller’s Office deems as tangible personal property and have taxed in audits that I have been involved in.

- Countertops and cabinetry installed in commercial spaces, regardless of how installed and not installed in kitchen or bathroom areas.

- Bars and food stations in bars and restaurants.

- Reception desks and bank teller stations.

- Lockers

- Blinds or drapes installed. Even motorized units that may hide in the ceiling.

- TV installation (fabrication labor), programming and cabling.

- Projection screens in conference rooms. Unit may hide in the ceiling.

- Specialized water systems that are outside the domestic water system that supplies water to the kitchen and bathroom areas.

- Backup generator systems for commercial customers.

- Canvas or vinyl awnings for commercial customers. Most residential awnings are considered tangible personal property.

- All types of signage. See Regulation 36.

- Fuel tanks, even those in the ground.

Another issue with this audit was credit card transactions. Even though this Taxpayer filed monthly use tax returns, the credit card bills were not reviewed for use tax due on purchases from out of state suppliers who did not collect MD sales tax. This is a favorite area for the MD auditor’s to review that usually leads to a lot of issues because more and more is being purchased via credit cards these days, there are missing invoices, and there is usually a fair amount of out of state purchases because a direct account is not setup with these suppliers to pay by the normal AP system.

Call Marsu

If you are a General or Subcontractor and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter