MD Case Study – Sales and Admission and Amusement Taxes – Golf Course

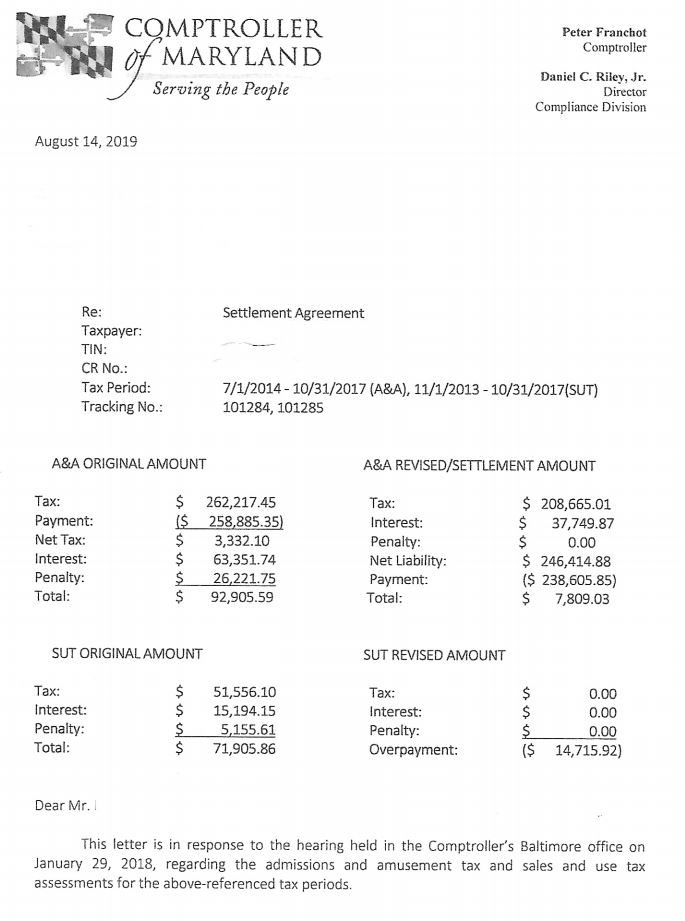

MD Sales Tax Assessment Amount – $51,556.10

Reduction Amount – $51,556.10 – 100%

Interest and Penalty Savings – $20,349.76

Refund Check Amount – $14,715.92

MD A&A Tax Assessment Amount – $262,217.45

Reduction Amount – $53,552.44 – 20%

Interest Savings – $25,601.87

Penalty Savings – $26,221.75

Maryland golf course was selected by the Comptroller’s Office for a Maryland sales and use tax and admissions and amusement tax audit. This taxpayer had been audited before for sales and use tax, but this time the audit was trigger by non-payment of admissions and amusement taxes. The number one issue that triggers an audit more than anything else is failure to file returns. Marsu was contacted by the Taxpayer’s lawyer to review the completed workpapers. Taxpayer had calculated the amount of admissions and amusement taxes that were due and submitted a check prior to the audit workpapers being finalized. I am assuming the Taxpayer did this to stop interest from accruing. Since the Taxpayer had received their Notice of Assessment, the case could not be reviewed in the field, so the lawyer filed for an informal hearing. Marsu did the following for the asset, sales, expenses and lease audit schedules for the sales tax audit and the admissions and amusement calculation schedule for the admissions and amusement tax audit:

- The auditor reviewed every asset purchased during the audit period and only listed 7 invoices. Marsu was able to obtain a copy of one (1) of the invoices to prove that sales tax had been paid to the supplier. The tax assessed was reduced from $2,007.56 to $1,932.39, a savings of $75.17.

- For expenses, the auditor reviewed a three month sample period and listed 38 invoices. Marsu reviewed each line item and provided documentation to the hearing officer to get 15 lines deleted from the workpapers. Documentation included contracts, account number information and copies of invoices. The tax assessed was reduced from $14,126.08 to $5,398.20, a savings of $8,727.88.

- For lease schedule, the auditor reviewed all leases and listed two (2) leases. Marsu presented copies of invoices from one of the leases where sales tax was paid. The tax was reduced from $18,062.85 to $13,424.64, a savings of $4,638.21.

- For sales, the auditor listed the revenue from the accounts that were taxable for the audit period on a yearly basis and totaled all taxable sales and subtracted the sales tax remitted to calculate the tax assessment. Since alcohol sales were involved, there was a 6% and 9% tax assessment schedules. Marsu reviewed these schedules and determined that not all the proper accounts were included and not all the sales were taxable sales. Marsu documented the additional accounts and the non-taxable sales to the hearing officer and the schedules were reduced. The 6% schedule was reduced from $18,062.85 to a refund of $13,544.42, a savings of $31,607.27. The 9% schedule was reduced from $2,413.37 to a refund of $10,710.04, a savings of $13,123.41.

- For admissions and amusement taxes, the auditor listed the revenue accounts that were taxable for the period to calculate the 10% tax that was due. Marsu reviewed this calculation and determined that not all sales were taxable and then provided documentation for those non-taxable sales to the hearing officer. The tax was reduced from $262,217.45 to $208,665.01, a savings of $53,552.44.

Main Audit Issues

Over the years, Marsu has reviewed several audits of golf courses for sales taxes. I believe they are a favorite target of the Comptroller’s Office because they are auditing for two taxes at one time, for sales taxes they are auditing that the 6% and 9% tax is collected properly, and that the industry purchases a lot of equipment from out of state suppliers and use tax is not always paid.

The first issue here was that the Taxpayer was not filing their admissions and amusement tax returns. That is a red flag for the Comptroller’s Office and they will always perform an audit to get their money. Taxpayers should always file tax returns and pay timely so you do not attract attention to themselves and get audited.

The second issue was that the Taxpayer was not paying any use tax. This was at least the second audit for sales and use taxes and re-audits is one area that the Comptroller’s Office obtains audit candidates from. The Comptroller’s Office will review the payment history of Taxpayers who were audited in the past ten years or so and had large assessments. A certain percentage of them will be selected for a re-audit to confirm that the Taxpayers made changes from their last audit to be in better compliance with collecting and paying use tax.