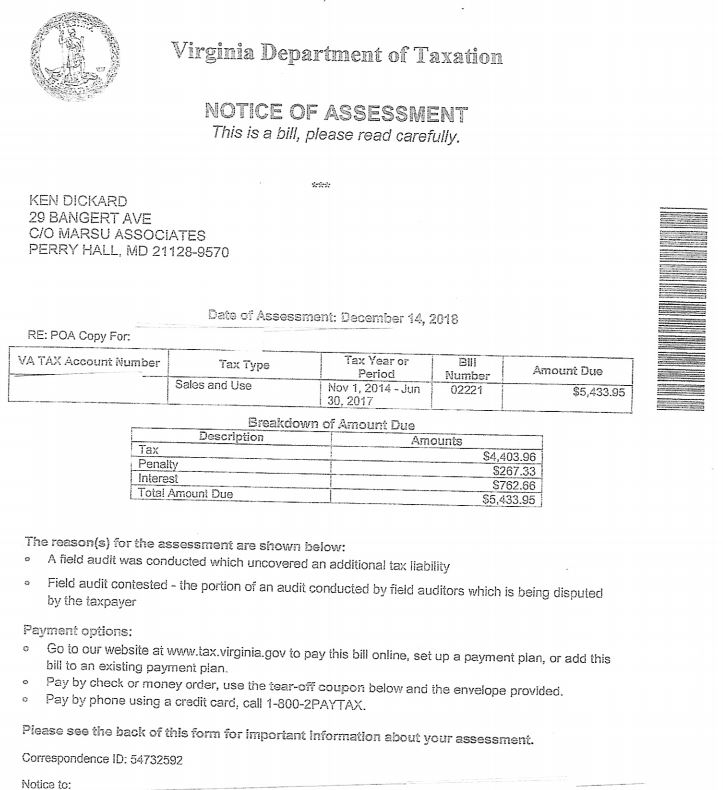

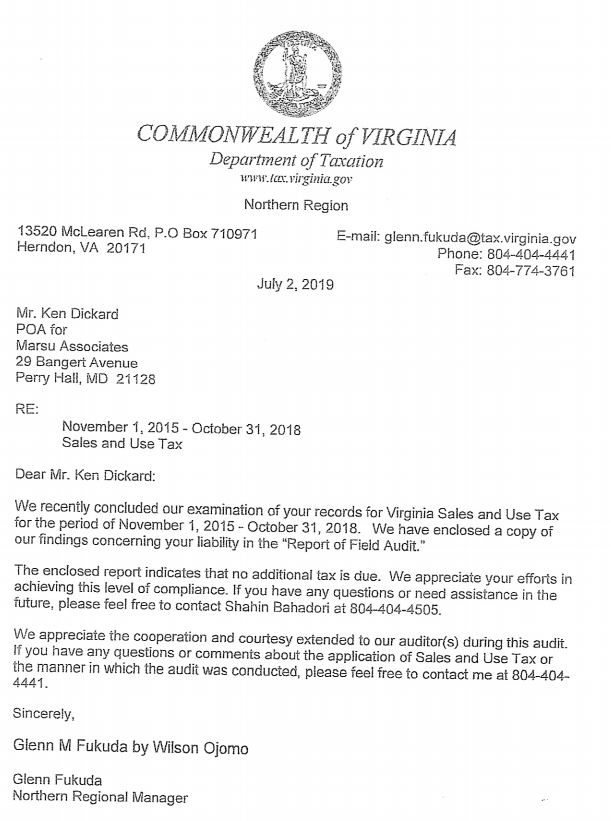

MD Tax Assessment Amount – $138,629.42

Reduction Amount – $84,911.83 – 61%

Approved Credit/Refund – $73,202.29

Interest and Penalty Savings – $55,451.77

Refund Check Received – $19,484.70

Maryland woodworking and cabinet making shop was selected by the Comptroller’s Office for a Maryland sales and use tax audit. This taxpayer had been audited before and Marsu was contacted by the Taxpayer’s lawyer to assist in the audit process. Like any other audit, the auditor reviewed a sample period of sales and expenses and projected the assessment over the audit period and reviewed all asset purchases. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- For sales, the auditor reviewed three months of sales invoices and listed 77 out of 223 invoices as taxable. Marsu had Taxpayer pull invoices, contracts, and job estimation sheets to prove to the auditor that an invoice was not taxable. Sales schedule ended up with just 8 taxable invoices where tax was not properly collected. The tax assessed was reduced from $54,939.82 to $24,488.35, a savings of $30,451.47.

- For sales tax projection methodology, the Comptroller’s methodology did not fairly represent the Taxpayer’s business over the audit period so Marsu had the Taxpayer document an alternative methodology that was accepted by the Comptroller’s Office. Alternative methodology saved the Taxpayer approximately $10,000 in tax on the sales schedule.

- For expenses, the auditor reviewed three months of expense invoices and listed 188 invoices as taxable. Marsu reviewed each line item and provided documentation to the auditor that the line was not taxable or that use tax was paid. The expense schedule was reduced by 67% of the dollar value of the invoices listed. The Taxpayer had a complicated system of paying use tax and showing that the purchase was for resale. The Comptroller made the Taxpayer prove each line item that was for resale by matching the purchase to its’ corresponding sales invoice. This was a very time-consuming process. The tax assessed was reduced from $78,406.27 to 23,945.91, a savings of $54,460.36.

- For assets, the auditor reviewed every asset purchased during the audit period and only found issue with one invoice. Marsu agree that the one invoice was taxable.

Marsu also performed a reverse audit and documented sales and use taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $73,202.29 in the audit workpapers as required by law. The original workpapers had the Taxpayer owing $138,629.42 in taxes and the final workpapers had the Taxpayer receiving a refund check in the amount of $19,484.70, a savings of $158,114.12. Since the Taxpayer received a refund, there was no interest and penalty assessed.

Main Audit Issues

Cabinet and countertop manufacturers have been a favorite audit target of the Comptroller’s Office for years. If a Taxpayer is not collecting tax properly, then the assessment will be in the tens of thousands of dollars or even hundreds of thousands of dollars depending on the size of the company and type of work performed.

Twenty years or so ago, the Comptroller’s Office added the infamous two sentences to Maryland Tax Regulation .19C(5) – Real Property Construction, Improvement, Alteration and Repair that sums up the Comptroller’s position of taxability when auditing a cabinet and countertop installer. “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential or commercial spaces will be treated as realty”. So if a Taxpayer does commercial work and it is not in a kitchen or bathroom, then the Comptroller’s Office is going to assess the Taxpayer regardless of how the cabinetry or countertop is installed. Even commercial built-in cabinetry work that is installed directly against wall studs or recessed into the wall is considered tangible by the Comptroller’s Office. For the Comptroller’s Office the word built-ins are defined as like garbage disposals not built-ins as understood by the cabinetry manufacturers and installers.

So if you furnish and install any of the following, then tax should be collected from the customer – any cabinetry and countertop installed in a non-kitchen or bathroom area, like in a doctor’s office or a work area room (paper copy station), bank teller stations, bars and food stations in restaurants, benches, cashier counters, concession stands, credenzas, lockers, reception desks, and service desks and counters. The Comptroller has even assessed window ledge under windows in conference rooms, recess cabinetry in walls, and sinks in common areas of doctor’s office or exam rooms.

One minor issue in the sales tax collection area was fabrication labor. If the Taxpayer takes the customer’s material and manufacturers an item or just performs a simple task as cutting or drilling holes in the material, then the Taxpayer’s labor charge is taxable. The Comptroller’s Office considers the labor as part of taxable price of the finished product. Just because the labor to manufacture a product is performed by two or more businesses, it is still taxable. If one Taxpayer had performed all the labor to manufacture a product, then the total price is taxable. See MD Tax Regulation 30 – Fabrication or Production for the Comptroller’s description of what fabrication labor is.

The last major issue in this audit was inventory items used in jobs for resale and also in jobs where the Taxpayer is installing the material into real property. If the material is used in a job for resale, then no tax is due on the material when purchased and tax is collected from the customer on that material. If the material is used by the Taxpayer on a real property job that is installed by the Taxpayer, then tax is due on the cost of the material incorporated into the job. Taxpayer was buying all the inventory items for resale and paying no use tax when used on realty jobs. Inventory items were items like bolts, caulk, glue, hardwoods, melamine, molding, nails, paint, plywood, screws, shims, stain, thinner and washers. Problem was that items purchased in bulk were not allocated to realty or resale jobs, so the Taxpayer had no methodology to self-assess use tax on the material cost of inventory items being used in realty jobs. The Comptroller’s Office took the position that 100% of the inventory items were taxable. For the hardwoods purchased by the Taxpayer, Marsu matched the purchase to sale invoices to get the purchase removed or reduced on the expense schedule. For all the other items, Marsu calculated a percentage of sales dollars of non-taxable jobs to total jobs for the sales sample period and used that percentage to reduce the inventory items on the expense schedule. The Comptroller’s Office accepted this analysis.

Call Marsu

Countertop manufacturers and installers are one of the most often audited types of businesses. That is because the MD sales tax law is so confusing and there are so little guidelines available. If you are a countertop manufacturer and installer and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter

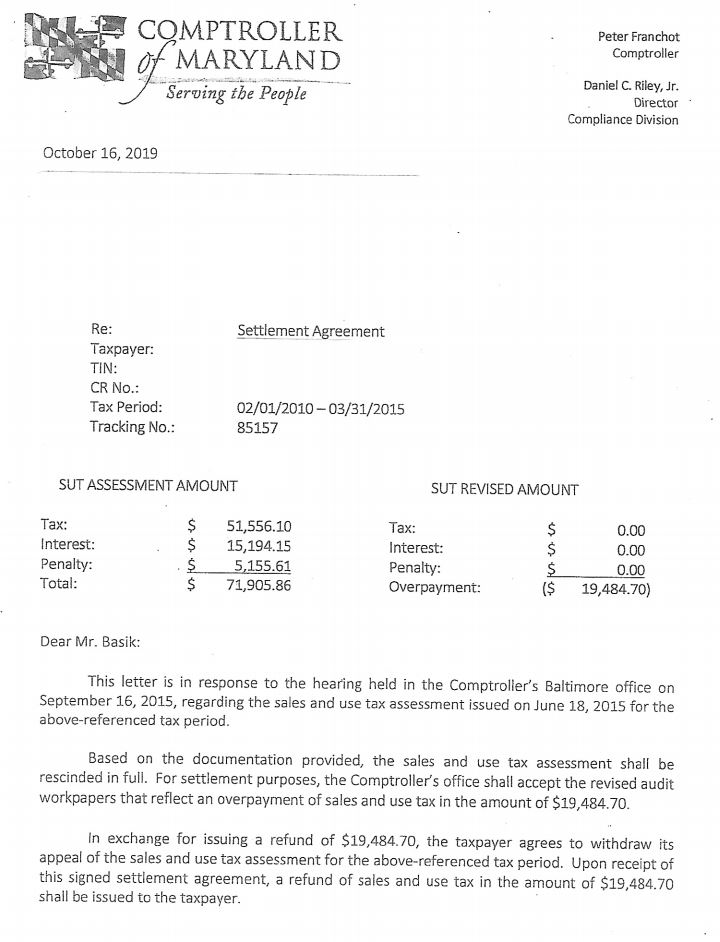

MD Tax Assessment Amount – $43,982.98

Reduction Amount – $16,891.50 – 38%

Approved Offset Credit/ Refund – $42,945.17

Interest and Penalty Savings – $17,593.19

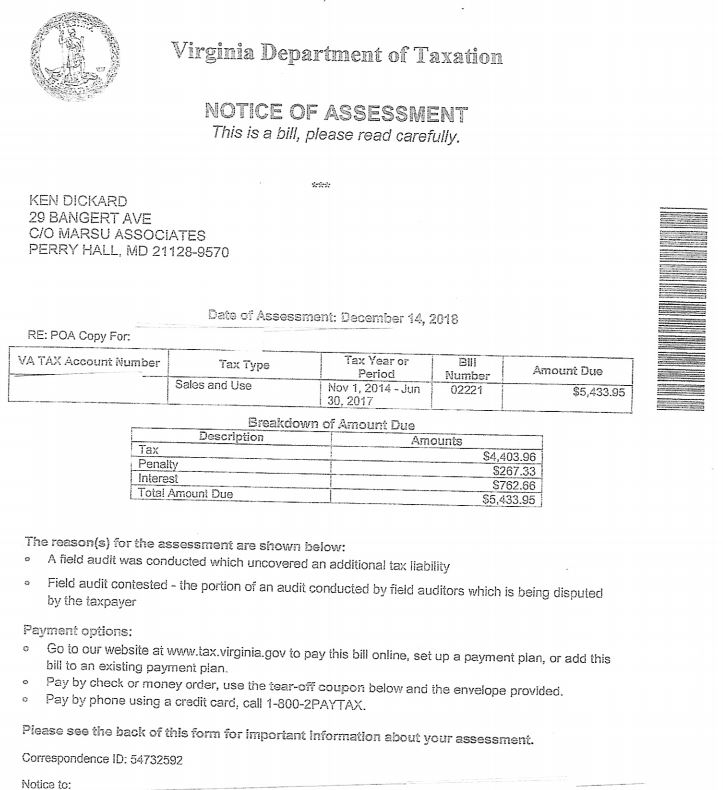

Refund Check Received – $15,853.69

Maryland countertop manufacturer and installer was selected by the Comptroller’s Office for a Maryland sales and use tax audit. This taxpayer had never been audited before and Marsu was recommended by the Taxpayer’s accountant to assist in the audit process. Luckily, we were contacted as the initial workpapers were issued and Marsu was able to review the workpapers with the field auditor and supervisor. No informal hearing was needed. Like any other audit, the auditor reviewed a sample period of sales and expenses and projected the assessment over the audit period and reviewed all asset purchases. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- The auditor reviewed six months of sales invoices and listed only 7 invoices as taxable. Marsu pulled the job folders to prove to the auditor how the three invoices were not taxable. The jobs that were removed were either a residential install or for resale. The sales schedule ended up with just 4 taxable invoices where tax was not properly collected. The tax assessed was reduced from $37,202.14 to $23,466.10, a savings of $13,736.04.

- The auditor reviewed three months of material (COGS) expense invoices and listed only 9 invoices as taxable. Marsu reviewed each line item and provided documentation to the auditor to have one line deleted and one line reduced. Even though Marsu only change two lines, the changes reduced the dollar value of the invoices listed by 32% and the tax due was reduced from $2,390.78 to $1,022.89, a tax savings of $1,367.89.

- The auditor created a second expense schedule for administrative expenses and again reviewed six months of invoices. There were 22 lines listed. Marsu reviewed each line and was able to prove to the auditor that either tax was paid or the invoice was a non-taxable transaction for nine lines. The tax due for this schedule was reduced from $$4,390.06 to $2,602.49, a savings of $1,787.57.

- The auditor reviewed every asset purchased during the audit period and the Taxpayer had properly paid sales tax to the vendor.

Marsu also performed a reverse audit and documented sales taxes paid in error and the Comptroller’s Office approved and included the refunds in the amount of $42,945.17 in the audit workpapers as required by law. The original workpapers had the Taxpayer owing $43,982.98 in taxes and the final workpapers had the Taxpayer receiving a refund check in the amount of $15,853.69, a savings of $59,836.67. Since the Taxpayer received a refund, there was no interest and penalty assessed. Without the refund, interest would have been assessed at approximately 30% and penalty at 10% to the total tax due of $27,091.48.

Main Tax Issue in Audit

Countertop manufacturers have been a favorite audit target of the Comptroller’s Office for years. If the Taxpayer is not collecting tax properly, then the assessment will be in the tens of thousands of dollars or even in hundreds of thousands of dollars depending on the size of the company and type of work performed.

Fifteen years or so ago, the Comptroller’s Office added the infamous two sentences to Maryland Tax Regulation .19 – Real Property Construction, Improvement, Alteration and Repair that sums up the Comptroller’s position of taxability when auditing a countertop installer. “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential or commercial spaces will be treated as realty”. So if a Taxpayer does commercial work and it is not in a kitchen or bathroom, then the Comptroller’s Office is going to assess the Taxpayer regardless of how the countertop is installed.

So if you furnish and install any of the following, then tax should be collected from the customer – any cabinetry and countertop installed in a non-kitchen or bathroom area, like in a doctor’s office or a work area room (paper copy station), bank teller stations, bars and food stations in restaurants, cashier counters, reception desks, and service desks and counters.

Call Marsu

Countertop manufacturers and installers are one of the most often audited types of businesses. That is because the MD sales tax law is so confusing and there are so little guidelines available. If you are a countertop manufacturer and installer and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter

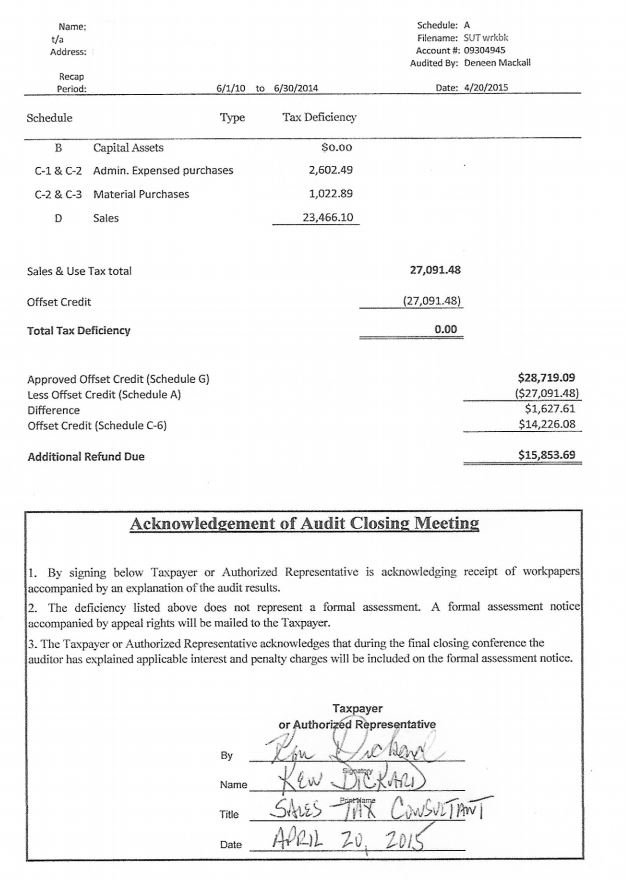

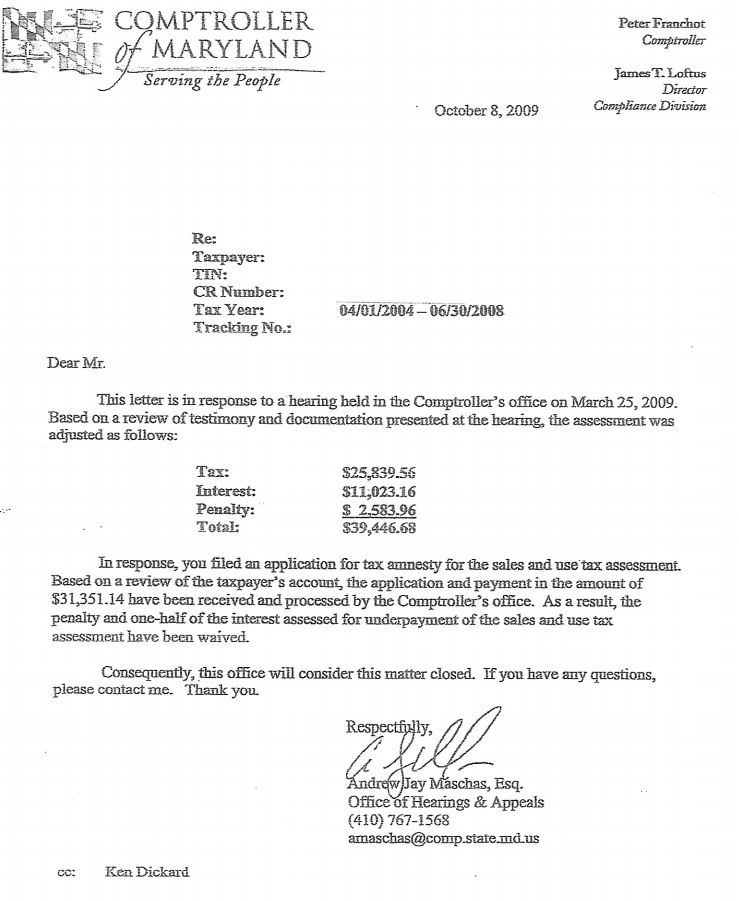

MD Tax Assessment Amount – $113,011.03

Reduction Amount – $69,836.18 – 62%

Approved Credit/Refund – $17,335.29

Interest and Penalty Savings – $42,698.94

Maryland countertop manufacturer and installer was selected by the Comptroller’s Office for a Maryland sales and use tax audit. Taxpayer manufactured and installed countertops for residential and commercial customers in DC, MD, and VA. This Taxpayer had never been audited before and Marsu was recommended by the Taxpayer’s lawyer to assist in the audit process. Unfortunately, Marsu was not contacted in time to review the workpapers in the field with the auditor so the lawyer had to request an informal hearing and Marsu had to present the documentation to a hearing officer. The Taxpayer had been assessed tax on sales for failure to collect sales tax on commercial jobs and for failure to remit use tax on expenses and capital assets. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- For sales, the auditor reviewed nine months of sales invoices and listed only 14 invoices as taxable, but the projected liability was $77,663.09. Marsu pulled the job folders to review each job and was able to document that 1 job was non-taxable, reduce the liability for 3 jobs and got the Comptroller’s Office to tax 2 jobs on an actual basis. These adjustments reduced the tax assessed from $77,633.09 to $25,496.05, a savings of $52,137.04.

- For COGS expenses, the auditor reviewed twelve months of invoices and listed 301 invoices as taxable. Marsu reviewed each line item and provided documentation to have 142 lines deleted and 2 lines reduced. These adjustments reduced the tax assessed from $24,908.39 to $14,924.70, a savings of $9,983.69.

- For assets, the auditor reviewed every asset purchased during the assessment period and listed 14 invoices. Marsu reviewed each of the assets and was able to provide documentation to get 3 of the lines deleted. The tax due was reduced from $10,469.55 to $2,754.10, a savings of $7,715.45.

Marsu also performed a reverse audit and documented sales taxes paid in error and the Comptroller’s Office approved and included refunds in the amount of $17,335.29 in the audit workpapers as required by law. At the time of the audit, the Comptroller’s Office was offering an Amnesty Program and the Taxpayer enrolled and was able to pay only half the interest due and have the penalty abated.

Main Audit Issues

Countertop manufacturers and installers have been a favorite audit target of the Comptroller’s Office for many years. If the Taxpayer is not properly collecting tax, then the tax assessment will be in the tens of thousands or even in the hundreds of thousands of dollars depending on the size of the company and type of work performed. As you can see from this case, this Taxpayer is a testimonial to that fact. This Taxpayer did a fair amount of commercial work and was not collecting sales tax.

Twenty years or so ago, the Comptroller’s Office added the infamous two sentences to Maryland Tax Regulation .19 – Real Property Construction, Improvement, Alteration and Repair that sums up their position on taxability when auditing a countertop manufacturer and installer. “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential and commercial spaces will be treaty as realty”. So if a Taxpayer does commercial work and it is not in a kitchen or bathroom, then the Comptroller’s position is that the job is taxable and will assess the Taxpayer for failure to collect tax unless tax was collected by the Taxpayer.

So if you the Taxpayer furnish and install any of the following for a commercial business, then tax should be collected from the customer – any countertop and cabinetry installed in a non-kitchen or non-bathroom area. Examples are bank teller stations, bars, beverage counters, food stations and wine racks in restaurants, built-in shoe racks, cashier counters, lockers, reception desks, and service desk and counters. Other examples include countertops and cabinetry in all non-kitchen and non-bathroom areas in office buildings, like in copy or conference rooms. The Comptroller’s Office in this case even assessed a stone countertop ledge and cabinetry that was installed in the conference room underneath the windows even though the ledge and cabinetry was installed to bare stud walls and an operating table in a veterinarian’s office.

How Audits Happen

This audit represents a typical way that a Taxpayer gets selected for a sales tax audit. The Taxpayer’s customer gets audited first and the auditor sees that the countertop manufacturer is not collecting sales tax, so the auditor turns in the Taxpayer for an audit.

Call Marsu

Countertop manufacturers and installers are one of the most often audited types of businesses. That is because the MD sales tax law is so confusing and there are so little guidelines available. If you are a countertop manufacturer and installer and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.

Click Here or Image Below for Full Letter

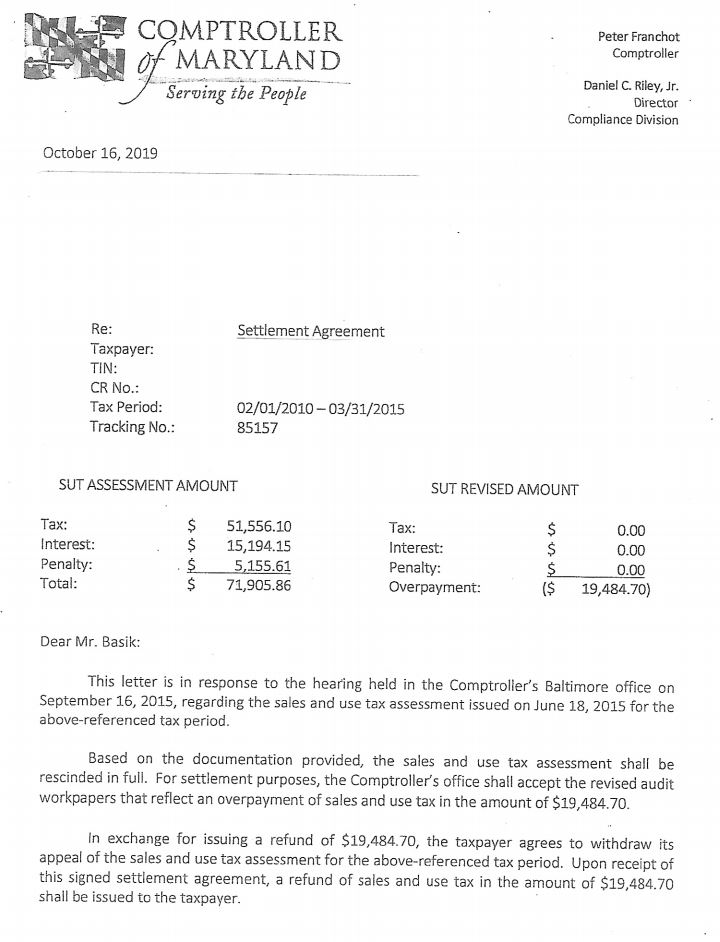

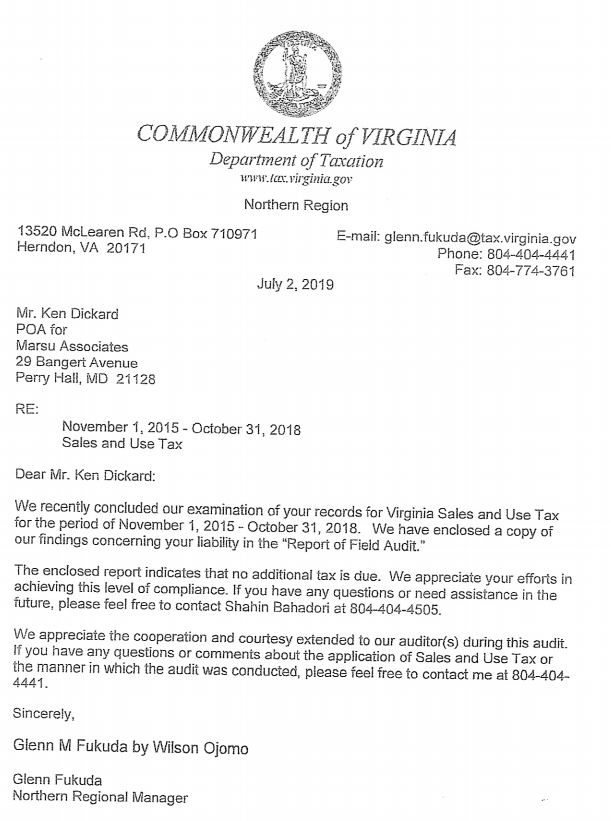

VA Tax Assessment Amount – $0.00

In March 2018, the Taxpayer was referred to Marsu by their accountant to address their methodology of paying use tax to Maryland and Virginia. Taxpayer manufactures countertops at their Maryland facility and installs countertops in Maryland and Virginia for residential customers only. Marsu determined that the “first use theory” applies and all sales and use tax on the materials incorporated into the countertops is due to Maryland because the materials are used in Maryland first thus titled passed in Maryland and Maryland is due the tax. So the Taxpayer closed their VA use tax account and in January 2019, the Commonwealth of Virginia selected the Taxpayer for a sales and use tax audit because the account was closed. At the initial meeting with the auditor, Marsu explained what had happened and why. The auditor agreed that this tax interpretation was correct. The auditor performed a cursory review and found no basis to assess the Taxpayer. Taxpayer was issued a zero assessment.

Main Tax Issue

States are always fighting over sales and use taxes due by contractors that have real property contracts in multiple states. This is especially true for companies that work in DC, MD, and VA. Marsu is always explaining the “first use theory” or that “title passes” in the Taxpayer’s home state to the auditors or hearing officers in the adjacent states to get invoices out of the audit workpapers. Just because the material is ultimately used in their state, the auditors and hearing officers think they are due the tax.

Click Here or Image Below for Full Letter

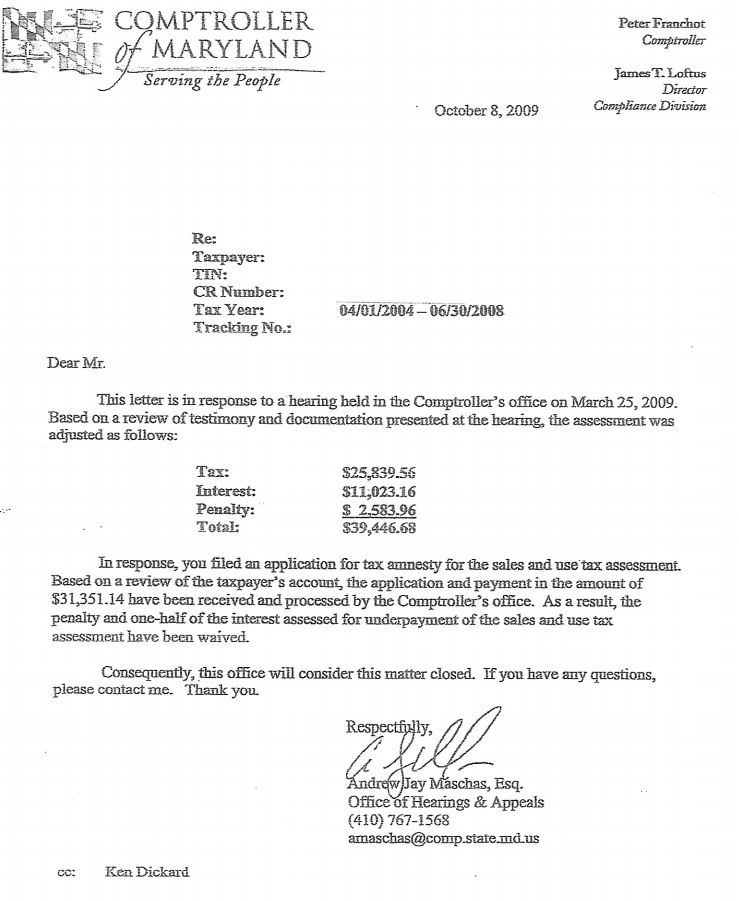

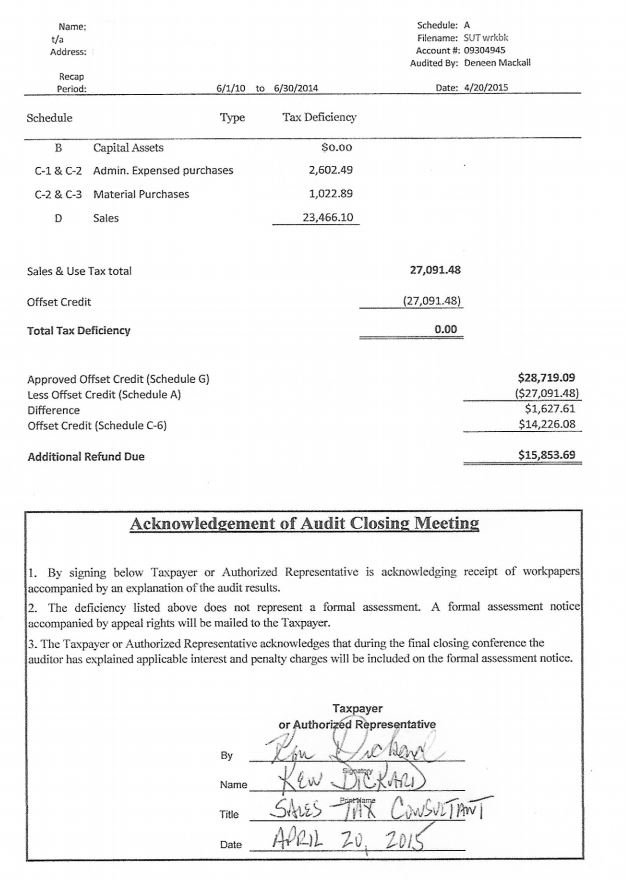

VA Tax Assessment Amount- $150,065.52

Reduction Amount – $145,661.56 – 97%

Interest Saved – $25,225.08

Virginia countertop manufacturer and installer was selected by the VA Department of Taxation for a Virginia sales and use tax audit. This was the first-time audit for this Taxpayer. Marsu was contacted by the owner of the business because the Taxpayer had just received workpapers stating that they owed $150,065.52 in sales and use taxes. Marsu immediately contacted the auditor and was able to start the review process in the field with the field auditor and supervisor which is a lot easier than having to request an informal hearing and having to explain everything all over again to a hearing officer. The auditor had reviewed a sample period for sales and expenses and projected the assessment over the audit period and reviewed all assets purchased during the audit period. Marsu did the following for each schedule in the audit:

- For sales tax collected, but not remitted, the auditor reviewed four sample months to confirm that sales tax collected was remitted. Taxpayer remitted taxes as they collected tax from customer instead of remitting taxes as billed (By law, taxes are supposed to be remitted as billed, not as collected). Auditor had problems reconciling the amount that was paid in the three of the four months selected and calculated a large deficiency. Marsu reexamined the three months and provided documentation that the Taxpayer had actually remitted all of the tax in two of the three months and had a small error in one month because of a change in bookkeepers. The tax assessed was reduced from $85,577.22 to $534.67, a savings of $85,042.45.

- In the sales sample of four months, the auditor listed four invoices where sales tax was not properly collected. Marsu reviewed these four invoices and obtained a resale certificate for one of the invoices. Luckily this one invoice was the largest invoice and consisted of 68% of the dollars listed in the schedule. The tax assessed was reduced from $28,493.20 to $1,709.58, a savings of $26,783.62.

- For expenses, Virginia was trying to assess the Taxpayer as a consuming contractor because the Commonwealth believed the Taxpayer did not meet the three prong test to be classified as a manufacturer/retailer because the Taxpayer did not have an inventory of products for sale, but purchased materials on a job cost basis. Marsu provided documentation that the Taxpayer actually did have inventory on hand and did not have to pay tax on the materials incorporated into the job where they had already collected sales tax from their customer.

- For expenses, the auditor reviewed three months and had listed 139 line items as taxable. This list included COGS, assets, shop supplies and administrative expenses. Since Marsu proved to the auditor that the Taxpayer had an inventory, all the COGS materials were deleted from the list. For the assets and shop materials, Marsu provided the auditor a description of exactly how the assets and shop supplies were used in the manufacturing process and these transactions were deleted from the list. For the administrative expenses, Marsu was able to obtain copies of these expenses to show the auditor that sales tax was billed and collected by the supplier. After all the deletions, only 17 line items remained. The taxed assessed was reduced from $35,995.10 to $2,159.71, a savings of $33,835.39.

The original workpapers had the Taxpayer owing $150,065.52 in taxes and the final workpapers had the Taxpayer owing only $4,403.96 in tax, a savings of $145,661.56. With penalty and interest, the Taxpayer paid $5,433.95 to settle the assessment.

Main Audit Issues

In VA, the sales tax laws regarding manufacturers/contractors/retailers are different than in DC and MD and is discussed in detail in VA Administrative Code 10-210-410(G). In VA, a Taxpayer who is installing fences, venetian blinds, window shades, awnings, storm windows and doors, floor coverings, cabinets, kitchen equipment, window air conditioning units or other like or comparable items is considered a retailer and should collect tax on the sale if the Taxpayer meets the following three conditions:

- Maintains a wholesale or retail place of business

- Maintains an inventory of the aforementioned items and/or materials which enter into or become a component part of the aforementioned items

- Who performs installation as part of or incidental to the sale of the aforementioned items

In July 2010, VA changed their law regarding countertop manufacturers/installers. Prior to this, a countertop manufacturer/installer was a consuming contractor and paid tax on all materials incorporated into the job and collected no tax. The law change made a countertop manufacturer/installer a retailer and should collect tax on their sales. With this law change, this Taxpayer started to collect tax on their sales because they met the three above conditions.

I am not exactly sure what happened during the auditor’s original examination of the Taxpayer’s business in determining if the Taxpayer was a consuming contractor or a manufacturer/retailer. For whatever reason, VA believed that the Taxpayer did not carry an inventory of granite or marble slabs and therefore did not meet the three-part test of being a retailer and was deemed a consuming contractor. I am chalking this error up to a miscommunication between the Taxpayer and auditor. I am guessing that the auditor did not explain the three-part test to the Taxpayer, so the Taxpayer did not know the importance of their answers regarding this issue. Regardless of what happened, the key point here is that we were able to straighten it out and the Taxpayer’s assessment was corrected in this area. I thought it was sad though that the Commonwealth of Virginia was trying to get the tax from both ends of the transaction. First from paying the tax on the materials when purchased and then from collecting the sales tax from the customer. If the Commonwealth thought that the Taxpayer was a consuming contractor, then I would have thought the Commonwealth would have just been happy in getting the tax on sales price vs. the cost of the materials and not try to assess tax on the COGS when the Taxpayer had already collected the tax from their customers.

Second issue is that by law sales tax is to be remitted as billed and not as collected. I know this creates a cash flow issue, but that is the law.

Further Discussion

The key issue with dealing with any type of auditor is communication. Marsu believes in knowing the answer before the question is asked and if Marsu does not know the answer, then Marsu has the ability to say I am not sure, and I will get back to you with the answer. The problem here is that the Taxpayer should know everything about their business, but does the Taxpayer know how to properly answer the questions for sales tax purposes? Probably not. When the audit starts, the auditor will have some preconceived ideas of what the Taxpayer should be collecting tax on, if any, and what the Taxpayer should be paying sales and use tax on. These preconceived ideas will probably come from the auditor’s experience of auditing other like Taxpayers or viewing the Taxpayer’s website. In the first meeting with the auditor, the auditor will usually discuss the Taxpayer’s business to exactly find out what the business does. The auditor will be asking targeted questions that deals with collecting tax vs paying sales and use tax on materials purchased for the business. The auditor will be clinging to every word that the Taxpayer says, and their preconceived ideas can change with whatever you tell them. This includes miscommunication to when the auditor improperly interprets what was said or the lack of what was said. If Marsu is involved before the audit starts, then the information for sales and use tax purposes can be effectively communicated to the auditor and hopefully no improper interpretations will be made.

Additional Law Change

Effective July 1, 2017, VA reversed their 2010 law change regarding countertop manufacturers/installers and deemed them to be consuming contractors again. Therefore, these Taxpayers pay tax on their materials incorporated into the job and collect no tax when the job is installed.

If at times, the Taxpayer just manufacturers a countertop without installation or manufacturers a countertop with material provided by the customer, then the Taxpayer should collect tax on these transactions. To do this, the Taxpayer needs to have a VA sales tax license to collect tax.

Click Here or Image Below for Full Letter