MD Case Study – Sales Tax Application Denied – Window Cleaning Service

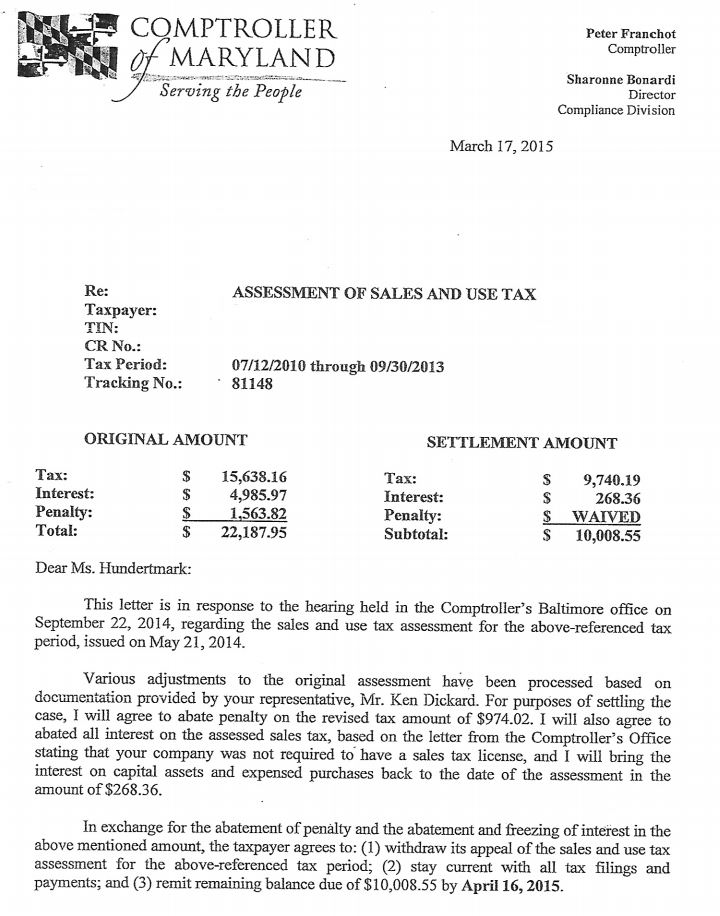

MD Tax Assessment Amount – $15,638.16

Total Reduction Amount – $5,897.87 – 38%

Interest Reduction – $4,717.61

Penalty Waived – $1,563.82

Total Savings – $12,179.40 – 55%

A three-year-old Company gets audited by the Comptroller’s Office for failure to collect sales tax on a taxable service – commercial window cleaning. Marsu was contacted by their accountant to assist their new client with the audit. The workpapers were just received by the Taxpayer so Marsu was able to perform the review of the workpapers in the field with the auditor. Like any other audit, the auditor reviewed a sample period of sales and expenses and projected the assessment over the 3 plus year audit period and reviewed all asset purchases. Marsu did the following for the three schedules:

- For sales, the auditor reviewed six months of sales and listed the total commercial sales for each month as a separate line item on the schedule. The auditor also did list three exceptions as non-taxable sales on this schedule to calculate the taxable sales amount for the sample period. Marsu reviewed these sales and found 17 more exceptions that were approved. The tax assessed was reduced from $12,432.74 to $9,122.49, a savings of $3,310.25.

- For expenses, the auditor reviewed six months of purchases and listed 12 line items as taxable. Marsu found no errors with the 12 lines listed but found that the projection schedule was incorrect in the fact the auditor did not use the total purchase amount for the accounts being audited for the sample period. Once corrected, the tax assessed was reduced from $2,698.91 to $397.05, a savings of $2,301.86.

- For assets, the auditor listed 7 line items where use tax was not properly paid on out of state purchases. Marsu found no errors with this schedule.

Marsu was able to make one more adjustment to the assessment. Marsu discovered in the sales tax returns folder that the Taxpayer had filed a Combined Registration Application to collect sales tax but was denied by the Comptroller’s Office. The Comptroller’s Office had stated in their reply that commercial window cleaning was a service and tax did not need to be collected. I brought this to the attention of the Director of Compliance and the hearing officer abated the interest on the sales portion of the audit and all penalties.

Main Tax Issue

For fifty years, Maryland was a tangible state meaning that sales tax was only collected on the sale of tangible personal property. Effective July 1, 1992, that all changed when the Comptroller’s Office amended the law to include certain services as taxable services. Seems like whoever was processing the Combined Registration Applications missed that change and this Taxpayer paid the price. It cost him $10,008.55 and a lot of aggravation.