MD Case Study – Woodworking and Cabinet Manufacturing Shop

MD Tax Assessment Amount – $138,629.42

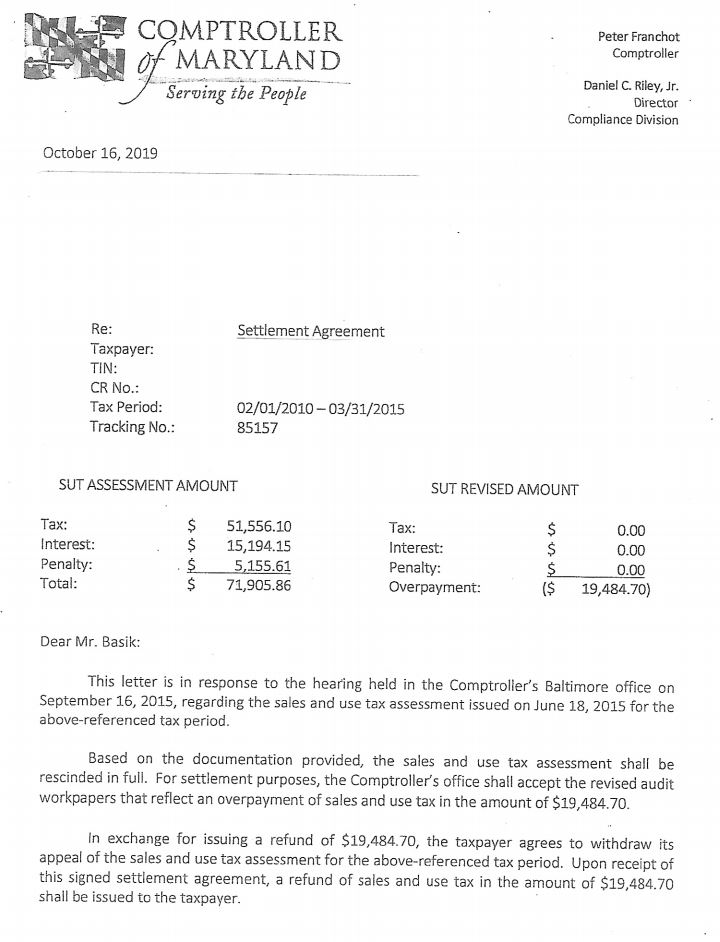

Reduction Amount – $84,911.83 – 61%

Approved Credit/Refund – $73,202.29

Interest and Penalty Savings – $55,451.77

Refund Check Received – $19,484.70

Maryland woodworking and cabinet making shop was selected by the Comptroller’s Office for a Maryland sales and use tax audit. This taxpayer had been audited before and Marsu was contacted by the Taxpayer’s lawyer to assist in the audit process. Like any other audit, the auditor reviewed a sample period of sales and expenses and projected the assessment over the audit period and reviewed all asset purchases. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- For sales, the auditor reviewed three months of sales invoices and listed 77 out of 223 invoices as taxable. Marsu had Taxpayer pull invoices, contracts, and job estimation sheets to prove to the auditor that an invoice was not taxable. Sales schedule ended up with just 8 taxable invoices where tax was not properly collected. The tax assessed was reduced from $54,939.82 to $24,488.35, a savings of $30,451.47.

- For sales tax projection methodology, the Comptroller’s methodology did not fairly represent the Taxpayer’s business over the audit period so Marsu had the Taxpayer document an alternative methodology that was accepted by the Comptroller’s Office. Alternative methodology saved the Taxpayer approximately $10,000 in tax on the sales schedule.

- For expenses, the auditor reviewed three months of expense invoices and listed 188 invoices as taxable. Marsu reviewed each line item and provided documentation to the auditor that the line was not taxable or that use tax was paid. The expense schedule was reduced by 67% of the dollar value of the invoices listed. The Taxpayer had a complicated system of paying use tax and showing that the purchase was for resale. The Comptroller made the Taxpayer prove each line item that was for resale by matching the purchase to its’ corresponding sales invoice. This was a very time-consuming process. The tax assessed was reduced from $78,406.27 to 23,945.91, a savings of $54,460.36.

- For assets, the auditor reviewed every asset purchased during the audit period and only found issue with one invoice. Marsu agree that the one invoice was taxable.

Marsu also performed a reverse audit and documented sales and use taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $73,202.29 in the audit workpapers as required by law. The original workpapers had the Taxpayer owing $138,629.42 in taxes and the final workpapers had the Taxpayer receiving a refund check in the amount of $19,484.70, a savings of $158,114.12. Since the Taxpayer received a refund, there was no interest and penalty assessed.

Main Audit Issues

Cabinet and countertop manufacturers have been a favorite audit target of the Comptroller’s Office for years. If a Taxpayer is not collecting tax properly, then the assessment will be in the tens of thousands of dollars or even hundreds of thousands of dollars depending on the size of the company and type of work performed.

Twenty years or so ago, the Comptroller’s Office added the infamous two sentences to Maryland Tax Regulation .19C(5) – Real Property Construction, Improvement, Alteration and Repair that sums up the Comptroller’s position of taxability when auditing a cabinet and countertop installer. “As a general rule, counters, countertops, and cabinetry installed in commercial spaces will be treated as tangible personal property. Doors, windows, molding, built-ins, and kitchen cabinetry installed in residential or commercial spaces will be treated as realty”. So if a Taxpayer does commercial work and it is not in a kitchen or bathroom, then the Comptroller’s Office is going to assess the Taxpayer regardless of how the cabinetry or countertop is installed. Even commercial built-in cabinetry work that is installed directly against wall studs or recessed into the wall is considered tangible by the Comptroller’s Office. For the Comptroller’s Office the word built-ins are defined as like garbage disposals not built-ins as understood by the cabinetry manufacturers and installers.

So if you furnish and install any of the following, then tax should be collected from the customer – any cabinetry and countertop installed in a non-kitchen or bathroom area, like in a doctor’s office or a work area room (paper copy station), bank teller stations, bars and food stations in restaurants, benches, cashier counters, concession stands, credenzas, lockers, reception desks, and service desks and counters. The Comptroller has even assessed window ledge under windows in conference rooms, recess cabinetry in walls, and sinks in common areas of doctor’s office or exam rooms.

One minor issue in the sales tax collection area was fabrication labor. If the Taxpayer takes the customer’s material and manufacturers an item or just performs a simple task as cutting or drilling holes in the material, then the Taxpayer’s labor charge is taxable. The Comptroller’s Office considers the labor as part of taxable price of the finished product. Just because the labor to manufacture a product is performed by two or more businesses, it is still taxable. If one Taxpayer had performed all the labor to manufacture a product, then the total price is taxable. See MD Tax Regulation 30 – Fabrication or Production for the Comptroller’s description of what fabrication labor is.

The last major issue in this audit was inventory items used in jobs for resale and also in jobs where the Taxpayer is installing the material into real property. If the material is used in a job for resale, then no tax is due on the material when purchased and tax is collected from the customer on that material. If the material is used by the Taxpayer on a real property job that is installed by the Taxpayer, then tax is due on the cost of the material incorporated into the job. Taxpayer was buying all the inventory items for resale and paying no use tax when used on realty jobs. Inventory items were items like bolts, caulk, glue, hardwoods, melamine, molding, nails, paint, plywood, screws, shims, stain, thinner and washers. Problem was that items purchased in bulk were not allocated to realty or resale jobs, so the Taxpayer had no methodology to self-assess use tax on the material cost of inventory items being used in realty jobs. The Comptroller’s Office took the position that 100% of the inventory items were taxable. For the hardwoods purchased by the Taxpayer, Marsu matched the purchase to sale invoices to get the purchase removed or reduced on the expense schedule. For all the other items, Marsu calculated a percentage of sales dollars of non-taxable jobs to total jobs for the sales sample period and used that percentage to reduce the inventory items on the expense schedule. The Comptroller’s Office accepted this analysis.

Call Marsu

Countertop manufacturers and installers are one of the most often audited types of businesses. That is because the MD sales tax law is so confusing and there are so little guidelines available. If you are a countertop manufacturer and installer and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.