MD Assessment Amount – $58,209.92

Reduction Amount – $36,250.95 – 62%

Interest Savings – $21,054.55

Penalty Savings – $5,820.99

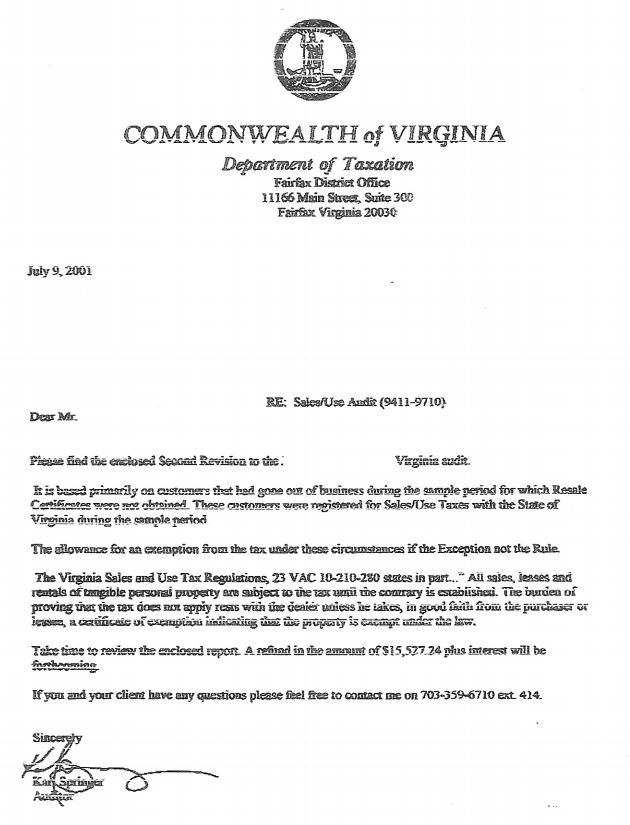

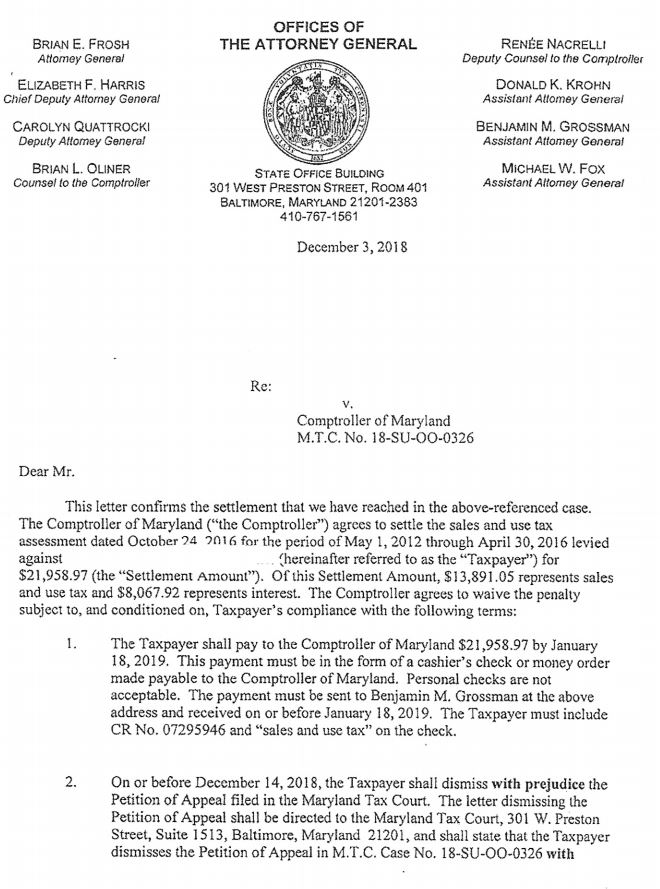

Maryland Taxpayer provides security guard and private investigative services to private, government and other clientele. Taxpayer was selected by the Comptroller’s Office for a Maryland sales and use tax audit. Taxpayer went through the audit process himself and went to an informal hearing without getting any relief from the $36,291.73 tax liability. Marsu was contacted by the Taxpayer’s lawyer to review the workpapers to determine if any adjustments could be requested. Taxpayer was being assessed for failure to collect sales tax on all line items on their invoices for security and private investigative services, failure to pay use tax and failure to remit all sales taxes collected. Since the Taxpayer had already had an informal hearing, the lawyer had to file an appeal to the Maryland Tax Court and then present our finding to the Maryland Attorney General’s Office for any reductions. Marsu did the following for each of the schedules:

- For taxes collected but not remitted, the auditor did an analysis comparing the MD sales tax collected, monthly sales tax liability report and the tax remitted to come up with the liability which was almost half the assessed tax amount for the whole audit. Marsu reviewed this schedule and found that the auditor had incorrectly recorded the tax collected amount for four of the months and tax liability became zero. The tax assessed was reduced from $15,915.00 to $0, a savings of $15,915.00.

- For sales, the auditor reviewed six months of invoices and listed 87 lines on the workpapers. Marsu reviewed the 87 lines and only found two adjustments. Marsu also reviewed the projection methodology and found that the total sales for the oldest year should have been for only 8 months and not for the entire year as the Comptroller had recorded. Marsu also found that the total sales for the sample period was higher than recorded. With these four minor adjustments, the liability for failure to collect sales tax was reduced from $17,378.10 to $13,492.88, a savings of $3,885.22. These four minor adjustments alone paid the bill for the lawyer and Marsu to do their review and present the case to the AG’s Office.

- For expenses, the auditor again reviewed six months of invoices and listed 38 lines on the workpapers. Marsu reviewed the 38 lines and found that all lines were correct. Marsu also reviewed the expenses projection methodology and again found that the expenses for the oldest year should have been for only 8 months and not for the entire year as the Comptroller had recorded. This minor adjustment reduced the expense tax assessment by $340.48.

In the Settlement Agreement with the Attorney General’s office, the lawyer was also able to get the 10% penalty abated.

The total assessment due, including penalty and interest, in the Notice of Final Determination was $58,209.91. After our review, the Taxpayer paid, per the Attorney General’s Settlement Letter, $21,958.97, a savings of $36,259.04.

Main Audit Issue

Effective July 1, 1992, security and private investigative services in Maryland became a taxable service. Over the years, Marsu has represented several security firms and has seen plenty of firms listed in the Maryland Business Journal for liens being attached against the business for a sales tax audit. Usually these cases have assessments in the hundreds of thousands of dollars in just tax amount due. And the reason for all these tax assessments is the failure to properly collect tax on all items listed on an invoice for services provided. The Comptroller’s position is that all charges are part of the price of the services provided and taxable. So security firms should be collecting tax on all lines listed on their invoice.

Call Marsu

If you provide taxable services and want to confirm that sales tax is being properly collected, then please call Marsu to do a mock sales tax audit. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law.

Click Here or Image Below for Full Letter

MD Tax Assessment Amount – $43,790.62

Reduction Amount – $29,862.58 – 68%

Interest Saved – $13,000.82

Penalty – Waived at Settlement

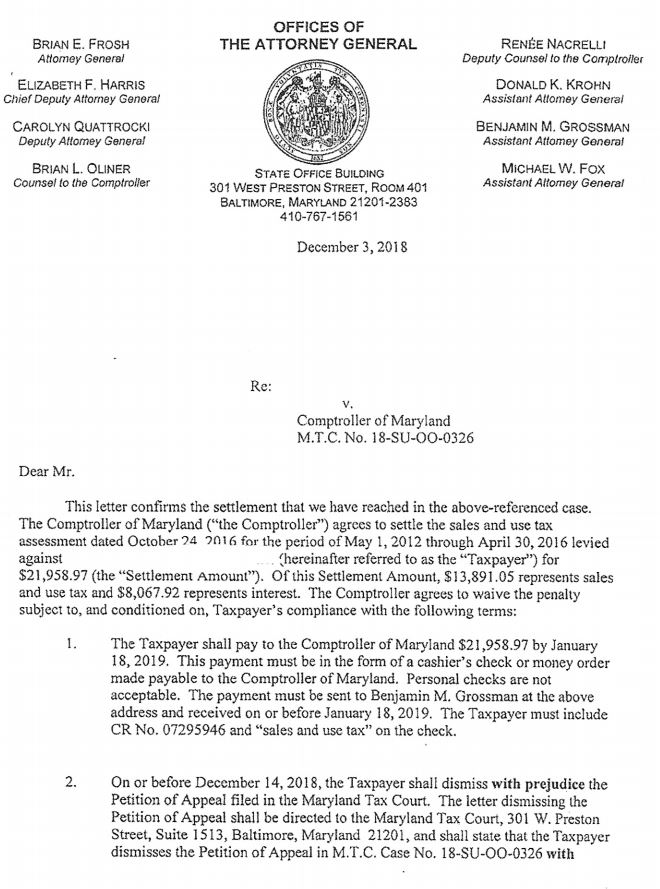

Maryland Taxpayer designs workplace environments, provides and installs office furniture, including workstations, in the Mid-Atlantic region. Taxpayer was selected for a first-time MD sales and use tax audit. Taxpayer contacted Marsu to assist in the review of the workpapers. The Taxpayer was assessed $43,790.62, $35,768.75 for failure to properly to collect sales tax and $8,021.87 for failure to pay use tax on assets and expenses where sales tax was not paid to the supplier. Marsu did the following for each schedule included in the audit:

- For sales, the auditor reviewed a block sample of two months and listed just 4 invoices as taxable to get the $35,768.75 tax assessment amount. Marsu convinced the hearing officer that the two month sample did not fairly represent the Taxpayer’s business and that the sample period should be expanded and a five month block sample was agreed upon. This five month sample included the original two months selected by the Comptroller’s Office. The auditor came back out to the Taxpayer’s office to review the additional three months and listed an additional 21 lines to the sales schedule as taxable sales. Marsu reviewed the job folder for each sales invoice and was able to document that 13 lines should be deleted from the schedule. The tax assessed was reduced from $35,768.75 to $6,957.40, a savings of $28,811.35.

- For sales projection methodology, the projection methodology did not fairly represent the Taxpayer’s business over the audit period and Marsu convinced the Controller’s Office to enlarge the sample period and to accept a different projection methodology that greatly reduced the sales tax collection liability.

- For expenses, the auditor reviewed the same two month block sample and listed 6 invoices as taxable. Marsu reviewed these 6 invoices and found no errors.

- For assets, the auditor reviewed all assets in the audit period and listed 31 invoices as taxable. Marsu reviewed these invoices and was able to document that 2 invoices were non-taxable. The tax assessed was reduced from $7,051.09 to $5,971.09, a savings of $1,080.00.

With Marsu’s assistance, this Taxpayer was able to significantly reduce their tax assessment by 63% and save $13,000.82 interest and to have the penalty abated at settlement. Marsu did perform a reverse audit, but this Taxpayer did not overpay on any sales or use taxes on their business purchases.

Main Audit Issues

When the Comptroller’s Office performs a sales and use tax audit, the procedure in how the sales and expense projections are calculated is always the same. The Comptroller takes certain information off the federal income tax returns and assesses the Taxpayer by multiplying the total expenses or sales for the audit period by the error factor calculated in the sample used and then multiplying the resulting taxable base by the 6% tax rate to finally calculate the amount of tax due. The problem with this methodology is that the sample does not always fairly represent the Taxpayer and his business over the four year audit period. Sometimes the sample is heavy in some type of taxable transaction or transactions that exaggerates the projection or sometimes the sample is light in non-taxable transactions that would also exaggerate the projection because they are not fairly represented.

This Taxpayer had a little bit of both problems in their sales projection. The sales sample selected by the state only had 4 sales invoices that were deemed taxable, but they were 4 large invoices which projected to a large assessment and the percentage of non-taxable transactions were not fairly represented in the original two-month sample. By expanding the sample size from two to five months, the average liability per month decreased so the total tax liability decreased and Marsu presented another projection methodology that pulled the non-taxable transactions out of the projection entirely.

A second issue that this Taxpayer had was that the Taxpayer was not collecting tax on all taxable separately stated lines items on their invoices. The Taxpayer was collecting tax on the furniture that was being sold but did not collect tax on the “fabrication labor” used at the jobsite to fully assemble the furniture or workstations. The Comptroller’s Office position is that all costs used to assemble a piece of property for the first time, on the jobsite or elsewhere, is taxable.

Call Marsu

If you are a retailer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.

Click Here or Image Below for Full Letter

MD Tax Assessment Amount – $25,145.41

Reduction Amount – $13,156.02 – 52%

Interest and Penalty Savings – $10,661.65

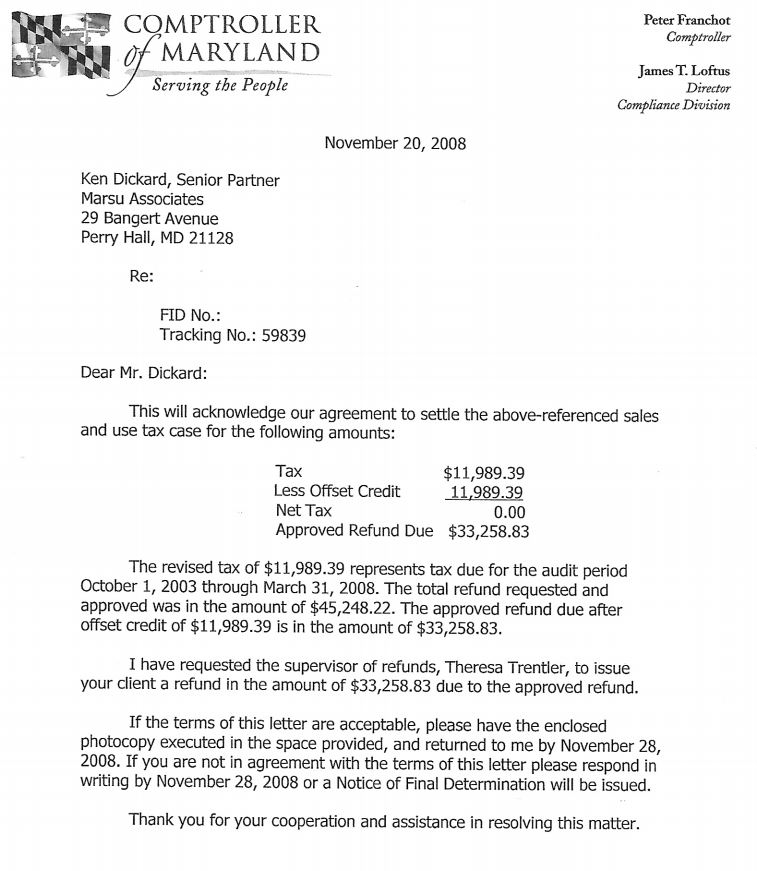

Offset Credit/Refund Amount Approved – $45,248.22

Refund Check Received – $33,258.83

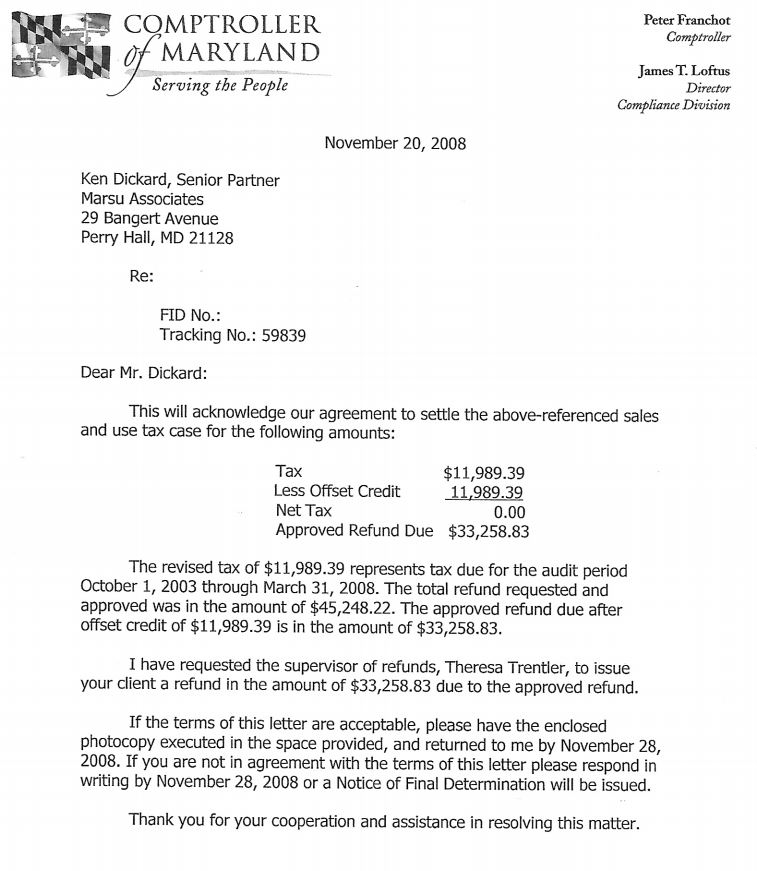

A small Maryland Taxpayer that provides printing and mailing services was being audited by the Comptroller’s Office. The accounting firm and Taxpayer had reviewed the original workpapers and provided the field auditor with some documentation to get the tax assessment down to $25,145.41. Marsu was contacted by the Taxpayer’s accounting firm to assist in continuing the review of the workpapers. Since the accounting firm and Taxpayer had completed the review of the workpapers with the auditor in the field, Marsu had to request an informal hearing to get any other adjustments out of the audit and to submit the refund request to the Comptroller’s Office. Like most Maryland sales and use tax audits, the workpapers had liabilities for assets, sales, and expenses. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- For sales, the auditor reviewed a two-month sample and had originally listed 195 invoices as taxable and now 57 invoices remained. Marsu reviewed each remaining sales invoice and provided documentation to get 26 more sales invoices deleted from the schedule and 7 invoices reduced. The tax assessed was reduced from $22,739.41 to $10,049.15, a savings of $12,690.26.

- For expenses, the auditor reviewed a one-month sample and listed 21 invoices as taxable and now 5 invoices remained. Marsu reviewed each expense invoice and provided documentation to get 1 invoice reduced in the schedule. At the time of the audit, the most current year tax return was not filed, and the expenses were estimated based on the previous years’ tax return. With the new tax return information, the tax assessed was actually increased from $1,254.50 to $1,285.77, an increase of $31.27.

- For assets, the auditor reviewed every asset in the audit period and listed 4 invoices as taxable. Marsu reviewed each invoice and provided documentation to get 2 invoices deleted from the schedule. The tax assessed was reduced from $1,151.50 to $654.47, a savings of $497.03.

After reviewing the audit workpapers, Marsu performed a reverse audit and documented sales and use tax paid in error and the Comptroller’s Office approved and included the refund in the amount of $45,248.22 in the workpapers as required by law. The hearing officer applied $11,989.39 of the refund to the outstanding tax assessment from the audit and instructed the Refund Desk to issue the Taxpayer a refund of $33,258.83.

Main Audit Issues

Another typical case where a small growing business did not have the manpower and knowledge to request and obtain proper executed MD resale certificates and to properly collect sales tax on sales of printed materials delivered in MD. This Taxpayer had evolved into a fulltime printer who not only provided mailing services, but sometimes printed the customer’s materials and shipped the final product all over the United States. One thing they forgot to consider was that any printed materials delivered to a MD location was taxable unless a properly executed MD resale certificate was obtained. Marsu assisted the Taxpayer in getting the properly executed MD resale certificates and to limit the liability on each sales invoice in the audit workpapers to those materials delivered to MD, if any, for the remaining sales invoices in the audit. Luckily the Taxpayer had customer files of the delivery locations for all the recipients for each job, so Marsu could easily document the adjustment requested and these adjustments were approved by the Comptroller’s Office for out of state sales which are not taxable for MD sales tax purposes.

Call Marsu

If you are a printer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.

Click Here or Image Below for Full Letter

VA Total Assessment Amount – $600,191.46

Total Reduction Amount – $562,737.85 – 94%

Interest and Penalty Savings – $220,337.36

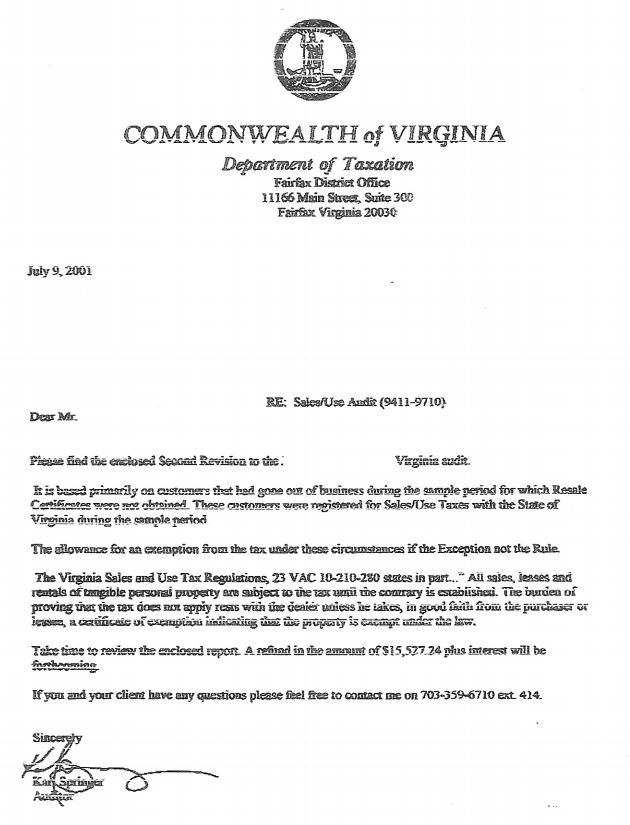

Large Maryland distributor of flooring materials to wholesalers and retailers in the MidAtlantic region was selected for a VA sales and use tax audit. Marsu had previously assisted this Taxpayer with a MD sales and use tax audit and the Taxpayer’s lawyer called Marsu for their assistance. Taxpayer was assessed $287,786.40 in tax for failure to collect sales tax and $82,224.67 in tax for failure to accrue use tax on purchases when sales tax was not billed. Marsu assisted the Taxpayer as follows with the sales and expense schedules:

- For sales, the auditor reviewed a two-month sample of sales and listed 132 invoices as taxable. Unlike MD, VA’s sample was a month in two separate years, whereas MD uses block sampling. Marsu reviewed each invoice and documented that 62 of the invoices were not taxable. The tax assessed was reduced from $287,786.40 to $24,536.02, a savings of $263,250.38.

- For expenses, the auditor reviewed the same two months as he did for sales and listed 29 invoices as taxable. Marsu reviewed each invoice and documented that 9 invoices were not taxable. These 9 invoices represented 82% of the sample dollars on the schedule. The tax assessed was reduced from $82,224.67 to $3,074.56, a savings of $79,150.11.

- For the sales projection methodology, Marsu determined that the numerator in the projection methodology did not properly include credit sales which makes the error factor higher, so the assessment was artificially inflated. The lawyer appealed the case to The Commonwealth of VA and The Commonwealth agreed, and the projection methodology was changed to include credit sales in the numerator as they were included in the denominator.

The original workpapers had the Taxpayer owing $370,011.07 in taxes and the corresponding Notice of Assessment also had the Taxpayer owing $119,177.07 in interest and $111,003.32 in penalty for a total amount due of $600,191.46. The final workpapers had the Taxpayer owing $27,610.58 in taxes, $922.38 in penalty and $8,920.65 in interest, for a total amount due of $37,453.61, a total savings of $562,737.85. VA’s penalty in their sales tax audits are based on their compliance level calculated in the workpapers. For this Taxpayer, the sales tax collection compliance level was only 78% in the original workpapers, so VA’s recommendation was to assess penalty at the rate of 30%. In the final workpapers, the sales tax collection compliance was 98%, so the penalty rate was reduced to 0%. So VA has a steep penalty for not collecting tax if that collection is not above a certain percentage of total sales.

Main Audit Issue

The worst nightmare for any Taxpayer that sells tangible personal property or provides taxable services is not to be properly collecting sales tax. This Taxpayer was initially assessed tax for failure to collect tax on sales that were for resale but had no resale certificate from the customer. Sales tax collection rule #1 is – If you have a taxable sale, then you collect tax unless you have a properly executed resale certificate in hand and here it is a properly executed VA resale certificate. Not a MD or any other state resale certificate. Also do not fall into the trap of the customer saying I have one and I will send it. If you do not have the properly executed resale certificate in hand, then tax should be collected and when the certificate is received, then credit the tax back.

Another problem arises when tax is not collected on sales that are supposedly for resale. These customers maybe just a customer for a short time, you never get the resale certificate or the customer goes bankrupt and then any of these three types of sales come up in the audit and you the Taxpayer are left holding the bag of liability. As I said above, collect the tax and then credit the tax back when the resale certificate is received.

Retention of Resale Certificates

The key here is whatever system you use to get and have copies of resale certificates on hand is fine with me if you can get that copy at a drop of a hat. I have clients who scan all their certificates and unfortunately, I am a little old school and recommend that you have a binder to put them in in alphabetical order. Also it would probably be good to have a copy in the customer file or with the initial credit report and account setup information.

I also recommend that with the initial setup of a new customer that in the application process, the Taxpayer ask for and receive any resale certificates that are proper for all states that the Taxpayer is legally obligated to collect tax in. The Taxpayer should also setup the new customer as a taxable or non-taxable customer depending on if a valid resale certificate is in hand.

VA Approach in a Sales Tax Collection Audit

VA’s approach in a sales tax audit is that the Commonwealth will usually sample three separate months in the three-year audit period and each sample month will come from a different year. The Commonwealth will also in the three-month sample pick a month that is high in collection of tax, average and low. In the Commonwealth’s mind, I believe they are honestly trying to select a total sample that represents the Taxpayer’s business.

I believe this is a good and honest approach and is probably better that MD’s approach where they will do a block sample of one or several months. The problems I see with VA’s approach is that we will be dealing with old records and possibly old accounting systems. If we are dealing with old accounting systems, then that can create problems with getting information. With old records, there is the question of getting copies of invoices and resale certificates and if the customer went bankrupt then we will not be able to get a resale certificate if the sale was for resale.

Call Marsu

If you are a retailer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.

Click Here or Image Below for Full Letter