DC Case Study – MD Elevator Contractor Working in DC, MD and VA

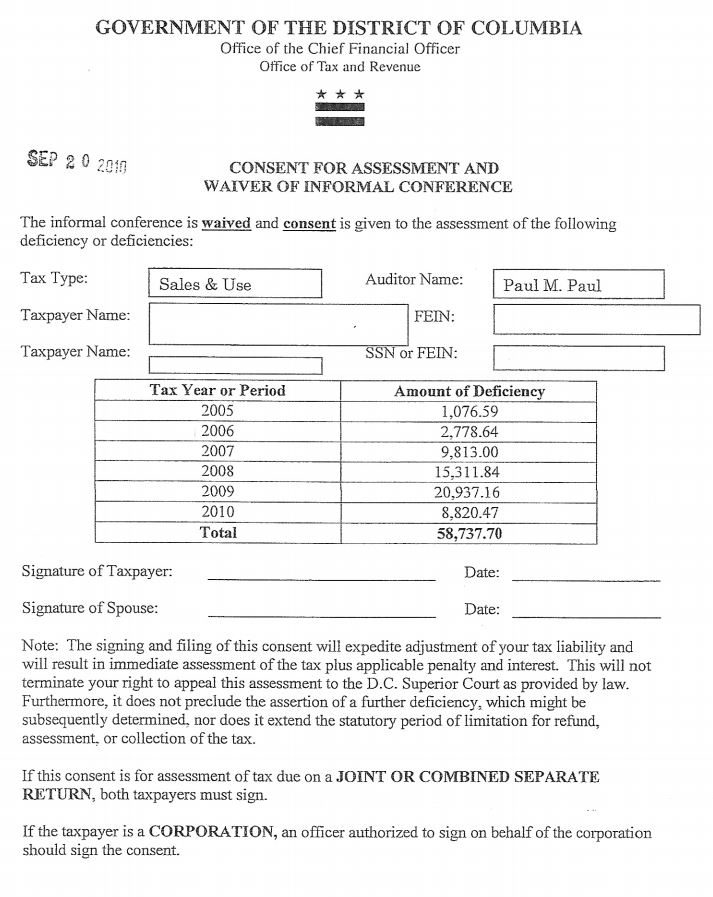

DC Tax Assessment Amount – $113,149.05

Reduction Amount – $54,411.35 – 48%

DC and MD Sales and Use Tax Refunds – $26,042.91

Maryland elevator contractor working in DC, MD and VA was assessed by the DC Office of Tax and Revenue for failure to collect sales tax on elevator maintenance agreements. Marsu was contacted by the Taxpayer’s lawyer to review the workpapers to determine if the assessment could be reduced. The taxpayer’s business is located in Maryland, but failed to properly register in DC for the collection of DC sales tax, so the statute of limitation for the audit was extended back beyond the normal three year audit period. The assessment period ended up to be for six years and four months. Marsu did the following for the sales schedule in the audit:

- For sales, the auditor reviewed the calendar year 2009 as a sample period and listed all the maintenance contracts by customer total. The sales schedule had totals for 56 DC customers who had maintenance contracts. Marsu reviewed each customer and was able to delete 20 customers from the list. The taxable sales for the sample period was reduced from $682,754.78 to $360,209.10 and the error factor was reduced from 11.8799% to 6.1671%, a reduction of 48%. This error factor was then applied to all maintenance contracts in the audit period to calculate the taxable maintenance agreement basis for each year and then that basis was multiplied by the applicable tax rate to obtain the tax assessment due.

After reviewing the DC audit workpapers, Marsu performed a reverse audit and was able to secure refunds for DC and MD in the amount of $26,042.91. These refunds assisted the Taxpayer in paying their liability to DC and to save tax dollars for years to come.

Main Audit Issue

In DC, there is a big difference is the sales tax laws regarding real property contractors who furnish and install, repair or alter equipment into real property in DC vs MD and VA. Certain services for elevator contractors, like maintenance contracts, are taxable services and tax should be collected from their DC customers. As mentioned above, the Taxpayer failed to register to collect DC sales tax and was held liable for the tax that the Taxpayer did not collect.

Please see section on our website on DC Real Property Services that are taxable for other services that are taxable besides maintenance agreements.

Other DC Concerns

The normal statute of limitations for a DC sales tax audit is three years, but DC’s policy is that if the Taxpayer should have been licensed to collect tax, but does not get licensed, then DC is allowed to extend the audit back as far as it wants. As mentioned above, the audit period for this Taxpayer ended up being for six years and four months, over twice the normal period.