MD Case Study – Sales and Use Taxes – Manufacturer and Installer of Awnings

MD Tax Assessment Amount – $254,494.80

Reduction Amount $150,789.63 – 59%

Refund from Reverse Audit – $12,850.09

Interest & Penalty Savings – $140,604.75

Maryland Taxpayer manufactured and installed canvas and fabric awnings and installed aluminum awnings. This was a first-time audit of the Taxpayer for sales and use taxes. Marsu was contacted by the Taxpayer’s lawyer to assist in the review of the workpapers right after receiving the initial workpapers that stated that the Taxpayer owed $254,494.80 for failure to collect sales tax on the sale of tangible personal property and to pay use tax on expenses. Marsu contacted the auditor to setup an appointment to review the workpapers. Marsu assisted the Taxpayer in reviewing the sales and expense schedules:

- For sales, the auditor reviewed just a one-month sample period and listed 40 invoices as taxable. Marsu pulled the contracts and job estimation sheets for each job and documented that 4 invoices were not taxable. Marsu also reviewed the projection methodology and presented an alternative methodology that significantly reduced the sales tax projected assessment. Part of the new methodology was assessing a certain type of awning installation and assessing it on an actual basis instead of projecting. 10 invoices on the sales schedule was moved from the projection schedule to sales that were assessed on an actual basis. This methodology was accepted by the Comptroller’s Office. The tax assessed was reduced from $199,547.67 to $130,107.79, a savings of $69,439.88.

- For expenses, the auditor reviewed just a one-month sample period and listed 14 invoices as taxable. Marsu reviewed the 14 invoices and documented that 8 invoices were not taxable. The tax assessed was reduced from $53,900.49 to $445.68, a savings of $53,454.81.

- For sales and expenses, Marsu was also finally able to get the Comptroller’s Office to agree that a certain type of awning installation was not a sale of tangible personal property but was deemed real property after installation for residential, not commercial sales. This transaction was taken out of the original assessment with the auditor as a sale that was included in the projected sales assessment to being assessed on an actual basis and now is having all residential sales taken out. The tax assessed for Actual Sales being taxed was reduced from $57,354.78, to $2,700.36, a savings of $54,654.42. Since this item was deemed to be real property after installation, the Comptroller’s Office had Marsu perform an audit on the purchases of the real property installation item and the Taxpayer was assessed an additional $26,759.43 in tax. These taxes were assessed as Expenses – Actual in the audit workpapers.

After Marsu’s review of the workpapers with the auditor in the field, the auditor was not able to make the adjustment outlined in #3 above and some other adjustment requests, so the lawyer filed for an informal hearing. Prior to the informal hearing, Marsu has been able to get the tax assessed reduced from $254,494.80 to $131,600.11, a savings of $123,894.69.

At the informal hearing, the lawyer presented our case to the hearing officer that the Taxpayer was a real property contractor and did not sell tangible personal property. The lawyer presented two (2) miniature types of awnings that the Taxpayer manufactured and installed to provide the Comptroller’s Office a better idea of what the awning looked like and how they are manufactured and installed. The lawyer also presented literature on a third type that the Taxpayer installed. Because of the complexities of this case, our case was handed to a higher official within the Comptroller’s Office for review.

Marsu presented the case again to this third person. Marsu was able to get the Comptroller to remove the third type of awning that was presented at the hearing out of the audit for residential customers only. The Comptroller agreed that these sales to residential customers were deemed to be real property and not taxable, but sales to commercial customers were still deemed to be tangible personal property and taxable. These sales had previous been taken out of the sales projection and assessed on an actual basis. The Sales – Actual that were added to the workpapers were reduced from $57,354.78 to $2,700.36, a savings of $54,654.42. Also at this review, the Comptroller’s Office approved a refund documented by Marsu in the amount of $12,850.09. This refund was incorporated into the workpapers as required by law.

Since these sales were taken out of the audit, the Comptroller’s Office had the Taxpayer perform an audit of the materials incorporated and installed for this third type of awning to determine if sales or use tax had been paid. The Taxpayer had not paid sales tax on these materials, but occasionally had paid use tax. The self-audit determined that the Taxpayer owed $26,759.43 in use tax on these materials. Even though the Taxpayer owed this tax, the taxpayer still saved $27,894.99 in taxes on these transactions from the audit because they were moved from the sales schedule to the expense schedule.

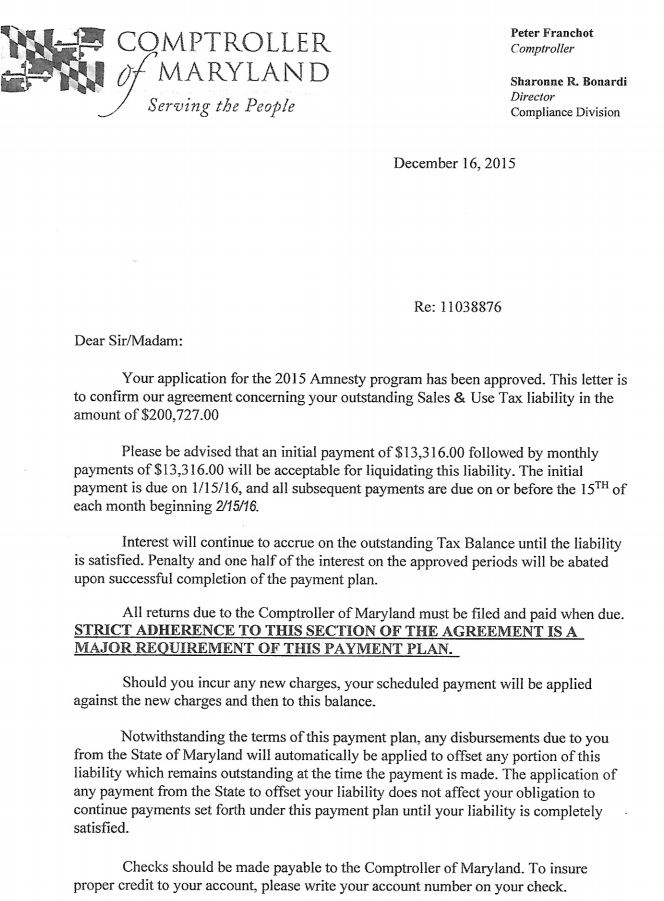

The last item that Marsu was able to do for the Taxpayer was to have them sign up for the 2015 Tax Amnesty Program. Taxpayer was approved to the program and upon full payment of the liabilities, the program abated 50% of the interest due and the 10% penalty was abated in full. See Comptroller’s Letter of December 16, 2015. By signing up for the Amnesty Program, the Taxpayer saved $25,021.48 in interest and $9,085.50 in penalty from the final assessment amount of $90,855.03.

Collection of Tax by Awning Installers

The problem in this industry is that their product, an awning, seems to be installed to improve real property because if its’ attachment to buildings or homes and for real property tax purposes is included in the real property assessment for all building or home owners. In a lot of states, awnings are deemed to be real property in their laws or regulations. But the Maryland Comptroller’s Office for sales and use taxes deem an awning as a sale of tangible personal property even though there is no public written information to that fact. The Comptroller’s Office audit department cling to some internal memo that was written in 2002 to a Taxpayer that had requested a response. Keynote … private letter. There is nothing in Maryland laws or regulations that say that awnings are tangible personal property, so the Taxpayers have no clue.

So when an awning installer gets audited, the audit department will conduct the audit and will use the 2002 letter as their documentation that awnings are tangible personal property and assess all new canvas and fabric awning installations as tangible personal property. Because of the letter, the audit department cannot audit otherwise. A Taxpayer must go further in the appeal process to possibly get tax relief.

Main Audit Issues

This is the classic case where the Taxpayer believes they are a real property contractor and has no knowledge otherwise, but when audited by the Comptroller’s Office they are deemed that some portion of their business is for the sale of tangible personal property and assessed 6% tax on those sales.

Another problem here was that the Taxpayer did not properly pay use tax on materials that were installed into real property. When being audited by the Comptroller’s Office for sales and use tax, the auditor will be auditing on two main issues. First if the Taxpayer is supposed to collect tax, then the auditor will review all sales invoices in a sample period to determine if sales tax was properly collected. And second, if the taxpayer is a real property contractor, then the auditor will be reviewing construction materials in a sample period to determine if sales tax was paid to the suppliers or use tax was self-assessed.

Call Marsu

If you are a Taxpayer who manufactures and installs awnings or just installs awnings and have been audited in the past, then please call Marsu now to determine if your case can be reopened pursuant to Section 13-509 of the Annotated Code of Maryland to get any taxes improperly assessed back as a refund or if you are just due a refund of sales and use taxes paid in error. Marsu’s review is performed on a contingent basis and no fee is due if no refund is approved by the Comptroller’s Office.