MD Case Study – Printer and Mailhouse

MD Tax Assessment Amount – $25,145.41

Reduction Amount – $13,156.02 – 52%

Interest and Penalty Savings – $10,661.65

Offset Credit/Refund Amount Approved – $45,248.22

Refund Check Received – $33,258.83

A small Maryland Taxpayer that provides printing and mailing services was being audited by the Comptroller’s Office. The accounting firm and Taxpayer had reviewed the original workpapers and provided the field auditor with some documentation to get the tax assessment down to $25,145.41. Marsu was contacted by the Taxpayer’s accounting firm to assist in continuing the review of the workpapers. Since the accounting firm and Taxpayer had completed the review of the workpapers with the auditor in the field, Marsu had to request an informal hearing to get any other adjustments out of the audit and to submit the refund request to the Comptroller’s Office. Like most Maryland sales and use tax audits, the workpapers had liabilities for assets, sales, and expenses. Marsu assisted the Taxpayer in reviewing each schedule as follows:

- For sales, the auditor reviewed a two-month sample and had originally listed 195 invoices as taxable and now 57 invoices remained. Marsu reviewed each remaining sales invoice and provided documentation to get 26 more sales invoices deleted from the schedule and 7 invoices reduced. The tax assessed was reduced from $22,739.41 to $10,049.15, a savings of $12,690.26.

- For expenses, the auditor reviewed a one-month sample and listed 21 invoices as taxable and now 5 invoices remained. Marsu reviewed each expense invoice and provided documentation to get 1 invoice reduced in the schedule. At the time of the audit, the most current year tax return was not filed, and the expenses were estimated based on the previous years’ tax return. With the new tax return information, the tax assessed was actually increased from $1,254.50 to $1,285.77, an increase of $31.27.

- For assets, the auditor reviewed every asset in the audit period and listed 4 invoices as taxable. Marsu reviewed each invoice and provided documentation to get 2 invoices deleted from the schedule. The tax assessed was reduced from $1,151.50 to $654.47, a savings of $497.03.

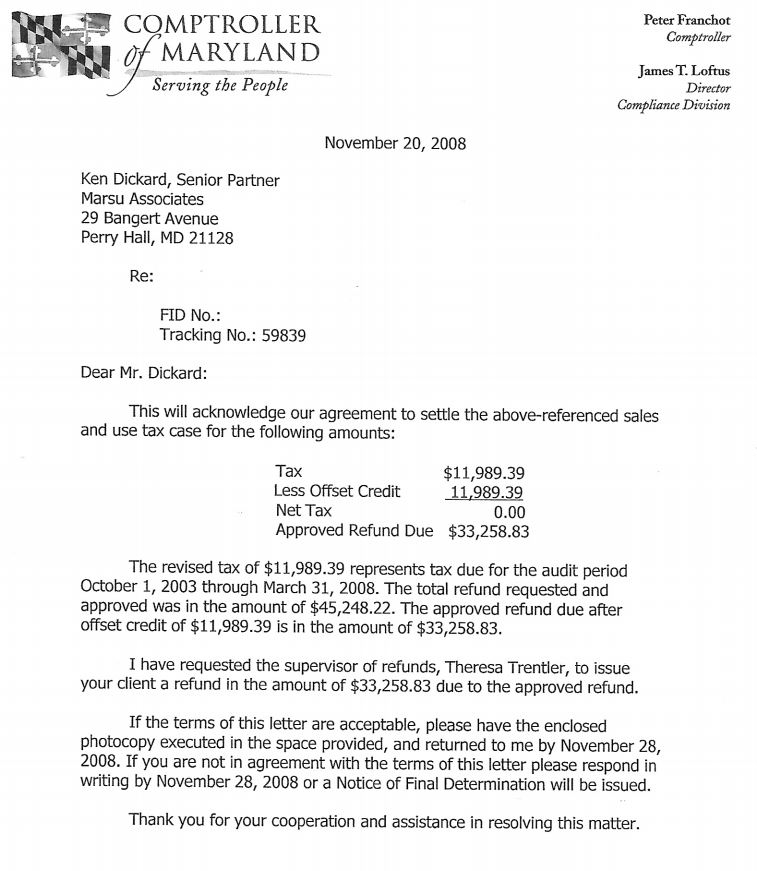

After reviewing the audit workpapers, Marsu performed a reverse audit and documented sales and use tax paid in error and the Comptroller’s Office approved and included the refund in the amount of $45,248.22 in the workpapers as required by law. The hearing officer applied $11,989.39 of the refund to the outstanding tax assessment from the audit and instructed the Refund Desk to issue the Taxpayer a refund of $33,258.83.

Main Audit Issues

Another typical case where a small growing business did not have the manpower and knowledge to request and obtain proper executed MD resale certificates and to properly collect sales tax on sales of printed materials delivered in MD. This Taxpayer had evolved into a fulltime printer who not only provided mailing services, but sometimes printed the customer’s materials and shipped the final product all over the United States. One thing they forgot to consider was that any printed materials delivered to a MD location was taxable unless a properly executed MD resale certificate was obtained. Marsu assisted the Taxpayer in getting the properly executed MD resale certificates and to limit the liability on each sales invoice in the audit workpapers to those materials delivered to MD, if any, for the remaining sales invoices in the audit. Luckily the Taxpayer had customer files of the delivery locations for all the recipients for each job, so Marsu could easily document the adjustment requested and these adjustments were approved by the Comptroller’s Office for out of state sales which are not taxable for MD sales tax purposes.

Call Marsu

If you are a printer who collects tax and is not being audited, then please call Marsu to do a mock sales tax audit to determine if the company is properly collecting sales tax. See our Mock Audit Services tab on the website. State sales tax collection assessments does not only deal with getting proper resale certificates, but with collecting tax on all appropriate line items on your invoices. General rule is that all lines are taxable unless there is a specific exemption in the law. Of course, the main exemption in Maryland is on freight, shipping or delivery that is separately stated on the invoice. If the invoice says shipping and handling, then that item is taxable because you are bundling a taxable and a non-taxable item together and that makes the entire charge taxable.