MD Case Study – Three-Year-Old Case in Collections – Electrical Contractor

MD Tax Assessment Amount – $132,652.42

Reduction Amount – $132,652.42 – 100%

Interest and Penalty Saved – $130,000.00

Maryland electrical contractor was assessed for failure to collect sales tax for the period of November 2009 through May 2015. The assessment period of five years and six months seems to be a little longer than normal. The Taxpayer told me that the audit was transferred from one auditor to another till it was completed and that is why it took so long to complete. The Taxpayer was assessed $132,652.42 in taxes in 2015 and now owes over $260,000.00. Marsu was contacted by the Taxpayer in October 2018 to determine if they could be of any assistance. Marsu reviewed the case and determined that the Taxpayer was a consuming contractor and not a retailer, so no sales tax needed to be collected from the Taxpayers’ customers. Marsu did the following for the sales schedule of the audit:

- For sales, the auditor reviewed three months of invoices and listed 13 transactions on the sales schedule which constituted all the revenue transactions for the period. Transactions were actually payments for subcontract work for a related company. Marsu had the Taxpayer document the detail of the four transactions that were all labor separate from the nine transactions that were for the furnishing and installing of equipment that after installation was deemed to be real property.

- After the Comptroller’s Office agreed that the equipment was real property after installation, Marsu had to prove that sales tax was properly paid on the equipment installed. Marsu supplied copies of the equipment invoices and payment checks to document that sales tax was properly paid to the supplier.

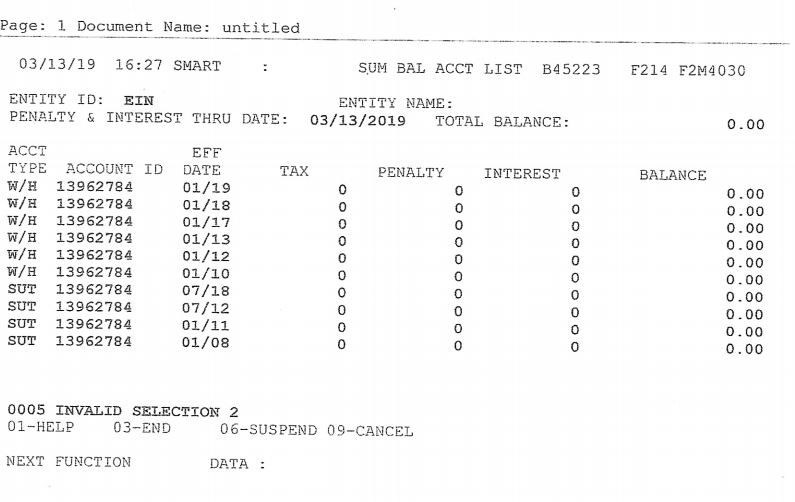

Marsu supplied the above documentation to the Comptroller’s Office and after their review, the Comptroller agreed with my position that the labor was a non-taxable transaction and that the equipment did become real property after installation. The original tax assessment of $132,652.42 plus all penalties and interest was abated in full. There was also a small issue with payment of sales and withholding taxes that was cleared up and the Taxpayer’s Statement of Account was reduced from $4,715.49 to $0.00, an additional savings of $4,715.49.

Main Audit Issues

From the hearing officer’s letter, the taxpayer did not file a timely appeal, but under Section 13-509 of the Tax-General Article, the Comptroller’s Office can open up a case to correct an erroneous final assessment. The Comptroller did open up the case and the Taxpayer provided documentation and it seems that the Comptroller and the Taxpayer went back and forth with documentation requests and extensions with no adjustments being made to the assessment. Undoubtedly the Taxpayer did not present the documentation in a manner that showed that the sales under audit was subcontract work for a related company, that the work was realty work and that sales tax was paid on all materials incorporated into the job. If the Taxpayer had done so, then the assessment would have been abated in full as Marsu was able to do.

Like many cases, this was a first-time audit of the Taxpayer and the Taxpayer tried to handle the audit on their own which now is easy to see was a big mistake. From the audit workpapers, I know that the Taxpayer provided expense invoices and sales amounts for the sample periods requested but have no idea what was provided in regard to what the sales were for. I know the auditors knew that if the equipment were furnished and installed that the equipment would be deemed real property. So I am at a loss as to why this case got so far for so long. Not sure if the problem had to do with having multiple auditors or with inexperienced auditors. Most likely, there was a communication gap between the Taxpayer and the auditors and supervisors. The auditors did not ask the right questions to determine exactly what the 13 transactions were on the sales schedule and probably presumed from the Taxpayer’s website that they were making retail sales of equipment, and the Taxpayer did not know the sales tax law for retail sales vs. furnishing and installing equipment into real property. Glad the case got resolved in favor for the Taxpayer, but sad to see the Taxpayer had to go through hell and back to get there.