VA Case Study – VA Use Tax Account Closed – MD Manufacturer/Contractor

VA Tax Assessment Amount – $0.00

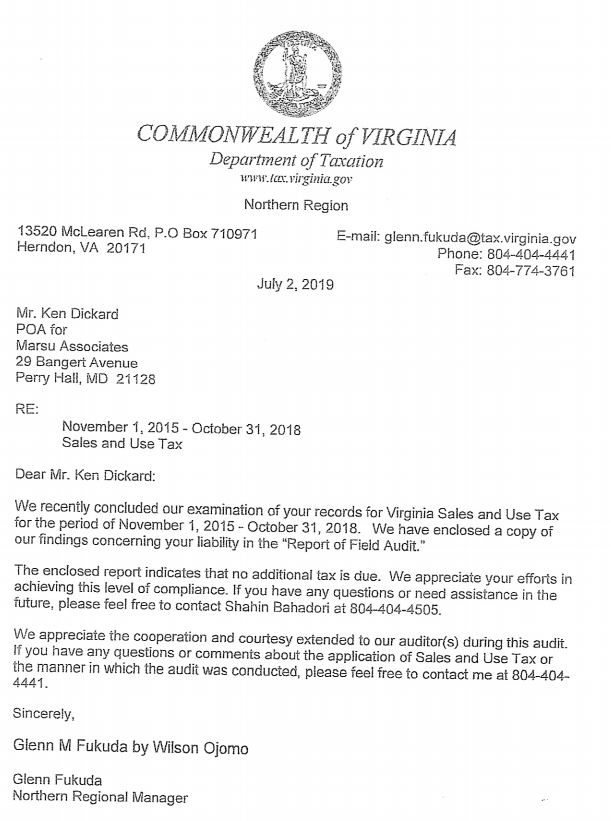

In March 2018, the Taxpayer was referred to Marsu by their accountant to address their methodology of paying use tax to Maryland and Virginia. Taxpayer manufactures countertops at their Maryland facility and installs countertops in Maryland and Virginia for residential customers only. Marsu determined that the “first use theory” applies and all sales and use tax on the materials incorporated into the countertops is due to Maryland because the materials are used in Maryland first thus titled passed in Maryland and Maryland is due the tax. So the Taxpayer closed their VA use tax account and in January 2019, the Commonwealth of Virginia selected the Taxpayer for a sales and use tax audit because the account was closed. At the initial meeting with the auditor, Marsu explained what had happened and why. The auditor agreed that this tax interpretation was correct. The auditor performed a cursory review and found no basis to assess the Taxpayer. Taxpayer was issued a zero assessment.

Main Tax Issue

States are always fighting over sales and use taxes due by contractors that have real property contracts in multiple states. This is especially true for companies that work in DC, MD, and VA. Marsu is always explaining the “first use theory” or that “title passes” in the Taxpayer’s home state to the auditors or hearing officers in the adjacent states to get invoices out of the audit workpapers. Just because the material is ultimately used in their state, the auditors and hearing officers think they are due the tax.