MD Case Study – 60 Day Letter Issued – Manufacturer/Wholesaler/Retailer

MD Tax Assessment Amount – $85,660.97

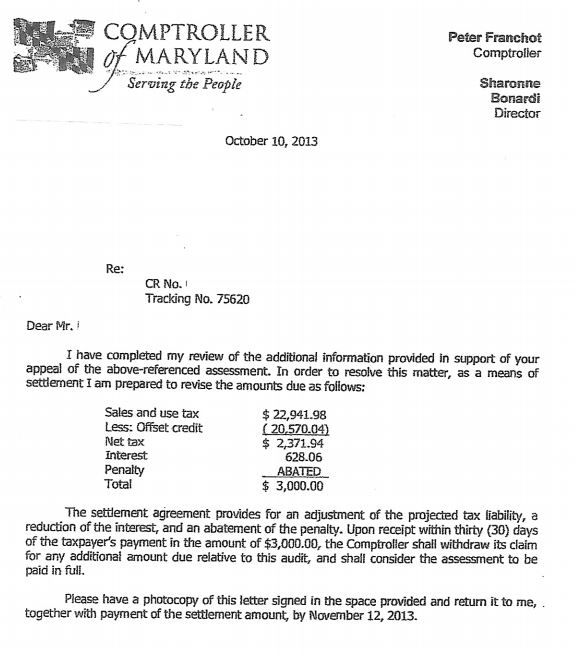

Reduction Amount – $62,718.99 – 73%

Offset Credit/Refund Approved – $20,570.04

Interest Saved – $22,053.89

Penalty – Waived at Settlement

Maryland manufacturer who sold products on a wholesale and retail basis was selected for a Maryland sales and use tax audit. Marsu was contacted by the company’s lawyer to assist in the review of the workpapers. The Taxpayer was assessed $85,660.97 for failure to collect sales tax on their sales and a small assessment for failure to accrue use tax on assets purchased when tax was not billed. Taxpayer was also issued a 60 day letter for their resale certificates which means that the Comptroller gave them 60 days from the date on the letter to obtain all properly documented Maryland resale certificates from their customers or the sales would be deemed to be taxable regardless if they were for resale or not. Marsu did the following for the capital and sales schedules in the audit:

- For the capital assets, the auditor reviewed every asset purchase in the audit period and listed every invoice that did not have sales tax billed and collected. The auditor listed 6 invoices on this schedule and Marsu was able to get three of those invoices deleted from the schedule for the manufacturer’s exemption. The tax assessed was reduced from $2,618.37 to $252.67, a savings of $2,365.70.

- For sales, the auditor reviewed a six-month sample period and listed just 19 lines, but the projection totaled $83,042.60 in tax liability. The majority of the assessment came from just two customers. One who did not have a resale certificate until after the 60-day grace period and the other went bankrupt and we could not get a resale certificate even if they had one. The Comptroller’s Office would not negotiate on the resale certificate customer because of the 60-day letter, but Marsu was able to get the bankrupt customer out of the projection and assess that customer on an actual basis over the audit period. Of the remaining lines listed, Marsu was able to get five (5) more lines out. The tax assessed was reduced from $83,042.60 to $22,689.31, a savings of $60,353.29.

Marsu also performed a reverse audit and documented sales taxes paid in error and the Comptroller’s Office approved and included the refund in the amount of $20,570.04 in the audit workpapers as required by law. The original workpapers had the Taxpayer owing $85,660.97 in taxes and the final workpapers had the Taxpayer owing $22,941.98 in taxes, a saving of $62,718.99.

Main Audit Issues

The Comptroller’s Office has the legal right to issue a taxpayer a sixty (60) day letter to have the Taxpayer obtain properly documented Maryland resale certificates for all customers that they do not collect tax from or The Comptroller will deem those sales as taxable and 6% tax will be due. See Title 11, Section 408 which allows the Comptroller to issue a Taxpayer a 60-day letter. The Taxpayer had a lot of customers that were for resale and the Taxpayer had actually done a great job in getting the majority of properly documented Maryland resale certificates for the auditor. The one thing the Taxpayer could have done a little different was to prioritize the resale certificates by dollar value in the audit so they would get the resale certificates for the customers that made up the largest portion of the $83,042.60 tax assessment. The one customer that they did not get a resale certificate in time for was worth $11,802.00 in tax.

The importance of getting properly documented resale certificates when the customer’s credit is approved or at the time of the first sale is also shown here by the fact that the Taxpayer got assessed for tax for a customer that went bankrupt. For whatever reason, the auditor had selected a sample sales period that was over two years old and that made it more difficult for the Taxpayer and Marsu in securing valid Maryland resale certificates and made it impossible for the customer that went bankrupt. Luckily Marsu was able to have the Comptroller assess the tax on the actual sales for the audit period instead of the projected tax assessment for this customer. The projected tax assessment was $34,397.00 and the actual amount due was only $3,790.49, a saving of $30,606.51.

The last important issue with the sales audit was that several of the lines included in the audit were sales where the customer picked up the product at the Taxpayer’s manufacturing plant in Maryland. Even though each customer could have had a resale certificate from their home state, DC, OH, PA, VA or WVA, pick-up sales are taxable unless the customer has a valid Maryland resale certificate.